Basic factors predict “on the throne”, the opportunity to reduce money with 5 groups of stocks in 2022

Recognizing this caution, KBSV believes that uncertain risk factors are somewhat dominant related to the trend of inflation, interest rates, the Russia-Ukraine conflict and the Fed’s move to raise interest rates at the meeting. May, June…, while the basic supporting factors have not had a strong impact.

However, KBSV still sees the market’s corrections in the second quarter as an opportunity for investors to accumulate stocks to expect the market’s prosperity in the second half of 2022. Accordingly, the market will have a clearly differentiated, cash flow is revolving and looking to industries that benefit from macro conditions and high profit growth.

Specifically, the analysis team assessed that the production and economic recovery would be one of the good investment topics in the coming time. Accordingly, KBSV expects Vietnam’s economy to keep recovering from the low level of 2021 due to the impact of Covid thanks to: (1) large coverage of vaccination (2) The economy operates normally with the war. epidemic “living with Covid” and completely open to international trade and tourism from March 15; and (3) Implement an economic stimulus package of VND 350,000 billion to help accelerate the recovery process. On that basis, KBSV forecasts that Vietnam’s GDP in 2022 will grow by 6.3%.

With favorable economic conditions as above, KBSV selected 5 industries that are expected to benefit the most from this factor, thereby positively impacting the stock price level in the rest of 2022:

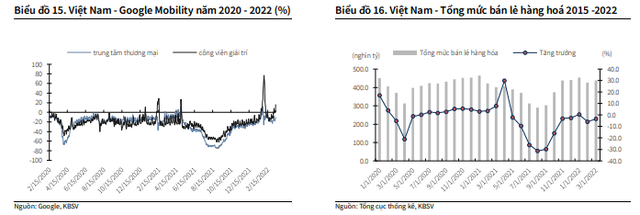

Firstly, the retail industry, especially non-essential consumer goods will benefit (expected EPS growth of 25% YoY in 2022) from the removal of social distancing regulations and the recovery of consumer demand. Data from the General Statistics Office and Google Mobility show that total retail sales of goods and travel activities to shopping centers and amusement parks recorded a rapid recovery when the distancing regulations were eased. .

In which, KBSV highly appreciated MWG (phone market share still has potential to expand market share thanks to new store model, chain of sales chart recovered / store), PNJ (recovered revenue from retail jewelry segment thanks to demand increased again and the number of new stores opened).

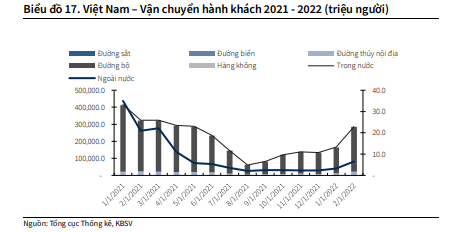

Second, the tourism industry Thanks to the opening of all tourism activities to both domestic and foreign visitors from mid-March, reducing entry regulations and promoting promotion will be a big step to help the tourism and aviation industries recover after 2 years of freezing. In the first two months of the year, the tourism industry has shown signs of marked improvement with the total number of domestic tourists reaching about 17.6 million arrivals, the total revenue from tourists also increasing by over 300% over the previous year. Beneficiary stocks such as HVN, VJC, AST, SCS, etc.

However, after the recent strong increase, the prospect factor has been partly reflected in the stock price, so investors should only consider disbursing when the stock price shows a correction and leaves room open. increase attractively above the target price.

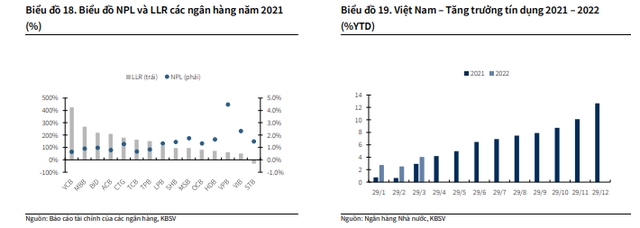

Third, the banking industry (VCB, BID, CTG, TCB, MBB, STB…) with the expectation that credit demand will grow strongly this year (around 14%) thanks to the supportive policy orientation of the State Bank and recovering capital demand from businesses. , bad debts will be reversed when corporate health recovers in the context that banks have proactively set aside a high level in 2021. In the first 2 months of the year, credit growth has reached 2.52% (high) significantly higher than the same period of 0.66%). Besides, capital increase will be a factor that positively affects profits in 2022.

Fourth, industrial real estate industry With the expectation that the recovery of the industrial sector will continue to accelerate in 2022 when large industrial centers gradually welcome workers from the provinces to return to work, and experts from partners come to Vietnam to work. study and sign contracts after implementing social distancing measures and closing international routes; combined with the trend of supply chain shifting that has been taking place in recent years. Businesses with a land bank ready for lease and a large new open land bank will have a lot of room for growth such as KBC, LHG, IDC…

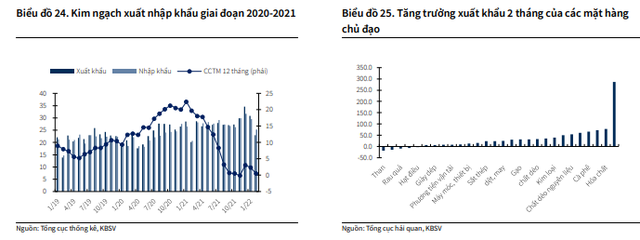

Fifth, the manufacturing and exporting industry such as textiles and garments, seafood will continue to benefit with the expectation that production will return to normal without interruption for a long time like 2021 and demand from major trading partners will continue to recover. Consider only in the first 2 months of the year. Opening up to international trade helped export value increase by 10.2% to about 53.8 billion USD.

Traditional commodities recorded positive growth in the first 2 months of the year, including seafood (+50.7%), textile fibers (+30%), textiles (+25.7%) and timber and wood products (+6.4%). For the textile industry, we prioritize enterprises with competitive advantages and capacity expansion such as MSH and STK. For the seafood industry, VHC, FMC, ANV, … are forecasted to grow strongly in 2022, in which the increase comes from both output and selling price.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here