Real estate lending situation at banks

In addition, the State Bank also said that currently 94% of real estate credit balances are medium and long-term loans (10-25 years), while the bank’s mobilization sources are mainly short-term.

Real estate loans of banks are classified in different forms such as loans for real estate business or personal loans, consumer loans to buy houses, buy land to build houses…

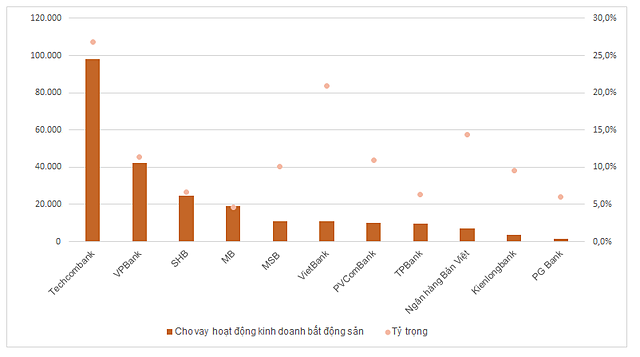

Loans alone real estate business According to Fiinpro data, Techcombank (HoSE: TCB) has the largest outstanding balance with more than 98,100 billion dong, accounting for 26.8% of the structure. In addition, this bank has VND 171,623 billion of personal loans, including loans to buy houses and real estate.

Mr. Jens Lottner, CEO of Techcombank once affirmed that in the past 5 years, the bank has not had a problem with real estate loans, bad debt is almost zero. He said risk management is still being done well. and affirmed to continue to maintain the orientation with real estate lending. Ho Hung Anh, Chairman of Techcombank’s Board of Directors, said that real estate is still a potential and profitable field. If the bank can manage risks well, there is no reason to limit entering this field.

Odd debt real estate business at some banks. Unit: billion VND, % |

Following, VPBank (HoSE: VPB) recorded loans for real estate business of more than 42,483 billion VND, accounting for 11.4% of the outstanding loan structure, as of March 31. At the same time, this bank has VND 66,387 billion in personal loans to buy houses, receive land use rights to build houses, proportion of 17.7%. Preliminarily, this bank has more than VND 108,807 billion in loans in the real estate sector, equivalent to 29% of outstanding loans.

At the 2022 annual general meeting, Mr. Nguyen Duc Vinh, General Director of VPBank shared that nearly 40% of the outstanding loans in the retail segment are home loans. This is an essential and practical need so VPBank will still maintain and expand lending, but some types such as resort real estate or speculative real estate will be managed and controlled by the bank. close these loans.

The next two banks with large outstanding loans for real estate business include SHB with VND 24,826 billion and MB with more than VND 19,311 billion, accounting for 6.7% and 4.6% respectively in each bank’s loan structure. .

As for MB, the bank has 138,147 billion dong of loans for household employment, production, material products and services for self-consumption of households, including a portion of loans. buying houses… MB’s General Director, Mr. Luu Trung Thai once mentioned in his sharing with shareholders about the proportion of loans in the business real estate sector (including industrial and residential real estate) accounting for 10%. In terms of structure, investment in real estate bonds accounted for more than 3%.

Other banks that update real estate loans in the first quarter financial statements can point to such as VietBank with VND 10,789 billion, accounting for 20.9% of total outstanding loans; Viet CapitalBank has a weight of 14.3%, PVCombank 10.9% and MSB 10.1%.

Besides, some leaders also revealed the proportion of real estate loans at the 2022 annual meeting. For example, Ms. Nguyen Duc Thach Diem, General Director of Sacombank said that the proportion of real estate sector is about 22%. . In which, consumer loans accounted for 60%, business loans 20%. Outstanding loans for real estate of enterprises are at VND 30,000 billion, accounting for 7.5% of the total outstanding loans of nearly VND 400,000 billion. Ms. Diem said the bank is controlling real estate lending.

There is no document on real estate lending restrictions

At the 2022 General Meeting of Shareholders and a number of events related to real estate credit, leaders of banks all said that real estate credit balances only account for a small proportion of total outstanding loans, some banks reduced the rate of real estate loans. Real estate lending weight is below 10% this year. Bank leaders also said that currently there are no restrictions related to real estate lending, banks will give priority to lending to effective projects and reputable investors.

At a recent seminar related to capital for the real estate market, Mr. Nguyen Dinh Vinh, Deputy General Director of VietinBank said that currently there is no document from the State Bank to mention tightening or restricting real estate lending. On June 1, Vietinbank issued a document guiding branches in lending related to the real estate sector. Real estate loans account for about 20% of the credit portfolio, real estate loan bad debt is about 0.3%, which is a positive figure compared to other industries.

Mr. Vinh also gave the opinion that when choosing between lending fields, real estate is one of the areas that banks can confidently lend, along with collateral and real needs of customers. population and economic growth. VietinBank will continue to give priority to lending to real estate projects from experienced and successful investors in project development, projects with good locations, infrastructure planning or tourist attraction, projects. resort project…

Sharing the same view with VietinBank, Mr. Tran Phuong, BIDV’s Deputy General Director, said that projects with experience, feasibility, suitable location and good sales ability will be loaned. BIDV leaders said that when borrowing capital, they still have to have conditions such as collateral, because real estate has high profits, so the risks are also great. This is not a short-term market, so in the process of working, there must be an agreement, businesses have sustainable revenue and profits, and banks must also be safe in the long term.

Sharing about real estate consumer lending, Mr. Phuong shared that by the end of May 31, credit growth reached 6.51%, consumer loans increased by nearly 14%. The bank has no restriction on disbursement of real estate loans and depends on the actual needs of home buyers, during the implementation process, the bank will carefully consider to avoid the case of granting credit to lending cases to collect investment land.

SBV has a cautious view of real estate credit

Real estate investment and business is assessed by the State Bank as one of the risky areas for banking activities, requiring control solutions. At the National Assembly session, Governor of the State Bank Nguyen Thi Hong said that the policy of the executive agency is to expand credit must go hand in hand with safety and efficiency, focus capital on production and business and control activities. capital into risky areas.

According to the governor, the nature of real estate credit is often large value, long term. Meanwhile, deposits of the banking system are short-term deposits. Therefore, the State Bank has legal regulations to control risks, directing credit institutions when lending with collateral to regularly re-evaluate collaterals to identify risks.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here