Stock news on March 25: The ‘shock’ of land tycoon Thu Thiem CII, flying 4 trillion, was called a warning

Landlord Thu Thiem CII returned to a downtrend after the shock of losing 50% of its value. The margin cut and the warning is the next bad news for this business. Real estate waves floating on the floor did not help this stock.

According to the Ho Chi Minh Stock Exchange (HOSE), Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company (CII) will be put under a warning from March 30, because this business has after-tax profits of the company. parent company shareholders in 2021 negative 332 billion.

CII recorded a sudden loss of 375 billion dong in the fourth quarter of 2021. The enterprise also recorded a negative net cash flow from operating activities of nearly VND 882 billion.

Previously, CII stock was also included in the list of securities not eligible for margin trading by HOSE.

According to the explanation, the situation of the Covid-19 epidemic is complicated, leading to a decrease in vehicle traffic, thereby reducing toll revenue from road and bridge projects. Meanwhile, CII’s construction projects had to be suspended for a while, leading to delays, causing revenue from real estate business, construction and maintenance to also decline.

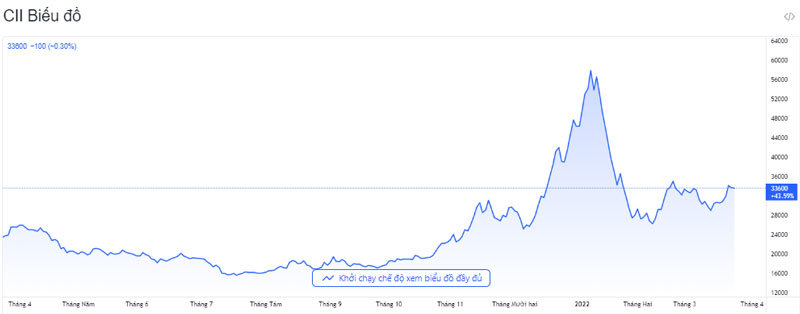

CII recorded two declines after gaining 3 consecutive sessions, following the wave of real estate stocks and the news that two companies won a total of about 1.5 hectares of Thu Thiem land (for about 500 million VND/m2), promising not to give up. such as Viet Star Real Estate Investment Company Limited and Binh Minh Investment and Trading Company Limited.

|

| Holding a lot of land in Thu Thiem, CII recorded poor business results. |

CII is an infrastructure investment business and has recently invested heavily in real estate. This enterprise has “diamond land” in Thu Thiem area. CII has been allocated about more than 90,000m2 of land for stable and long-term use and more than 6,000m2 of land used for 50 years (for office construction). These are all beautiful lands, along the river, park, and North-South axis, adjacent to Thu Thiem 1 bridge.

Although holding a huge gold land fund and implementing many outstanding projects, CII has recorded modest profits in recent years.

From the beginning of 2022 until now, CII has continuously divested at Nam Seven Seven (NBB), turning from a subsidiary to an associate. This is considered a move to help CII make a profit this year after negative events.

Since the peak at the beginning of the year, the stock has lost 50% of its value, from about 58,000 VND/share sometimes down to 26,000 VND/share, equivalent to a capitalization loss of about 4,000 billion VND. Recently, this stock has recovered slightly or above around 33,000 dong/share, but being put under warning makes this stock continue to weaken.

Before the Lunar New Year, CII witnessed a floor reduction of up to a dozen sessions after the shock “Tan Hoang Minh withdrew from the auction of 2.4 billion VND/m2 in Thu Thiem”.

Previously, within about the last 2 months of 2021, CII skyrocketed from less than 20,000 VND/share to a peak of 58,000 VND/share after the news that Tan Hoang Minh Group successfully auctioned a land plot of 10,000m2 in Thu Thiem for a price 2.4 billion VND/m2.

The stock price went up, a series of leaders promptly exited CII stocks right before the series of dramatic declines to the floor for ten consecutive sessions.

|

| CII stock volatility. |

Ms. Nguyen Thi Mai Huong, Head of CII’s Internal Audit Committee, has completed selling out all of her nearly 291 thousand shares held by CII from November 29 to December 16, 2021. Around the first half of November 2021, Mr. Le Vu Hoang, Chairman of CII’s Board of Directors and Mr. Duong Quang Chau, Director of CII’s infrastructure project management department sold 393 thousand and 180,000 shares of CII, respectively.

The major foreign shareholder, VIAC (No.1) Limited Partnership, “hardly” divested capital at CII when the market price increased. The organization sold 13.5 million CII shares from November to early January and recently registered to sell 5.5 million CII shares from January 10 to August 2022.

Bottom-fishing demand increased

According to VDSC, the cash flow seems to have bottom-fishing trend, reflected in the divergence between price and volume, especially when the index moves in the downtrend. With a decrease in supply pressure and bottom fishing, VDSC believes that the market is still backing down but will soon be supported and recovered.

According to YSVN, stock market might return to the upside and VN-Index retested the resistance level of 1,512 points in the session of March 25. At the same time, cash flow is still diverging among stock groups and trading on a low scale because large-cap stocks have not yet confirmed a clear short-term uptrend, while cash flow mainly concentrated in small and medium-cap stocks. In addition, the short-term sentiment continued to increase, showing that the main short-term strategy is to gradually increase the proportion of stocks.

Closing the session on March 24, the VN-Index dropped 4.08 points to 1,498.26 points. HNX-Index increased 0.7 points to 462.8 points. Upcom-Index increased 0.69 points to 117.27 points. Liquidity reached 29.9 trillion dong, of which 24.8 trillion dong was on HOSE.

V. Ha

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here