A financial crisis is taking root in America

So, exactly how serious is this problem? The answer is that, even with positive assumptions, this situation could still overwhelm the entire US budget.

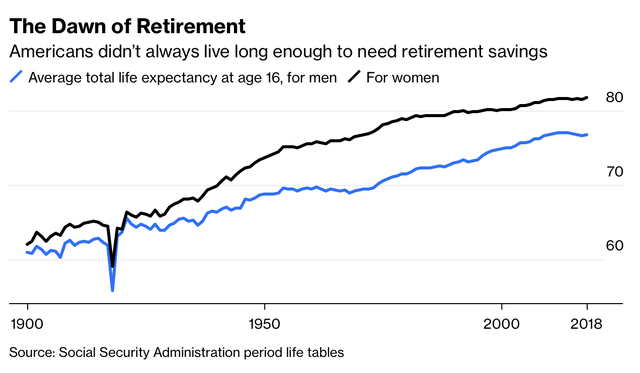

In the past, in the late 19th century, Americans used to work until they died – a period they estimate was often before the age of 65. With the exception of a few people who receive pensions from working in the army, the elderly and sick have to rely on charities or their descendants.

Average retirement age for men and women in the United States.

All of this has changed amid rapid industrialization and rising wealth in the 20th century. The estimated life expectancy of people of working age has skyrocketed: As of 5 2018, that’s 77 years old for men and 82 years old for women. Businesses, in increasingly dominant sectors of the economy, are reluctant to employ older workers because they perceive them to be less productive. For the growing number of elderly people, leisure time has become even more inevitable.

The US government recognized this new reality and established the Social Security Program in 1935. The program was initially only a benefit for workers aged 65 – the official retirement age. However, they were never meant to provide more than the minimum income. To maintain a good standard of living, workers will have to do something they have rarely done before: save enough money for life after retirement.

That is the “source” of the retirement crisis in America. The United States has never satisfactorily considered the difference between what workers receive from the social safety net and financially secure old age. This week, the House of Representatives will consider legislation to expand the age of workers to join retirement plans and make it easier for small businesses to offer certain benefits.

The size of the problem will depend on several factors: how much the retirement population will grow; how much money they need to live comfortably and how much money they have in savings.

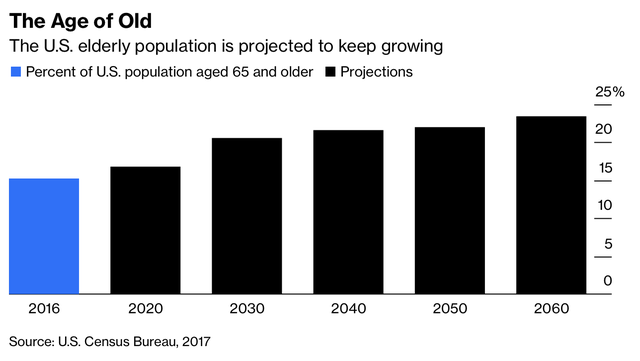

Percentage of Americans aged 65 and over.

The US will have more people of retirement age in the coming decades, in part because the baby boomer generation is aging. By 2030, there will be more than 73 million people aged 65 and over, accounting for about 21% of the total population of the country. This is up from 49 million, or about 15%, in 2016.

What they need to retire depends on how much they earned while working. On average, each person needs 75% of their income before retirement to ensure a comfortable life in old age. Accordingly, most Americans fall short of the average. A well-off person can live well on about half of their annual income. Meanwhile, poorer workers may need 100%, or more, to cover rising medical costs.

So will they have enough money to retire? The Center for Retirement Research at Boston University estimates that about half of working-age American households are “at risk”. This means they will soon be 10% short of the income they need to retire comfortably. Accordingly, the amount of money needed for retirement in the US could be about 7 trillion USD short. And this is the case assuming that social security benefits will not be cut in the future.

People can reduce that shortfall by working beyond the age of 65. So many people have done it. As of December, about a third of 65-69 year olds were employed in the United States. However, workers at this age face some limitations. For example, a truck driver is unlikely to work until the age of 70 as a university professor. Furthermore, even if half of workers continued to work beyond 65, the proportion of people in the “at-risk” group mentioned above could fall to only about one-third. This is still a bad number for one of the richest countries in the world.

Meanwhile, workers’ shortage of savings is on a larger scale than the humanitarian crisis. This is also a financial crisis that is about to take shape. The more people reach retirement age without sufficient financial resources, the more they will have to rely on benefit programs such as Mediaid, food stamps, and Security Income (SSI).

One study estimates that, by 2030, older adults will need an additional $7 billion in annual government assistance in the state of New Jersey alone. This is equivalent to a fifth of the current state budget and New Jersey is also not a state with many people in the aging population. The situation in other states could be even worse.

Business and marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here