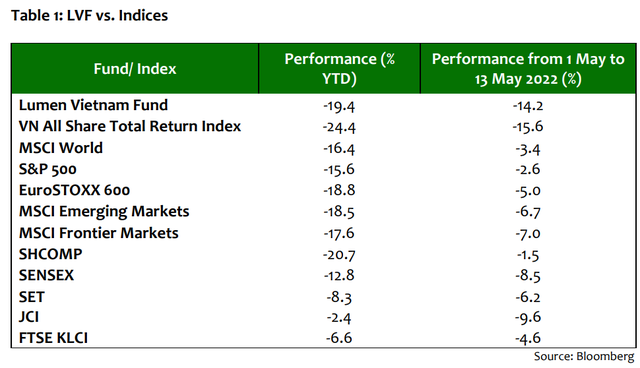

A series of investment funds recorded negative performance after the first 5 months of 2022

In a recently published report, Lumen Vietnam Fund said that the fund was under strong adjustment pressure in the first half of May 2022 when the market was volatile. Accordingly, calculated by Bloomberg, as of May 13, 2022, the fund’s performance decreased by 19.4% from the beginning of the year and decreased by 14.2% compared to the end of April that estimate (in USD). .

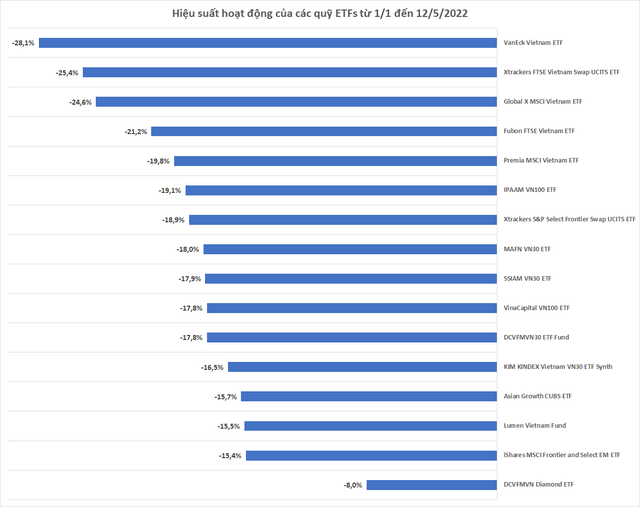

Notably, not only Lumen Vietnam Fund, but Bloomberg data shows that at least 15 other ETFs on the Vietnamese stock market recorded negative performance from the beginning of 2022 until about mid-May. . Even the negative 15.5% of Lumen Vietnam Fund is more positive than many large funds in the market.

The biggest disappointment could be the Vaneck Vectors Vietnam ETF (VNM ETF) with a performance as of 12/5 of negative 28.1%. Compared with the adjustment of the main index of the Vietnam stock market VN-Index is about 15%, the decrease of VNM ETF is nearly doubled.

Most ETFs are negative on average 10-18%. Some funds can be mentioned such as Xtrackers FTSE Vietnam Swap UCITS ETF when the performance was negative 24.6%, Premia MSCI Vietnam ETF recorded a negative performance of 19.8%; The IPAAM VN100 ETF also suffered a loss after more than 5 months of 19.1%.

Among the list listed by Lumen, DCVFM VN30 ETF recorded the most positive performance with negative 8% from the beginning of the year to about mid-May 2022.

Source: Bloomberg; Lumen Vietnam Fund

As observed by Lumen Vietnam Fund, the market is waiting for positive signals to recover. The level of recovery will not be too fast, but it will be healthier than previous corrections when there is support from listed companies with good fundamentals and potential for breakthrough growth.

Lumen Vietnam Fund believes that now is a great time for long-term investors to buy. Efforts from Vietnamese regulators to ensure stability and develop the stock market will attract more quality investors both locally and internationally. An important content mentioned was the working session between the State Securities Commission and the Stock Exchanges and member securities companies, which focused on discussing to come up with solutions to improve operational efficiency. , services, capacity and professional ethics of securities service companies. Along with that, the State Securities Commission is also coordinating with relevant agencies to come up with a clearer roadmap to upgrade the market.

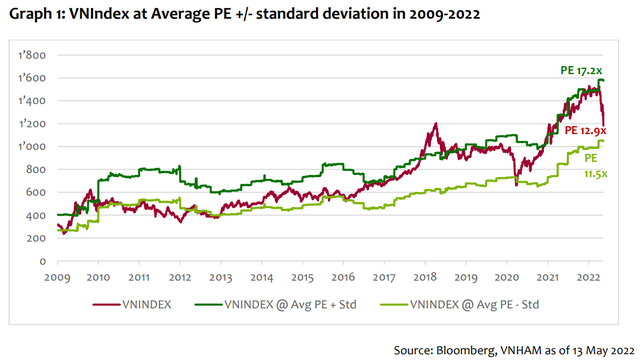

In terms of valuation, as of May 13, 2022, calculated data shows that VN-Index is trading around P/E trailing level of 12.9 times, corresponding to the lowest level in the past 12 years. . The P/E level of about 11 times is currently the lowest bottom when the market is facing negative events.

Even so, most forecasts are still in consensus that earnings per share (EPS) of listed companies will grow by 18% to 20% in 2022. Under this scenario, the P/ E forecast in 2022 is 10.7 times, extremely attractive valuation for long-term investors.

Movements in the first 5 months of 2022 show a large difference between groups of stocks. VN-Index adjusted about 21.06% since the beginning of the year, however, the large-cap group, represented by VN30 basket stocks, corrected more than 20%, while midcaps and penny stocks recorded a much larger decline, on average. average rate up to about 30%, causing many retail investors to suffer losses due to holding “hot” stocks, even leaving the market. In contrast, Lumen Vietnam Fund assesses that foreign investors are actively trading again, they are trying to accumulate more shares at the current low valuation.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here