Which bank gives the most real estate loans?

Although real estate is a high-risk field, many banks still orient loans if the real demand is good, the project is good. Outstanding real estate loans in some places amounted to more than 95,000 billion VND.

According to a report of the State Bank of Vietnam, by the end of April, the total outstanding loans to the real estate sector (real estate) of credit institutions reached more than 2.28 million billion VND, up 10.19% compared to the end of April. In 2021, accounting for 20.44% of total outstanding loans to the economy, bad debt ratio is 1.62%.

Currently, about 94% of real estate credit balance is for medium and long-term loans (10-25 years), while the bank’s mobilization source is mainly short-term. The State Bank of Vietnam recognizes that the difference in terms and interest rates between capital and lending in this field presents a huge risk to banks.

Real estate loan “champion”

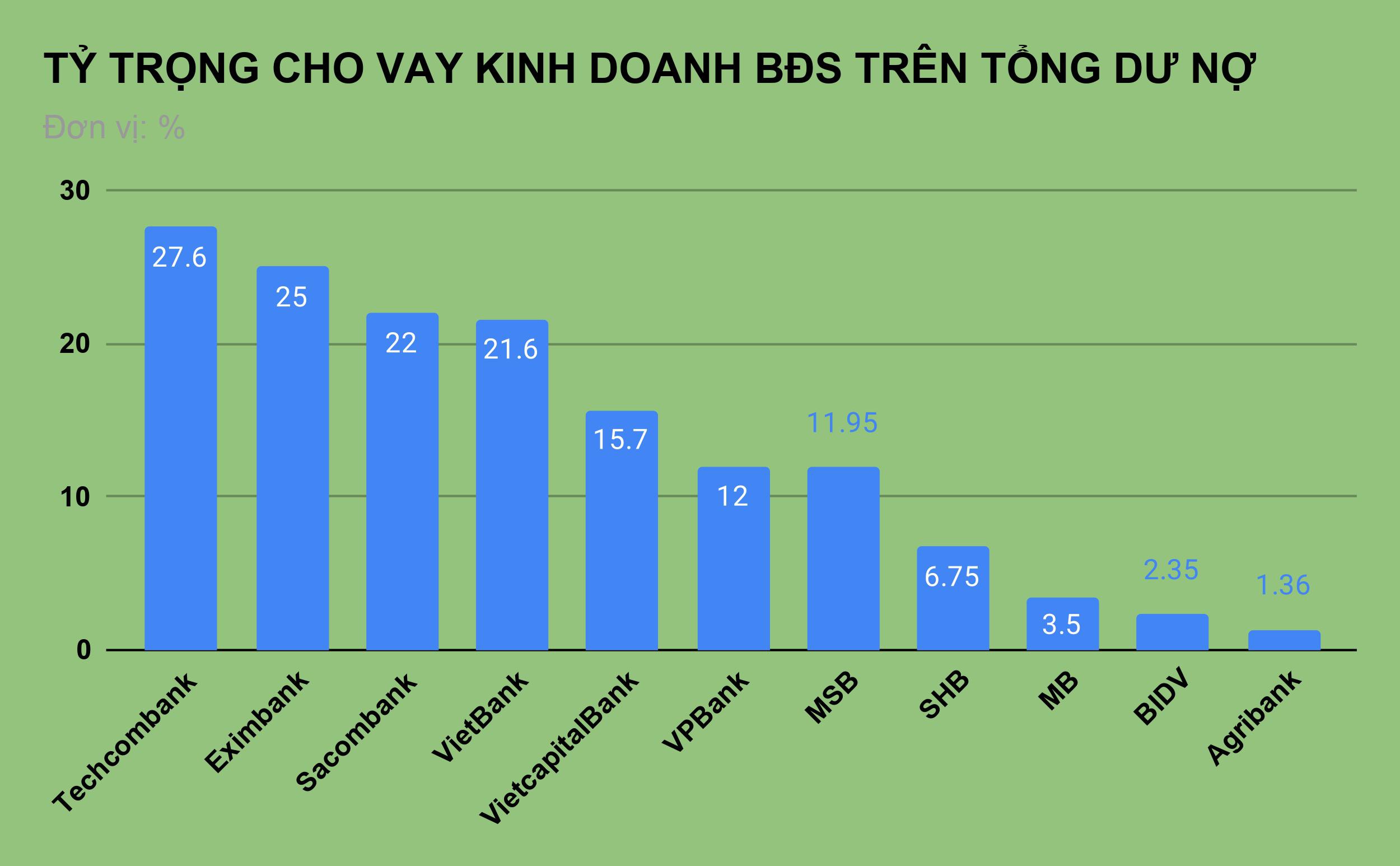

By the end of 2021, Techcombank was the bank that gave the most loans to real estate business with a loan balance of VND 95,913 billion, accounting for 27.6% of total outstanding loans to customers. This ratio is very high when the survey shows that no bank has a balance of loans for real estate business exceeding 30%.

Outstanding loans for real estate business of this bank also increased by 4,500 billion VND compared to 2020 but the proportion decreased by more than 5.3 percentage points. In fact, the increase in the loan balance for real estate business but the decrease in the proportion occurred in most banks.

At the end of March, Techcombank issued a document to “tighten” the disbursement of loans to buy real estate, with the explanation to ensure compliance with the regulations of the State Bank on the credit growth rate.

The ratio of loans for real estate business to total outstanding loans (Figure: Van Hung).

Despite the high proportion of real estate loans compared to the common ground, in response to questions from shareholders at the annual shareholder meeting, Techcombank CEO Jens Lottner affirmed that in the past 5 years, the bank has not had any problems with banks. real estate loans, bad debt is almost zero. He said risk management is still being done well and affirmed that he will continue to maintain the orientation with real estate lending.

Mr. Ho Hung Anh, Chairman of the Board of Directors, also affirmed that Techcombank over the years has focused on lending to people wishing to buy houses and good projects, minimizing the lending of land as speculation that does not bring value.

In addition to Techcombank, Sacombank also announced to suspend lending to the real estate sector until the end of June. In 2021, Sacombank’s real estate loans will account for about 22% of total outstanding loans (equivalent to more than 85,000 billion VND). In which, loans to people to build and repair houses account for 60%. Loans for project development only account for a small percentage.

The proportion of outstanding loans for real estate business reached over 20%, and there were Eximbank and VietBank. Eximbank lends real estate nearly VND 28,700 billion, over nearly VND 114,700 billion of total outstanding loans to customers (accounting for 25%).

Meanwhile, VietBank has a loan balance in the real estate sector of only about 10,900 billion VND, but because customer loans are at an average level (about 50,530 billion VND), the ratio is up to 21.6%.

How do other banks lend real estate?

According to the survey, only a few banks have outstanding loans for real estate business exceeding 20% of the total outstanding loans to customers. Most of the parties maintain the lending ratio in this sector around or below the threshold of 10%.

In 2021, VPBank provided loans for real estate business of VND 42,567 billion, accounting for 12% of total outstanding loans. Mr. Nguyen Duc Vinh, CEO of VPBank, said that in the context of bad debts tend to increase due to the impact of the epidemic, it is appropriate for the management agency to strictly control real estate lending. However, the leader of this bank said that there is still room to grant credit to this sector, especially with a properly invested and legal project.

Meanwhile, the proportion of outstanding loans for real estate to total outstanding loans to customers at Vietcapital Bank is 15.7%, equivalent to 7,300 billion VND; MSB is 11.95%, equivalent to 12,100 billion VND; SHB is 6.75%, equivalent to 24,400 billion dong; MB is 3.5%, equivalent to 12,632 billion VND.

In the group of state-owned banks, Agribank lent about 17,900 billion VND for real estate business, accounting for 1.36% of the total outstanding loans. BIDV lent to this group of customers nearly VND 31,900 billion, accounting for 2.35%. Meanwhile, Vietcombank and VietinBank did not disclose the proportion of real estate loans in their financial statements.

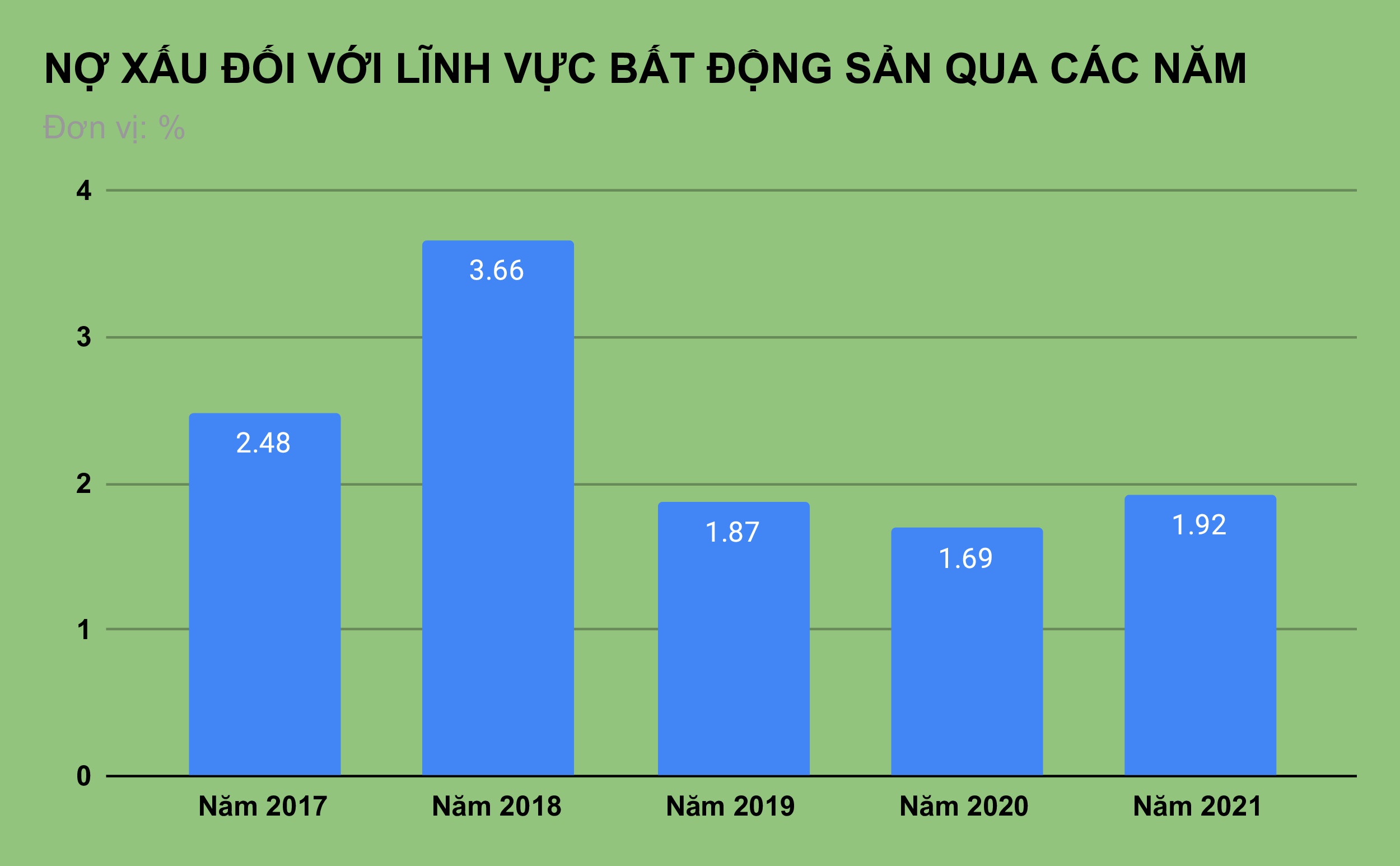

Bad debt for real estate over the years (Chart: Van Hung).

Many banks believe that the sources of real estate loans go to the need to buy real houses, so the risk of bad debt is not high. Credit quality for the real estate sector is increasingly improving.

In terms of numbers, bad debt for the real estate sector has gradually decreased. Specifically, in 2017, the bad debt ratio was 2.48%; in 2018 is 3.66%; In 2019, the bad debt ratio decreased to 1.87%. By 2020, this figure will be 1.69% and by 2021 it will be 1.92%.

Meanwhile, the State Bank (SBV) assessed the real estate investment and business sector as one of the risky areas for banking activities, requiring control solutions. In the report serving questioning just sent to the National Assembly, Governor of the State Bank Nguyen Thi Hong worried that the real estate market fluctuated sharply, the situation of inflated prices caused a virtual real estate fever, land auctions at unusually high prices, etc. providing credit, valuing collateral assets of credit institutions.

Therefore, the banking industry is closely monitoring the growth rate of outstanding loans and credit quality with the securities and real estate sectors to promptly detect potential signs of risks and take appropriate measures to ensure system safety.

Regarding orientation, Governor Nguyen Thi Hong affirmed that the State Bank will strictly control credit in potential risky areas, including real estate investment and business. As for the purchase of housing for self-use, consumption, or the need for loans to buy social housing, housing for workers or low-cost commercial housing… it is facilitated.

According to Dan Tri

at Blogtuan.info – Source: infonet.vietnamnet.vn – Read the original article here