Run away from hot stocks, new opportunities appear

Unpredictable movements in the world commodity financial market caused money to rush in and out of hot stocks.

After a period of hot rise, stocks of some industry groups turned down sharply due to reversals in the market.

GAS shares of Vietnam Gas Corporation fell sharply for the third consecutive session, from a peak of 124,600 VND/share to 106,000 VND/share, equivalent to a decrease of nearly 15% in a very short time.

PVG shares of Northern Petroleum Trading JSC also fell deeply for 3 consecutive sessions, from 19,200 VND/share to 15,800 VND/share, equivalent to a decrease of nearly 18%. In the session of March 14, this stock dropped nearly 10%.

Petrochemicals and Services Corporation (PVC) fell at a level not inferior to 3 consecutive sessions of decline, bringing this stock from 34,400 VND/share to 26,700 VND/share (equivalent to a decrease of more than 22%). .

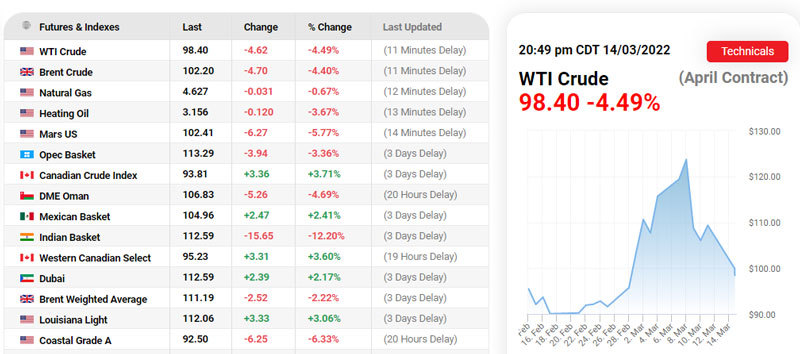

The group oil and gas stocks dropped sharply as oil prices on the world market plunged from a peak of 140 USD/barrel last week to the threshold of 100 USD/barrel in the context of Russia-Ukraine tensions showing signs of cooling down and negotiations could break through.

|

| Cash flow is still quite large on the stock market. |

Stocks of steel, fertilizer, chemical, shipping,… also fell after a few weeks of strong gains thanks to a breakthrough in world commodity prices.

In the market, statistics show that transactions in many groups of stocks decreased sharply, liquidity decreased by several tens of percent. Cash flow showed signs of withdrawal when profit-taking activities increased strongly. Liquidity of steel stocks such as TLH, POM, VGS or variable transportation groups like TCL, PHP… decreased.

Coal stocks also recorded cash outflows such as Mong Duong Coal (MDC), Vang Danh Coal (TVD), Ha Lam Coal (HLC)… Liquidity reduction was up to 30%.

Corresponding to the cash outflow momentum, the prices of these stocks also decreased. In recent sessions, Mong Duong Coal decreased from 20,100 dong to 16,800 dong/share. Than Ha Lam meanwhile fluctuated very strongly, from floor to ceiling.

Banking stocks also witnessed a 30-50% decrease in liquidity, with faces like VPBank, Vietinbank, MSB, TPBank…

Previously, according to SSI Research, rising oil prices brought both short- and long-term investment opportunities. Oil price volatility will directly affect GAS, as well as PLX and OIL and BSR. For upstream oil and gas companies (PVD & PVS), the 14-year peak oil prices did not immediately affect net profit in the short term as these companies rely on projects of a longer-term nature.

SSI Research believes that a stable oil price environment and maintaining above 60-70 USD/barrel will be favorable conditions for Vietnam to exploit existing oil and gas fields as well as deploy new oil and gas projects.

A positive oil price will help promote exploration and production investment activities, especially the implementation of large projects, helping to bring potential workloads for PVD and PVS in the long term.

Money hasn’t left the market yet

Contrary to the trend of declining liquidity in hot stocks, the cash flow still showed signs of staying on the stock market.

Liquidity in the market increased sharply in the session of March 14 when the stock indexes dropped sharply, VN-Index dropped more than 20 points to below the threshold of 1,450 points. Transaction value on HOSE also increased to nearly 29 trillion dong. Trading volume on Hanoi floor even increased by over 22%.

VN-Index broke through 1,450 points. Many leading stocks have fallen quite sharply and are said to be in attractive territory. Vinhomes shares fell to 74,000 VND/share, corresponding to a P/E of 8 times, an attractive indicator for a leading real estate company in Vietnam.

Dragon Capital believes that the war between Russia and Ukraine has not had a big impact on Vietnam’s economy except for the increase in raw material prices. The USD/VND exchange rate will not be affected by abundant FDI inflows, high foreign exchange reserves, and low foreign debt outstanding.

|

| World oil prices fell sharply. |

In the worst case scenario, where commodity prices increase sharply and for a long time, leading to stagnant inflation in developed economies, Dragon Capital believes that Vietnam can still outperform other markets thanks to factors such as: positive intrinsic.

In fact, Russian-Ukrainian war is showing signs of cooling off with statements expecting the 4th negotiation.

The oil price is plummeting, thereby negatively affecting the oil and gas group but supporting most other stock groups.

Wti oil price in the early morning of March 15 continued to fall sharply and reached the threshold of 98 USD/barrel. Brent oil is close to 100 USD/barrel, much lower than the peak of 140 USD/barrel in the previous week. However, the current price is still about 30% higher than at the beginning of the year.

Investors also focused on the move of the US Federal Reserve (Fed) at its March 16 meeting with the expectation that the agency will raise the target interest rate by 25 percentage points, from a record low. 0-0.25% now up 0.25-0.5%.

In Asia, many stock markets fell sharply on concerns that China’s blockade of the city of Shenzhen because of the Covid-19 outbreak and the Russia-Ukraine war would disrupt shipping and air transport. According to ANZ, if the blockade order is prolonged, the Chinese economy will be severely affected.

V.Ha

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here