Why did the US exploit more oil but failed to do so despite the record high gasoline prices, forcing OPEC to increase production?

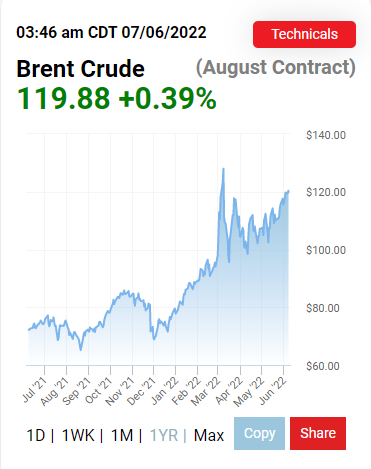

According to the Financial Times (FT), although Saudi Arabia and major oil producers have agreed to sharply increase oil production, oil prices have not yet declined. The international price of Brent oil on the futures market for August delivery stood at 119.51 USD/barrel in the session of June 6, 2022, which is higher than the price before the Organization of the Petroleum Exporting Countries (OPEC). ) meeting on June 2.

After months of pressure from the United States, OPEC agreed to increase production to counter the current skyrocketing oil price. According to the plan, OPEC will exploit an additional 650,000 barrels of oil per day to solve the situation of gasoline prices at record highs in the US.

Brent oil price delivered in August 2022 on the futures market

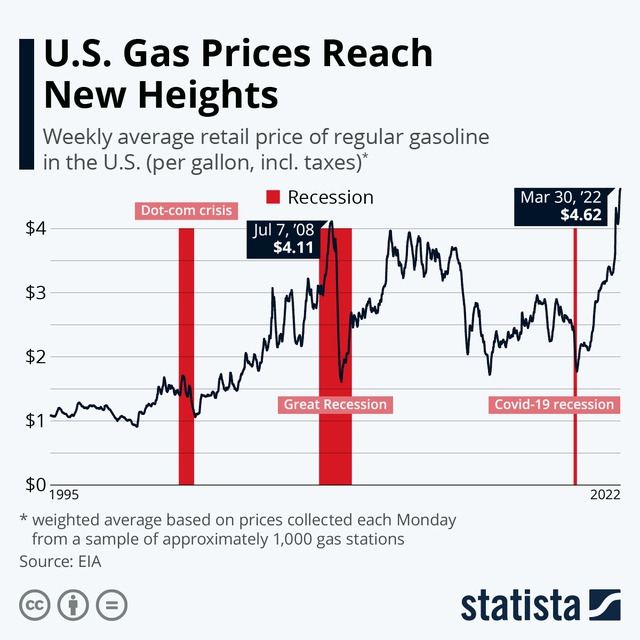

Currently, US President Joe Biden is facing a midterm vote in Congress and high gas prices and inflation are becoming major contentious issues.

However, the question that attracts many people today is why Saudi Arabia, a country considered a key to the oil industry, and OPEC members decided to increase production but prices have not yet declined?

The actual number

If you look closely, OPEC’s commitment to increase production is actually not much, if not much lower than it actually is. Of the additional 650,000 barrels of oil, about 432,000 barrels per day are already part of the previous plan to increase production and have been anticipated by investors and the market. So the real increase is only 218,000 bpd.

Next, many small members of OPEC were behind schedule, did not exploit enough of the committed oil, thereby making the organization short of 2.6 million barrels of oil per day compared to the plan, equivalent to nearly 3 % of total world oil demand.

Meanwhile, consulting firm Rapidan Energy Group said that OPEC will probably only increase about 355,000 bpd in the next two months. This is too small compared to the gap of 3 million bpd in the second half of this year that the International Energy Agency (IEA) warned when Russia was withdrawn from the market.

“Saudi Arabia’s oil policy has changed, but they have not helped much. We can hardly bring the role of OPEC back to the way it was before and this increase in production will only bring symbolic,” said former US President George W Bush adviser Bob McNally.

Capital interests

Another factor that makes the US push OPEC to increase production is the country’s shale oil industry is struggling. Despite the price of gasoline rising by 60% in the past year to an all-time high, US shale oil companies, instead of increasing production, take advantage of the high price to pay dividends and buy back shares for shareholders. bronze. After all, it is investors who need to pay attention, not consumers or the US government.

Gas prices in the US are too high

The FT reported that negotiations to import gasoline from Venezuela, an energy powerhouse that suffered from an inflation crisis because of oil devaluation as well as the US embargo, have yet to go anywhere. Meanwhile, the nuclear deal with Iran, which exported 2.8 million bpd before the US reimposed sanctions in 2018, is at an impasse.

Another option is to import oil from Canada, but with the decision to cancel the license to build the Keystone XL oil pipeline, this move could bring political criticism to the White House.

Even if the US successfully negotiates with all of the above countries to import oil, it will take several months because of futures contracts, old customers, and transportation of capital is congested around the world. .

In addition, the reopening of the Chinese economy also caused demand to rebound sharply, making the supply unable to meet. OPEC estimates that total world oil demand will increase from 97 million bpd in 2021 to 100.3 million bpd this year.

Currently, the US is having to open petroleum reserves to cool the market, and at the same time, urge mining companies to increase production. Even the White House has loosened regulations on environmental pollution to increase gasoline supply, and discussed to suspend the federal gasoline tax to lower gasoline prices.

However, the FT said that the above measures are only temporary and do not improve the current supply and demand situation to help lower gasoline prices in the long term.

*Source: FT

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here