What future for apartments?

Will apartment prices increase or decrease in the near future? Photo: Thu Huyen

Apartment supply is vibrant, prices are still increasing

Trung Thuy Group has just announced the Lancaster Legacy project with a price of about 9,000 USD/m2 (about 216 million VND/m2). The project includes 1 lock with 38 floors, including 5 commercial podiums and 4 basements, expected to provide the market with nearly 420 apartments with area from 50 m2 to 150 m2. Lancaster Legacy has extended the supply of luxury apartments in Ho Chi Minh City recently.

Another project that has also been started is Stella Residence, District 5. Located in front of Tran Hung Dao Street, the project has about 250 apartments in 1 high-rise tower. Expected selling price is about 80 – 120 million VND/m2.

Previously, Vinhomes also opened for sale 2 subdivisions The Beverly and The Beverly Solari in the Vinhomes Grand Park urban area, Thu Duc City. If The Beverly Solari is near Vincom Mega Mall, The Beverly has a direct view of the 36-hectare park. Selling price from 45-55 million VND/m2.

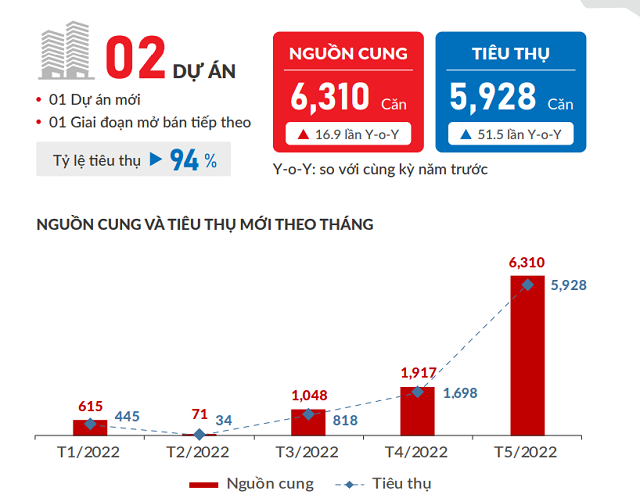

Supply and consumption of apartments in Ho Chi Minh City in May. Source: DKRA |

The supply of apartments in Ho Chi Minh City has rebounded, according to DKRA Vietnam. Recorded in May, the market has more than 6,300 apartments sold, the highest since the beginning of the year, mainly in Thu Duc City. Projects open for sale are located in the Grade A segment with a popular asking price of 60 million VND/m2. Under the pressure of credit tightening, all projects opened for sale in the month have been granted a bank guarantee room in advance, flexibly applying a grace period of up to 48 months in order to stimulate demand. buying. The market absorption rate is good, reaching 94%.

Not only in Ho Chi Minh City, the new supply of apartments in the peripheral provinces also increased significantly, but not including Long An, Dong Nai, Ba Ria – Vung Tau or Tay Ninh. DKRA said that the supply mainly comes from projects in Ho Chi Minh City and Binh Duong, of which Ho Chi Minh City accounts for 81% of supply and 85% of consumption. In Binh Duong, projects are distributed in Di An and Thu Dau Mot cities, the common price level is at 40-45 million VND/m2.

A representative of DKRA said that the market supply and demand in May increased sharply compared to the previous month and the same period. However, the increase was uneven, focusing mainly on certain projects, regions and provinces. The primary price level continued to remain at a high level in the face of increasing input cost pressure.

Difficult to talk about the possibility of price increase

The Vietnam Association of Realtors (VARS) said that apartments in Ho Chi Minh City are entering a price increase cycle and forming a new price level. The increased demand for apartments, along with the delayed supply, has caused apartment prices to tend to increase rapidly in recent times.

Mr. Dinh Minh Tuan, director of Batdongsan.com.vn in Ho Chi Minh City, said that the price of primary apartments must increase, because investors have to pay for increased input of raw materials, increased selling costs, and higher selling costs. The market also increases… This means that after about 2-3 years, the investor will hand over the apartment and have to include the price increase during the past 2-3 years. The primary price of apartments increases, leading to a corresponding adjustment in the price level of the whole market. In addition, the supply put out in the market compared to the current demand is still a huge gap.

However, recently, the Ministry of Construction has proposed a draft to apply the apartment ownership period of 50 – 70 years. This is controversial in the market, especially in terms of apartment prices. Mr. Su Ngoc Khuong, Senior Director of Savills Vietnam said that if applied, in the future, the trend of people will not choose apartments but switch to buy townhouses. This will affect the liquidity of the apartment market and the selling price will slow down.

Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, affirmed that the cost of creating a land fund, including land use fees, which must be paid to the state, has not been 100% included in the selling price of the apartment. duration. If the regime of ownership of an apartment building is implemented, the selling price of such a fixed-term apartment is definitely lower than the current selling price of a permanently owned apartment.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here