“Criticize” the high price of real estate in the inner city, investors move to this area, causing the price to increase “galloping”

Investors move to neighboring provincesyes

So far, real estate is a relatively safe investment channel and can only be changed through real estate, which seems to have become the truth of many investors. However, investing in real estate is not as easy as in the period 2015 – 2016.

Because the development of the housing market in recent years has experienced many local fevers. Every time the land fever passed, land prices skyrocketed and set up price levels sky-high.

In the current context, even peri-urban land banks such as Hoai Duc, Thach That, Son Tay, Gia Lam… also have extremely high prices. If you look at the market movements in these areas, there are no opportunities for many investors.

Therefore, investors expanded to neighboring provinces, notably Bac Ninh, Hoa Binh and Hung Yen. As a province with strong industrial development in the North with many large and small industrial parks in the area, Hung Yen enjoys many advantages after the US-China trade war and the impact of the Covid-19 epidemic. Many industrial parks have been approved for investment and infrastructure deployment in this province in the past 2 years. Hung Yen real estate, especially land near industrial zones, big projects has grown very well.

According to a survey by Batdongsan.com.vn at the end of 2021, Hung Yen’s land plot has established a new ground higher than 2020 after a period of anchoring due to the Covid-19 epidemic.

Specifically, land near Pho Noi industrial park (My Hao) at the end of 2020 priced at VND 17-21 million/m2, has increased to VND 24-29 million/m2. Particularly for the large pieces of road surface, business can cost up to 36-40 million VND/m2. Land near industrial zones such as An Thi, Van Giang also has a price increase of about 20-30%, from 13 – 18 million/m2 to 17 – 23 million/m2, or 20 – 24 million/m2 to 27 – 31 million/m2…

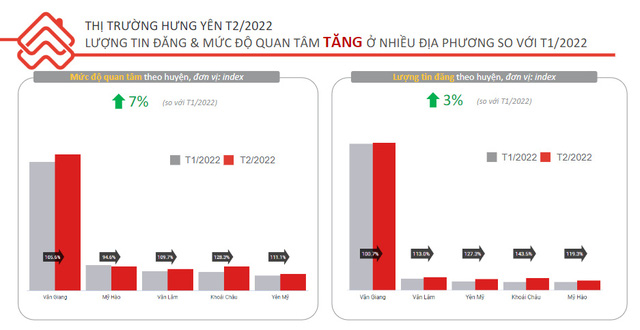

Source: Hung Yen market report February 2022 of Batdongsan.com.vn

The location at the gateway to Hanoi, the abundant land bank with a good price increase margin are the factors that make up the attraction of Hung Yen real estate.

According to the February 2022 market report of Batdongsan.com.vn, the interest in Hung Yen real estate in the main areas continued to increase by 7% compared to January. Notably, the private house segment recorded Search volume increased by 35%, land plots increased by 11% over the same period in 2021.

The volume of listings for sale in the whole market increased by 3% on average. While Van Giang barely had any new listings, the smaller markets saw very good gains, such as Khoai Chau up 43.5%, Yen My up 27.3%. This also means that the supply of housing in Van Giang is starting to narrow, and is gradually expanding to emerging areas, where there are changes in infrastructure, new projects…

Although there is still a lot of potential, from the data of Batdongsan.com.vn, it can be seen that Hung Yen real estate develops unevenly. Land price fever only occurs locally in some localities benefiting from project infrastructure or industrial zones. The market heat is mainly concentrated in Van Giang district, which is also the place that accounts for almost the entire market share of Hung Yen real estate.

Recently, however, investors are starting to pay more attention to other segments, typically private houses. According to Batdongsan.com.vn’s February market report, the private home segment accounted for a very small market share, but recorded a 92.6% increase in listings for sale, and a 35% increase in interest compared to January/January. 2022. In addition to Van Giang, some other areas of Hung Yen that are also interested by searchers are My Hao, Van Lam, Khoai Chau and Yen My.

Big data of Batdongsan.com.vn shows that, under the impact of increasing prices of oil, precious metals and construction materials, real estate prices in the first quarter of 2022 tend to increase and are forecast to continue to increase in next time.

Real estate “eats” according to industrial zones to become a new investment direction

Vo Van Muoi – General Director of Kim Thinh Phat Real Estate Joint Stock Company also said that the US-China trade war has caused the global supply chain to shift to neighboring countries. In particular, Vietnam is a country with great advantages in attracting supply chains and large industrial plants.

In the past period, types of real estate such as resort villas, townhouses or subdivision plots have developed very strongly. The value of many places has increased by 3-5 times, there are even areas where the value of real estate has increased up to 10 times. From the period 2013 – 2019, the market experienced a good period of development, but since 2019 has tended to slow down. The Covid-19 epidemic in the last 2 years has caused many segments and markets to continue to slow down.

Real estate near the industrial zone is considered a potential segment for investment thanks to its sustainability and good exploitation ability. (illustration).

Mr. Muoi said that the market needs a new wave. Real estate “eating” under industrial zones becomes a new investment direction. The big guys poured money into industrial real estate, leading to factories, factories, and workers flocking to work. Demand for residential and business real estate near industrial zones has increased sharply. Mr. Muoi affirmed that the wave of investment in real estate in the suburbs and in real estate on the edge of industrial zones will become a trend and develop strongly in the coming time. Many investors will win big if they choose good products here.

In order to invest effectively and avoid risks, Mr. Muoi said: “Investors participating in this segment must pay attention to legal and planning issues. Currently, investors have pages to view information. planning information, know the location of a plot of land inside, outside or bordering an industrial park, or go to the department, the natural resources and environment department for inspection”.

According to him, there are 3 stages to invest in real estate near the industrial zone. The new phase is deployed when information about the project is available, the risks are high but the profits are high. This period is prone to land fever, as evidenced by the land fever in Ba Ria – Vung Tau in 2021, according to information a large real estate corporation opens a factory here. Speculators take advantage of that opportunity to surf, some make a lot of money but there are also investors caught in the boom.

In the implementation phase, legal information has been completed, industrial parks have been shaped and planned. Investors started to build factories and invited factories to cooperate. During this period, the best price increase, good liquidity, easy trading and profitable time.

The stage of transparent information, the factory is complete, investors note that this is no longer the time to invest in capital gains, but to invest in cash flow. Investors can choose premises in a prime location for business inns, restaurants, services for workers and experts.

Mr. Muoi emphasized: “Investors need to consider when to make money, when to go out. The important thing is the legality and planning to have a specific investment plan for individuals.”

at Blogtuan.info – Source: cafebiz.vn – Read the original article here