Supporting factors appear gradually, but it is difficult to make big profits in the short term

Illustration.

Rong Viet Securities Company has just released a report on securities investment strategy in June. Accordingly, this securities company believes that the market in June will not have much information strong enough to affect the market, in both positive and negative directions. pole.

According to a report of Rong Viet Securities, in terms of valuation, many stocks with good fundamentals have dropped to a reasonable price range for the holding dimension. But in terms of cash flow, because of the lack of supporting information, the liquidity will only improve slightly compared to the average level of May.

Considering the factors of information, cash flow, or valuation, it can be seen that the market is in an equilibrium – weak. Therefore, Viet Rong believes that a somewhat defensive investment strategy and for medium-long-term goals will be more appropriate during this period. Accordingly, instead of “full margin” as before, investors should reduce the leverage ratio (or with prudent investors, they can maintain the stock:cash ratio at 70:30), to spend buying power to wait for opportunities in strong correction sessions of the market. At the same time, disbursement requires “patience”, waiting for preferred stocks to return to a good price range to buy, instead of following the “FOMO” mentality as before.

The VN-Index recovered quite quickly after falling sharply to 1,165 points in May. In June, Rong Viet expects there will not be many similar sell-off sessions. VN-Index will fluctuate in the range of 1,240-1,350 points until there are more catalysts for the index to clearly identify the trend.

Pressure from selling mortgages has decreased but cannot expect strong cash flow to enter the market

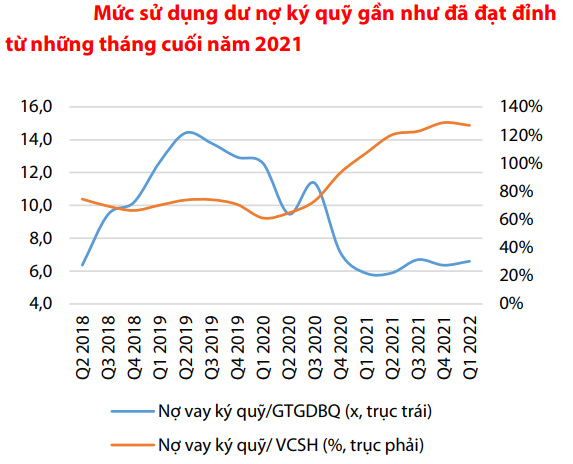

According to Rong Viet Securities, the VN-Index has had a hard time conquering the high threshold in the context that the margin loan utilization rate has almost peaked since the last months of 2021. In April and May. , the market experienced many strong decline sessions with a decrease from approximately 1.5 – 2% to approximately 4.7 – 4.8%.

In addition, the total matched value in May decreased by more than 32% over the same period. Except for February 2021 which is the traditional Tet month, this is the month with the lowest matching value in the past 17 months on the HSX. Rong Viet believes that the outstanding loan balance has also decreased significantly. This will at least help the market avoid the sharp drops and shocks in June, often caused by mortgage selling.

The beginning of summer is usually the off-peak time for the stock market

After the season of the general meeting of shareholders ended, the market almost entered the information blank area until the news about the company’s second-quarter earnings results were announced. This is the reason that May and June are often unfavorable times for the stock market.

In terms of information, at the present time, Rong Viet Securities sees a fairly balanced influence between positive and negative information. In that balance, if new cash flow actively participates, it will be a great support for the index as well as market movements. Rong Viet Securities expects this new cash flow to come mostly from ETFs –

Hard to make big profits in short term

With the recovery from the low of the market in May, investors who persisted in holding and accumulating stocks have more or less got results. Some stocks recorded a recovery that outperformed the VN Index with supportive factors from positive business results and net capital inflow into the VN Diamond ETF (for FPT only). On the other hand, cash flow continued to decline in real estate and banks, making the “bottom-fishing” strategy not as profitable as expected.

According to Rong Viet, Vietnam’s stock market is still facing a lot of macro risks from the outside, especially related to tight monetary policy in the context of difficult global inflation, led by energy prices. High yield and food due to the impact of the Russian-Ukrainian conflict. Rong Viet Securities believes that this factor will continue to affect Vietnam’s inflation expectations, thereby, becoming a major obstacle to the market’s upward momentum in the context of increasingly cautious and difficult cash flows. many positive news spread on a large scale in June. Therefore, unexpected increases in the month will be a good opportunity for investors to structure their portfolios towards reducing leverage (or maintaining a high cash ratio for prudent investors). , to save buying power to wait for opportunities in strong correction sessions of the market.

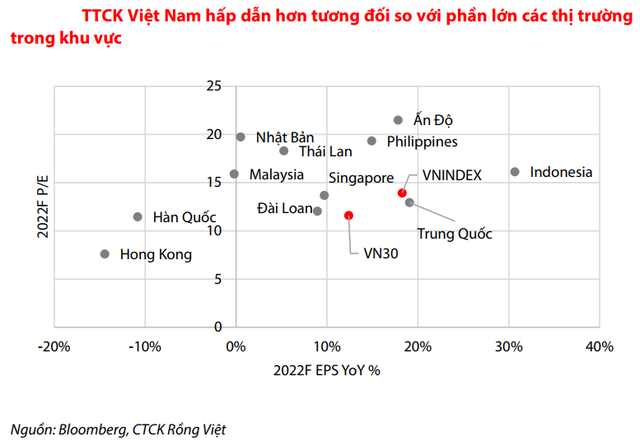

While cash flow from investors is unlikely to improve sharply in June as investment sentiment is still quite cautious, Rong Viet expects ETFs like DCVFM VN Diamond or Fubon FTSE to maintain their status. short-term net attraction thanks to internal factors Vietnam stock market is still more attractive compared to some countries in the region.

As of June 3, 2022, the VN Index’s 2022 P/E valuation is 13.9x, with a forecasted EPS growth in 2022 of 18%. Moreover, the fact that VND is stronger than many countries like Thailand and Taiwan is also a positive factor supporting the trend of net withdrawal of ETFs in these markets. Taking advantage of cash flow from ETFs is probably not a bad choice in the short term.

Therefore, Rong Viet believes that the opportunity to accumulate stocks with a large proportion in the ETF portfolio is still possible this month.

Factors that support the market gradually appear

Together with Dragon Viet, VnDirect Securities Company also has a report assessing the stock market in June, and thinks that the supporting factors for the market are gradually appearing.

Firstly, the improved Covid-19 situation in China is good news for the global supply chain.

Second, the strong recovery of the Vietnamese economy in the coming quarters.

Third, the official implementation of the 40,000 billion VND interest rate compensation package can help reduce the average lending interest rate by 20-40 basis points in 2022.

Fourth, the strong prospect of listed companies in the period of 2022-2023.

On the contrary, the market also faces some risks, such as the Fed tightening monetary policy more aggressively.

Based on these factors, VnDirect believes that the market will continue to recover in June. However, the market has not formed a clear uptrend and the liquidity is still at a low level. Therefore, investors should continue to maintain a reasonable proportion of stocks and limit the use of financial leverage (margin) to limit risks.

Following the Economic Lifestyle

at Blogtuan.info – Source: cafebiz.vn – Read the original article here