CEO increased capital by VND 2,500 billion, calculating big projects

The General Meeting of Shareholders of CEO Group (CEO) unanimously approved the plan to issue shares to increase charter capital in 2022 for existing shareholders and ESOP for employees, the number of shares is expected to be more than 257 million, equivalent to 257 million shares. equivalent to 2,573 billion VND.

The charter capital of CEO Group after issuing shares is expected to reach over VND 5,146 billion. This is a decisive step to strengthen this real estate giant to make a transformation with big steps and projects in 2022.

In 2022, CEO Group will carry out restructuring of main business lines, focusing more on developing residential real estate, urban areas integrating tourism and resorts. In the field of tourism – hotel management, the CEO focuses on serving domestic guests to match the new situation, increase occupancy rate, and prepare to welcome international visitors when tourism fully reopens. whole.

CEO researches and expands into new industries and fields such as green energy, industrial real estate, logistics real estate, real estate serving the elderly, nursing homes…

A focus of CEO 2022 is to promote land fund development through participation in bidding, auction, M&A, investment cooperation in potential projects. At the same time, this giant plans to develop more new projects across the country with the total scale expected to be one-and-a-half to double the current one, ensuring the development land fund for the next many years. The land fund is expected to increase up to 1,000 ha compared to the current 1,000 ha.

Some big projects on the expected implementation list are Sonasea Van Don Harbor City (Quang Ninh), CEOHomes Hana Garden (Hanoi), Sonasea Residences (Phu Quoc)…

Previously, in 2021, the CEO implemented product sales activities in two key markets, Van Don (Quang Ninh) and Phu Quoc (Kien Giang) and received positive results.

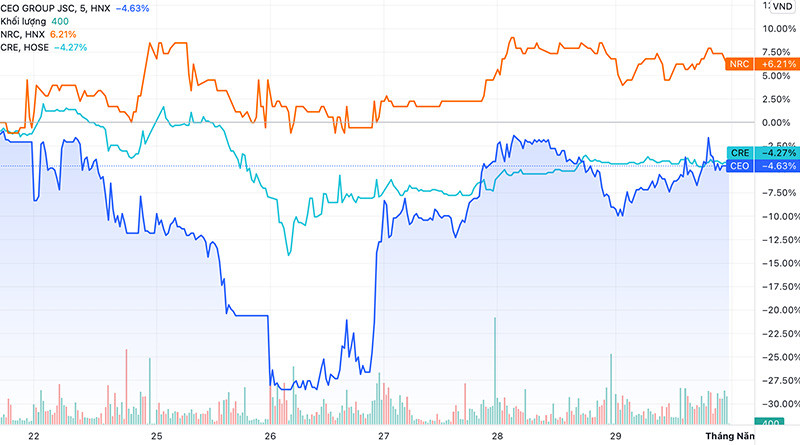

In the real estate market, many businesses also set impressive growth plans after the pandemic. Danh Khoi (NRC) set a target of net revenue of 905 billion dong, profit after tax of 220 billion dong, along with a plan to increase capital from 881 billion dong to 1,389 billion dong. At the end of the first quarter of 2022, the parent company’s own revenue of NRC reached nearly 27 billion dong, 30 times higher than the same period; profit after tax reached nearly 16.6 billion dong, while the same period lost nearly 6 billion dong.

Similarly, Cen Land (CRE) has just released its financial statements for the first quarter of 2022 with the parent company’s profit after tax growing by 80% and consolidated profit after tax increasing by 15% over the same period last year. Profit after corporate income tax was VND 141.88 billion, up 15% over the same period last year. In which, the parent company’s profit after tax was 154.6 billion, up 80%.

This year, Cen Land targets net revenue from sales and service provision of VND 8,500 billion, an increase of about 52% compared to 2021 results.

However, in contrast to the above enterprises, Danang House (NDN) recorded revenue of 0.14 billion dong, profit after tax of 23.46 billion dong, down 99.7% and 51.3% respectively over the same period last year.

Notably, in the first quarter of the year, gross profit was only 0.18 billion dong, lower than selling and administrative expenses of 1.6 billion dong, the Company only made a profit from financial activities. .

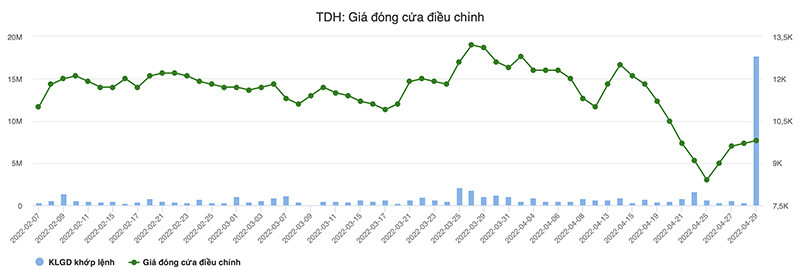

And at Development Joint Stock Company Thu Duc House (TDH), at the end of fiscal year 2021, the Company recorded a revenue decrease of 75.2% to 487.2 billion VND and profit after tax recorded negative 890.5 billion VND compared to the same period of 309.4 loss. billion dong, bringing the company’s accumulated loss to 693.7 billion dong. Thus, the Company had two consecutive years of losses.

In which, notably, in the year, companies doing business below cost of money led to a negative gross profit of 66.5 billion dong compared to the same period of 209.8 billion dong,

Told him

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here