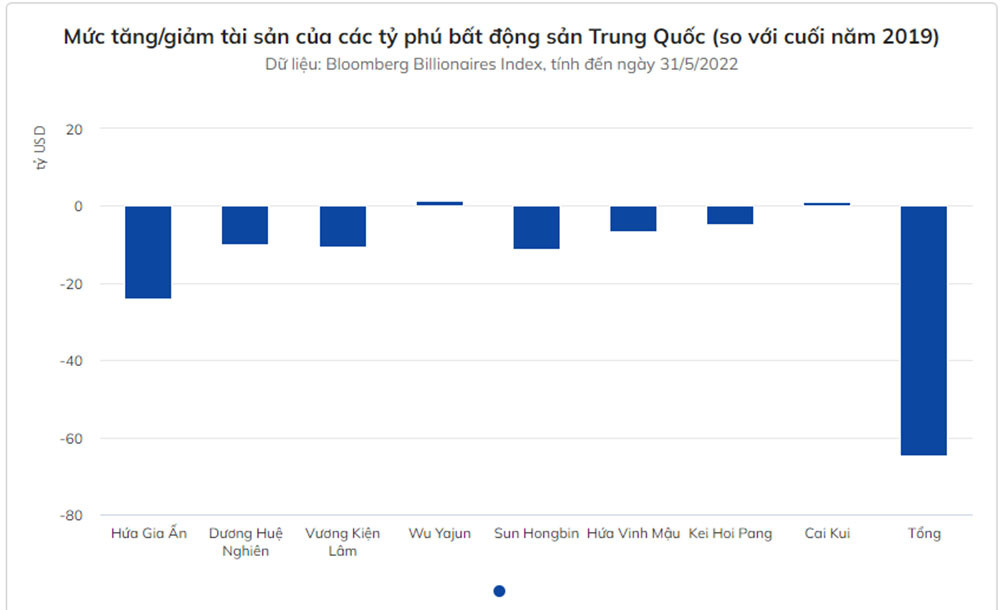

Beijing tightens credit, Chinese real estate giants lose 65 billion USD

Follow BloombergThe Beijing government’s campaign to cool down house prices has shaken the country’s largest real estate groups. House prices fell for 11 consecutive months. The assets of the top real estate giants evaporated 65 billion USD.

Behind the real estate overhaul is Chinese President Xi Jinping’s “common prosperity” strategy, which means bringing moderate wealth to everyone. In the future, China will no longer be the birthplace of many real estate billionaires as before.

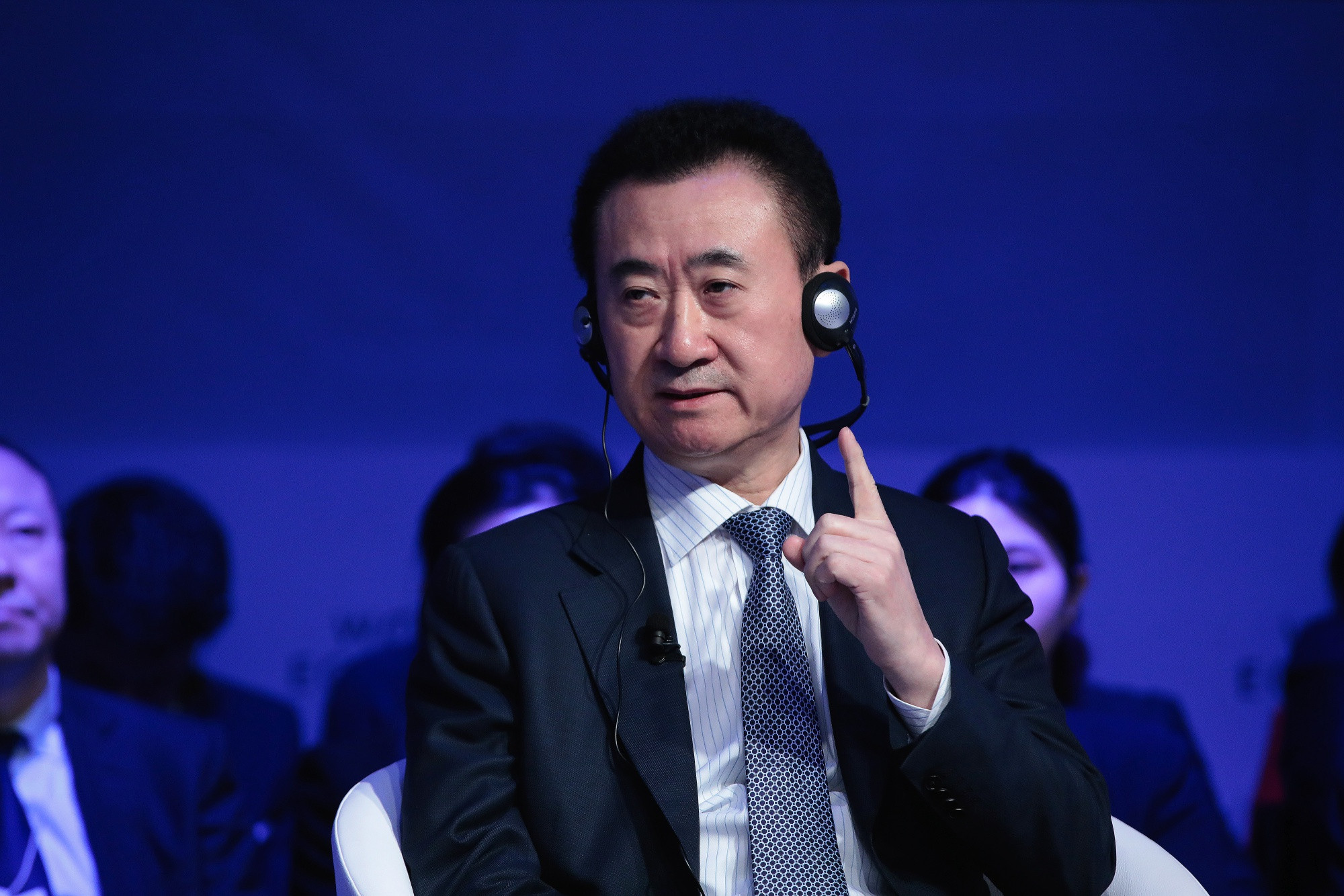

Real estate used to make a great contribution to the development of China’s economy. This industry and related fields account for nearly 30% of the country’s GDP, producing billionaires like Mr. Vuong Kien Lam – Chairman of Van Dat Real Estate Group.

Assets evaporate

Real estate accounts for 60% of the wealth of Chinese people. For decades, for Chinese households, the surest way to get rich and financially secure was to invest most of their money in real estate. House prices have risen steadily since the early 2000s, fueling speculation.

Real estate developers expanded strongly thanks to a massive debt strategy. They also raise capital from huge sources of money outside of China.

Global investors rushed to buy high-yield bonds of the Chinese real estate industry. Heavy debt poses significant risks to the financial system.

Beijing started eyeing this industry in 2016. At that time, President Xi Jinping declared: “House to live, not speculation”. But it won’t be until 2020 that the regulatory storm will sweep the sector.

The 3-red line policy is introduced including a debt-to-assets ratio (excluding advances) up to 70%, a net debt-to-equity ratio of up to 100%, a liquidation ratio of up to 100%. cash payments (cash on short-term debt) 1.

|

Mr. Vuong Kien Lam – Chairman of Van Dat Real Estate Group. Image: Bloomberg. |

If all three red lines are crossed, the real estate group will not be allowed to borrow more money from the bank. At that time, only 6.3% of Chinese real estate companies complied with the debt limits.

The new regulations hit real estate corporations and pushed China Evergrande – China’s second-largest property developer – into default. The debt of the corporation has reached more than 300 billion USD.

Since the beginning of last year, Chinese property developers have defaulted at least 18 billion USD bonds denominated in USD and 2.5 billion USD yuan-denominated bonds.

The fortunes of real estate billionaires also evaporated. Mr. Vuong Kien Lam witnessed a 61% decrease in value compared to the end of 2019. The fortune of billionaire Sun Hongbin – founder of Sunac China Holdings Ltd. – 90% evaporation.

And Mr. Hua Gia An – the billionaire founder of China Evergrande – died nearly 24 billion USD. Last year, Beijing urged Mr. Xu to use his own money to solve China Evergrande’s cash crisis.

According to the Bloomberg Billionaires Index, real estate billionaires now make up less than a tenth of the richest people in China.

The golden age is over

Beijing’s regulatory crackdown has also dragged down other sectors such as technology and education. The country was forced to change its attitude to boost its already slowing economic growth.

At a meeting of the Politburo of China on April 29, President Xi Jinping signaled a change in stance towards the weakening real estate sector. Beijing encourages local governments to “optimize real estate policies based on local realities.”

In other words, local governments can begin to step up their support for the real estate industry, which is a major growth engine of the world’s second economy.

In May, the People’s Bank of China (PBoC) cut mortgage rates for first-time homebuyers.

Mortgage interest rates for first-time homebuyers will fall from 4.6% to 4.4%.

“This change is intended to support housing demand and promote stable and healthy development of the real estate market,” the PBoC said in a statement.

However, observers say that the industry will not be able to recover quickly. Part of the reason is the new wave of the Covid-19 epidemic.

“In addition to the precariousness of the economy in the short term, speculative activity is also likely to continue to decline, as the government repeatedly signals that it will prioritize market development in an orderly manner,” he said. Frederic Neumann, chief economist for Asia at HSBC Holdings Plc.

In the long term, the aging population, falling birth rate, and slowing economy will make the boom phase of China’s real estate industry never return.

“We’re not going to see a V-shaped recovery. Beijing doesn’t want the sector to grow too fast for a long time,” said Alicia Garcia Herrero, chief economist for Asia-Pacific at Asia Pacific. Natixis SA., commented.

(According to Zing)

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here