By the end of the first quarter, stocks have not “come ashore” while gold investors have “sprung up” profits

Gentle is also 10% more profitable.

From the beginning of the year until now, the stock market has remained relatively volatile. From the first trading session of 2022 to March 31, many stocks have not yet brought investors to the shore.

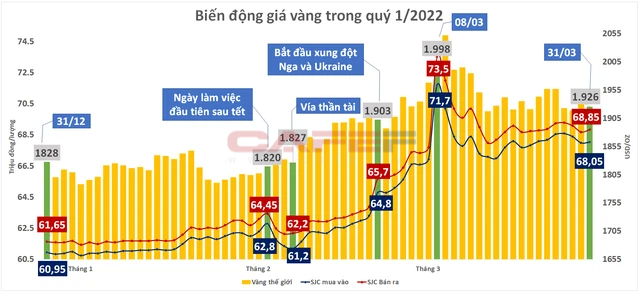

In another development, gold investors are “flooding” with profits. At the beginning of the year, the domestic price of SJC gold was at 61.65 million dong/tael in the selling direction; buying price is 60.95 million VND/tael. As of March 31, the selling price of SJC gold was at 68.85 million dong/tael, buying at 68.05 million dong/tael. If holding gold from the beginning of the year until now, investors have at least a rate of return of 10.38%.

As for the international gold market, investors in this precious metal are also recording a return of more than 6% if holding gold so far this year. On December 31, the world gold price closed at 1,828 USD/Ounce, as of 9:30 am on 31/03 it was 1,926 USD/Ounce.

However, the above cases are investors choosing to hold gold. In fact, if you close at the top of big waves, investors’ profits can be even higher. As on the occasion of March 8, the gold price made waves with prices up to 74-74.4 million VND/tael. If closing at that time, investors can achieve a profit rate of more than 16%.

The wave from the conflict between Russia and Ukraine is also a story that investors cannot ignore in the first quarter of this year. Immediately after Russia launched a military campaign in Ukraine on February 24, the price of gold quickly increased from VND 63.9 million/tael to VND 65.7 million/tael and then to over VND 70 million.

|

According to experts, the price increase of the domestic gold market is largely driven by domestic demand for gold and a number of macroeconomic factors. As for the international market, the influence largely comes from inflation expectations and the need to seek a safe haven.

Forecasting the gold price trend in the coming time, many experts are still optimistic about the uptrend. Chantelle Schieven, head of research at Murenbeeld & Co., believes that the need for safe havens is not going to disappear anytime soon, as conflict has become a key point, and is changing. change the geopolitical landscape as well as the global financial market. The precious metal has found a “new price range,” she said, and is building a “solid base” between $1,900 and $2,000 an ounce.

Wall Street analysts and retail investors surveyed in recent weeks have also not abandoned their gold price target at $2,000 amid market sentiment about the overall near-term outlook for gold. are all optimistic.

(By Business and Marketing)

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here