How China restored the credit market worth more than 12 trillion USD

China’s $12.3 trillion domestic credit market is seeing a significant recovery from overseas markets, after the real estate sector faced a major crackdown, according to Bloomberg. most in history.

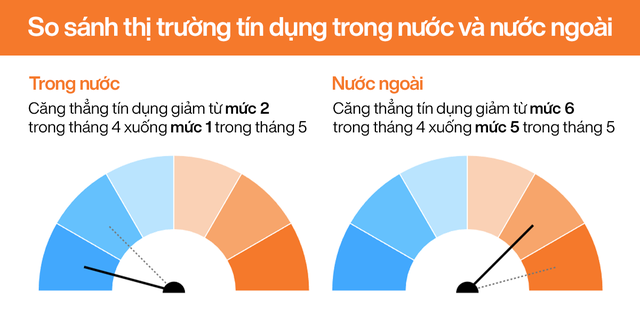

According to Bloomberg’s credit tracking tool, stress in the debt market has fallen to the lowest level in May. The average gap between AA-rated local bonds and government bonds has also narrowed. to its lowest level since 2011.

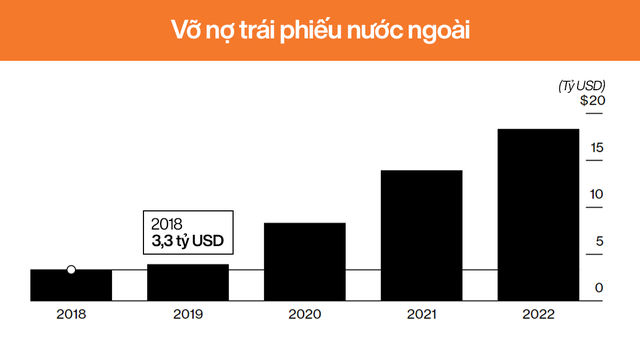

This is in stark contrast to the smaller foreign bond market. This is where planners saw a wave of defaults worth $18 billion, five times the number recorded on the mainland.

For now, maintaining stability in the credit market is a top priority for Chinese authorities as they embark on an ambitious campaign: mitigating financial and moral hazard. The planners are also rebalancing the borrowing policy, allowing people to delay payments while ensuring the safety of the general financial system.

China has traditionally relied on government bonds to raise much-needed public funding. According to Citic Securities, mainland authorities may release at least 1.5 trillion yuan ($225 billion) in bonds this month to support the economy through additional stimulus packages. Chinese banks are buyers of government bonds.

So far, tensions in the real estate sector have largely been contained, especially for the overseas market. The record defaults at real estate giant Evergrande and Kaisa Group, thankfully, did not completely disrupt the achievement of mainland authorities.

This helps the domestic corporate bond market to always maintain positive data over the past 24 months, even when “junk” bonds fluctuated for 9 consecutive months, up to May. After more than a difficult year In difficult times, planners have tried to cool down the credit market by cutting interest rates and deploying credit risk mitigation tools.

Most recently, Chinese state media reported that the country had set up a credit line of $120 billion for infrastructure projects, to revive the economy, which has been affected by epidemic prevention measures. Last week, Premier Li Keqiang also called for boosting economic growth in the second quarter, in which supporting infrastructure projects is seen as a key tool to help China create more jobs and boost economic growth. promote economic growth.

China has set up a credit line of $120 billion for infrastructure projects, aiming to revive the economy

According to experts from S&P Global Ratings, although China’s anti-default policy is only symbolic because they only help to guarantee a part of the principal, it is still considered an essential effort to help the mainland regain confidence. investors’ confidence. The recovery of China’s bond market during the past two years is one of the driving forces for this country to achieve that.

However, there is also an opinion that credit demand in China will continue to weaken, even if the COVID-19 epidemic begins to cool, in which, the decline in consumer confidence is one of the factors. reason.

“Bank credit in the real estate sector fell to 9% in the first quarter of this year, compared with a record high in 2016 of 45%. This decline is likely to continue into the second quarter, despite the commitment of the authorities in the financial support efforts,” said Kristy Hung, banking and real estate analyst.

Follow: Bloomberg

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here