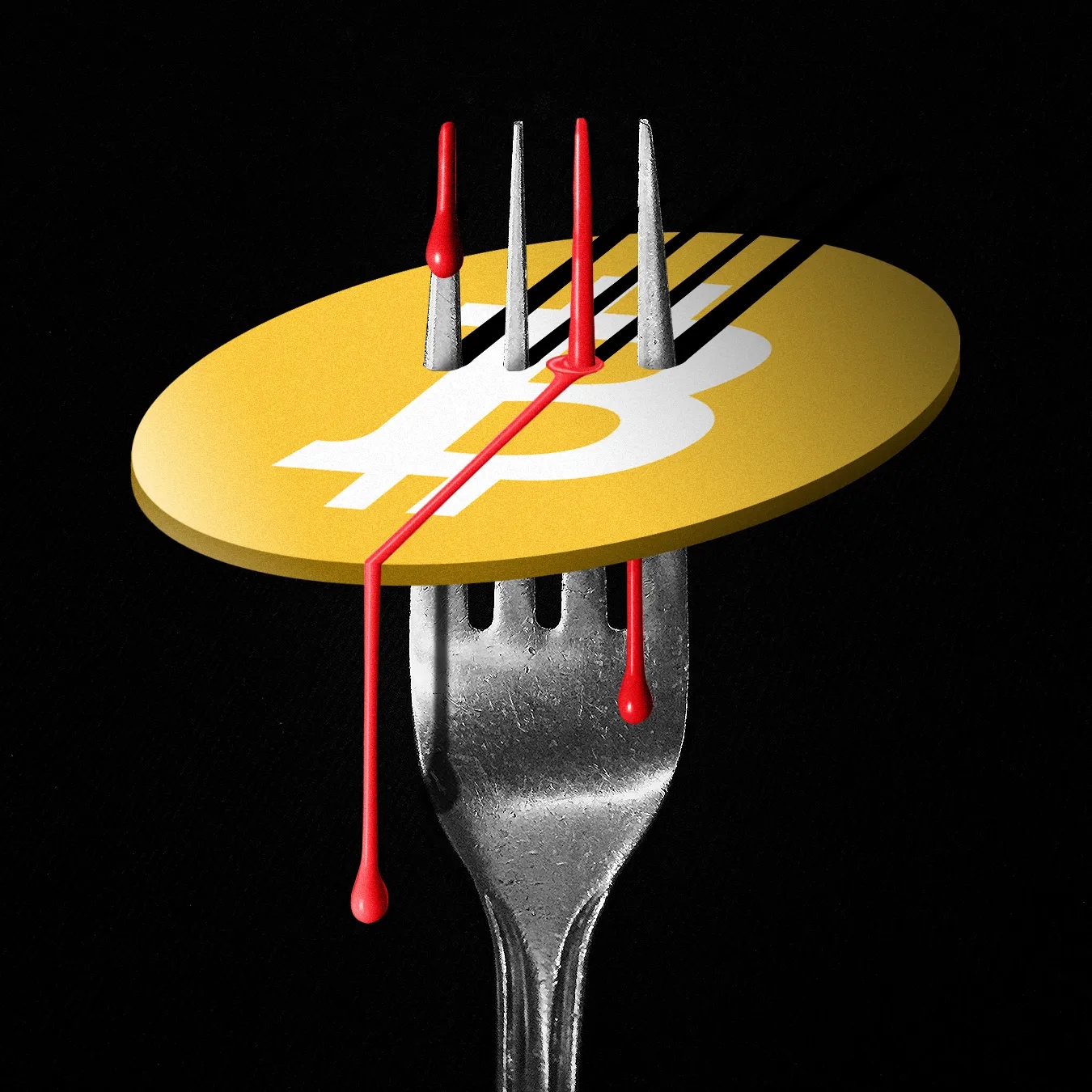

Cryptocurrencies are a threat to the safety of the global payment system?

The tremendous growth, volatility, and financial innovation being seen in the crypto-asset ecosystem, as well as the growing participation of institutional investors, demonstrate the importance of gain a better understanding of the potential risks that crypto assets can pose to financial stability if trends continue on this trajectory.

Systematic risk increases with the degree of connectivity between crypto-assets and the traditional financial sector, the use of leverage, and lending. It is important to close the regulatory and data gaps in the crypto-asset ecosystem to mitigate such systemic risks.

Currently, crypto assets are currently the subject of fierce policy debates. Different segments of the crypto-asset market include unsupported crypto-assets (such as Bitcoin), decentralized finance (DeFi), and stablecoins.

Cryptocurrencies are a “threat to the security of our payment plans,” warned Anne Boden, CEO of digital bank Starling, UK. Photo: @AFP.

Just recently, the owner of the Goldman Sachs-backed digital bank Starling doubled down on criticism of cryptocurrencies, calling cryptocurrencies a threat to the security of the payments infrastructure.

“That’s very dangerous,” warned Anne Boden, who founded Starling in 2014, at the Money 20/20 fintech conference in Amsterdam. Based in the UK, Starling offers free loans and checking accounts through an app. The company was last privately valued at £2.5 billion ($3.1 billion) and has capital from investors such as Goldman and Fidelity.

“A lot of crypto wallets are being connected directly to payment schemes,” Boden said. “This is a threat to the safety of our payment plans worldwide.”

According to Anne Boden, crypto-assets lack intrinsic economic value or reference assets, given their frequent use as a speculative tool, their high volatility and energy consumption, and their use Using them in illegal activities makes crypto assets a high-risk instrument. This also raises concerns about money laundering, market integrity and consumer protection, and could have implications for financial stability.

Major paying players are accepting cryptocurrencies – credit card giants Mastercard and Visa, for example, have opened their networks to digital assets, while PayPal also allows users to trade bitcoin and other cryptocurrencies. Regulators are concerned that the financial system will become increasingly caught up in the volatile world of cryptocurrencies.

About $400 billion has been removed from the aggregate value of all cryptocurrencies over the past month, as investors worried about the demise of terraUSD, a popular cryptocurrency known as stablecoins. always worth 1 dollar.

However, this is not the first time Boden has warned about the dangers of the crypto space. In the past, she has sounded the alarm about the risk of consumers falling victim to financial fraud, due to investing in cryptocurrencies.

“Customers are being scammed,” said the Starling director. “We are spending more time protecting customers from scammers than we are trying to promote crypto.”

When asked if Starling will ever offer crypto, Boden said this is unlikely to happen in the next few years, adding that crypto companies have a lot of work to do when it comes to cryptocurrency. anti-money laundering controls.

Regulators are concerned that the financial system will become increasingly caught up in the volatile world of cryptocurrencies. Photo: @AFP.

In April, the UK’s Financial Conduct Authority released the results of a review that found online banks were not doing enough to tackle financial crime. The regulator did not name any, but Anne Boden confirmed it was one of a number of companies whose systems were being scrutinized, she told a spokeswoman and said her company had been “extremely strong” in fighting fraud.

Anne Boden further added that major payment networks have “increased support for crypto services” and institutional investors “now also invest in bitcoin and cryptocurrencies more generally.” , but the link between eurozone banks and crypto-assets “has been limited so far”.

The EU is finalizing the so-called crypto-asset market law, but it won’t come into force until 2024 at the earliest. Anne Boden said: “Given the speed of cryptocurrency development and increasing risks, increase, it is important to bring cryptocurrencies into regulation and under scrutiny is a matter of urgency.”

at Blogtuan.info – Source: danviet.vn – Read the original article here