Look at the segment that dominates the real estate market and welcomes massive cash flow

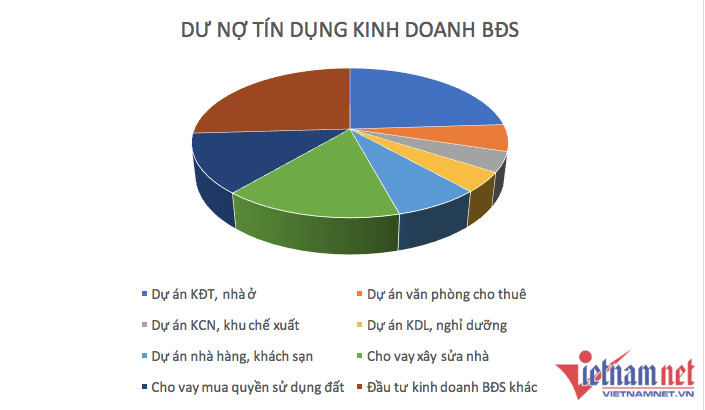

In which, outstanding credit for investment projects to build urban areas and housing development projects reached VND 188,105 billion, accounting for 24% of total credit outstanding for real estate business.

Outstanding credit for tourism, ecological and resort projects reached VND 33,509 billion, accounting for 4.3%. Outstanding credit for restaurant and hotel projects reached VND 57,898 billion, with a rate of 7.4%.

Still credit balance loans for construction and home repair for sale and lease reached VND 121,153 billion, accounting for 15.4% of total credit outstanding for real estate business.

Outstanding credit for loans to buy land use rights reached VND 101,071 billion, accounting for 12.9%. Outstanding credit for other real estate investment and business reached VND 203,339 billion, accounting for 25.9%.

Citing the report of the State Bank, the Ministry of Construction said that by the end of March, credit growth of the whole economy reached 4.03%, according to which the credit growth rate is increasing much faster than the same period last year. last year (report of the General Statistics Office).

Accordingly, the State Bank will continue to keep the operating interest rate unchanged, creating conditions for credit institutions to continue reducing lending interest rates, supporting the recovery of the economy…

Strict control of credit flowing into real estate

According to statistics of the Bond Market Association (statistics of SSC and HNX), in the first quarter of 2022, there were a total of 48 separate issuances with a total value of about VND 30,998 billion (accounting for 78.09% of the total price). issuance value) and 9 issuances to the public with a value of VND 8,696 billion (accounting for 21.91% of the total issuance value).

Notably, the real estate group is currently leading in terms of issuance value, with a total issuance volume of VND 17,211 billion, accounting for 43.36% of the total issuance value.

According to the Ministry of Construction, the fact that many real estate businesses move to mobilize capital through issuance bonds With large-scale issuance, high interest rates will pose risks to the market.

“The amount of bond issuance is many times larger than equity, in some cases 40 times equity. The issuance term is short (from 3 to 5 years), especially for real estate businesses to mobilize to deploy projects (project implementation time is usually longer, over 5 years). However, collateral is projects and real estate, but the valuation of collateral may not be close to the actual price (valuation higher than the actual value) “- the Ministry of Construction said.

In the face of the recent increase in issuance of corporate bonds, especially real estate bonds, which have not yet complied with the provisions of the law, posing many potential risks to the market, the Ministry of Construction proposed the concerned ministries and branches. According to their functions and tasks, the Government will amend Decree 153/2020 on the offering and trading of corporate bonds in the domestic market and the offering for sale of corporate bonds in the international market.

In addition, the Ministry of Construction proposed to closely monitor developments in the real estate corporate bond issuance market in order to promptly control and adjust policies, so that the real estate market develops in a stable and healthy manner.

The Ministry of Construction also recommends strict monitoring and control to avoid double risks; preventing the use of production and consumption loans for investment and real estate business in the form of speculative.

Recently, the State Bank also directed to strictly control credit in potential risky areas such as investment, real estate business, securities, BOT projects, BT traffic, corporate bonds…

Conveniently style

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here