Banks have excess money because of “running out” of credit room: Why is the State Bank still “outside”?

In a document issued on May 26, the State Bank still requires credit institutions and foreign bank branches to continue to comply with the credit growth target in 2022 announced by the State Bank.

Banks have excess money because of “running out” of credit room

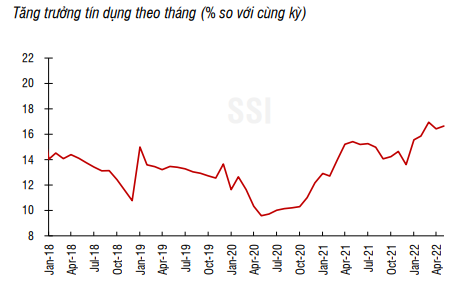

According to the money market report just released by the research department at SSI Securities, credit increased sharply in the first 5 months of the year.

Credit increased sharply in the first 5 months of the year.

Specifically, credit growth at the end of May increased by 8.03% compared to the end of 2021, and increased by 16.9% over the same period, according to data from the State Bank.

“Credit growth at most commercial banks has almost reached the credit ceiling. This made it difficult for capital outflows in the past week and has eased pressure on liquidity,” the research department said. SSI study emphasized.

However, experts also noted that the fact that abundant liquidity during this time was quite important, not only helped the interbank interest rate drop to a low level, and reduced pressure on the interest rate level. mobilized, this also helps the exchange rate to be more stable when the State Bank sells USD (withdrawal of VND) to improve the domestic supply of USD.

Mentioned in the updated macro report, experts at Bao Viet Securities (BVSC) also emphasized that credit growth in the first 5 months of the year recorded the highest level in the past 10 years, and at the same time doubled the growth rate in the past 10 years. growth in the same period last year.

However, the fact that commercial banks have run out of credit room while the State Bank has not yet loosened the room has prevented more credit from being pushed out in the last days of May 2022.

This movement caused interest rates on the interbank market to drop sharply, overnight interbank interest rates fell to the lowest level since April 2021.

In addition, the 2% interest rate support package with a scale of 40 trillion (equivalent to 2 million billion of low-interest capital) was officially approved in May and has been started by the State Bank of Vietnam. implementation with commercial banks. The research department at BVSC expects that, in the second half of the year, when the State Bank opens the credit room for commercial banks, this interest rate compensation package will be the driving force to help credit continue to grow. strong.

All commercial banks have run out of credit room while the State Bank has not yet loosened the room, which prevented more credit from being pushed out in the last days of May. (Photo: TN)

Banks “run out” of credit room: The State Bank knows but…

Regarding credit growth, General Secretary of the Banking Association Nguyen Quoc Hung also pointed out that the economy initially recovered and businesses resumed production and business activities, which is the cause of credit pull. high growth in the first 5 months of this year.

It is worth mentioning that the credit increase is high, the credit limit is about to expire, so it is necessary to open the credit room because otherwise it will be difficult to effectively implement the programs to support businesses and business households, including the interest support package. 2% rate.

However, from a macro perspective, with inflationary pressures in the world increasing and input material prices increasing, the State Bank will have to carefully consider extending credit growth because this may lead to an increase in credit growth. increasing domestic inflation pressure – according to Mr. Hung.

The General Secretary of the Bankers Association also noted that the State Bank’s goal is to stabilize the macroeconomy, control and prevent inflation. Therefore, even though they know very well the situation that credit institutions are having difficulty in terms of credit room, the State Bank’s leaders must consider it very carefully in order to have the most suitable solution.

Accordingly, the State Bank will have to carefully review the credit activities as well as the financial situation of banks, so the loosening of the room will certainly be uneven. The State Bank will have to base itself on the compliance level of credit institutions on capital adequacy.

For example, Circular 22 stipulates that besides reducing the maximum ratio of short-term funds used for medium and long-term loans to 30% from October 1, 2022, any bank that does not meet the demand, it will be difficult to have the opportunity to expand the room – Mr. Hung cited.

According to Dan Viet’s research, in a document sent out on May 26, the State Bank requested credit institutions and foreign bank branches to continue to comply with the 2022 credit growth target set by the Bank. announced by the State.

In the report just sent to the National Assembly for the interrogation session on June 8-9, Governor Nguyen Thi Hong emphasized that the announcement of credit growth targets for credit institutions has been carried out. According to the principle, credit institutions with safer and healthier operations will be considered by the State Bank to allocate a higher credit growth target. Thereby, promoting credit institutions to improve governance and administration capacity, enhance quality, operational efficiency and operational safety indicators.

at Blogtuan.info – Source: danviet.vn – Read the original article here