Steel sheet group’s profit was stable in the first quarter of 2022, except for one large company that declined

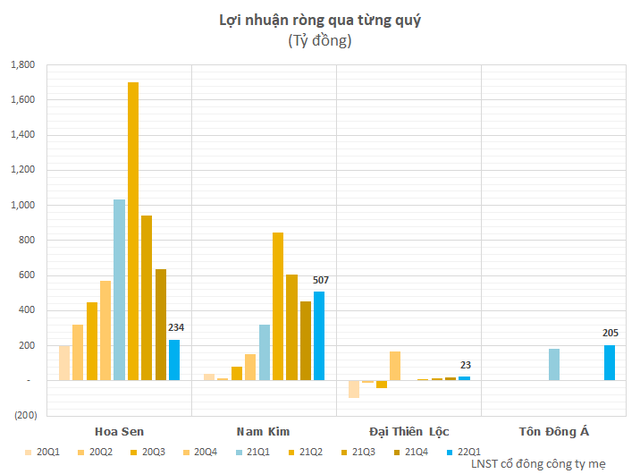

Although not as sudden as in the first quarter of 2021, the profit of steel group in this period is quite stable with a significant growth base after the sublimation period with steel price. However, Hoa Sen Group (HSG) – a unit that received a lot of expectations, especially in the field of export – announced a record decrease in profit of 77%, to only 234 billion dong.

Specifically, in the period HSG recorded net revenue of 12,661 billion dong, up 16.7% over the same period last year. However, COGS increased sharply, causing gross profit to narrow to VND 1,430 billion, down 24% over the same period, gross profit margin decreased to 11.3%. Other expenses also increased, making HSG’s profit after tax only 234 billion dong, down 77% over the same period.

This result is contrary to most of the remaining units. For example, Nam Kim Steel (NKG) reported net sales of 7,151 billion dong and gross profit of 957 billion dong, up 47% and 157% respectively over the same period. Not to mention, NKG’s gross profit margin was also at 13.4% in the first quarter of 2022, higher than 12.6% in the same period.

Deducting expenses, the company’s net profit reached 507 billion, an increase of 59% compared to the first quarter of 2021. Similar to HSG, the growth story of NKG in the current context is the export market. Reporting to shareholders at the recent Annual General Meeting of Shareholders, the representative of NKG said that the output in 2022 could not reach the peak as in the 2-3/2021 quarter when accounting for 70-80%, but it is expected to remain well. with export volume equivalent to the previous year.

As of March 31, 2022, NKG’s inventory is still high with about 8,500 billion VND – enough to meet the sales demand for a quarter. NKG’s existing export orders are now closed until mid-July 2022.

“The forecast for steel prices in 2022 is still high, ranging from $840-850/ton or more. This is due to production costs, transportation costs, coal prices, energy prices and also prices. ore has increased to a very high level, thereby forming high cost of goods for HRC steel producers.CEO NKG added.

Similar in business field, Ton Dong A (TDA) also closed the first quarter of the year with sales revenue of 6,134 billion, up 35% and gross profit of 541 billion, up 40% over the same period. Although selling expenses recorded a sudden increase of 78% to 281 billion dong, TDA’s EAT still increased by more than 11% to 204.5 billion dong.

The explanatory report said that during the subproject period, the domestic sales channel was promoted, domestic revenue accounted for 54% of consolidated revenue of this period. In the first quarter of 2022, the subproject recorded production of 220,800 tons of galvanized steel and consumed 226,400 tons, accounting for 18.1% of the market share. Compared to other enterprises, Ton Dong A is only inferior to HSG.

Or “big brother” Hoa Phat (HPG), The company achieved VND 44,400 billion in revenue, up 41% and profit after tax reached VND 8,200 billion, up 17% compared to the first quarter of 2021. Note, the production of iron and steel products and steel products contributed 90% to HPG’s overall results in the first quarter of 2022.

Currently, HPG has a crude steel capacity of over 8 million tons/year, equivalent to about 700,000 tons/month. HPG said that in the first quarter of 2022, the Covid-19 epidemic was still complicated, the prices of input materials for steel production such as coke refining coal and iron ore increased. However, Hoa Phat’s factories always operate at full capacity to meet market demand. Hoa Phat has produced 2.16 million tons of crude steel, up 8% over the same period….

Back to HSG, announcing a lot of good news during the hot bull market made the company become the focus of investors. Accordingly, the market price also grew very strongly with sudden liquidity.

Although a lot is expected from a stable production system as well as domestic and international distribution channels, recently the head, Mr. Le Phuoc Vu, suddenly said that HSG will sell all properties for sale in the near future. That is, HSG will specialize in distribution and no longer do production, and this is also Mr. Vu’s last effort before leaving the Group.

“Like the previous congress, we clearly determined that HSG will have a turning point, the new strategy is to form the Hoa Sen Home system. Now, when people talk about HSG, they mean Hoa Sen corrugated iron pipes, Hoa Sen steel pipes. But in the next 5-10 years, when it comes to HSG, people will refer to Hoa Sen Home building material distribution system, if it works well, this system can achieve current revenue, approximately VND 50,000 billion. VND (more than 2 billion USD).

The steel industry is currently at a huge disadvantage, P/E is high, but the stock keeps falling, once it reaches 50,000 VND/share, it will depreciate. Therefore, Hoa Sen Home will be a turning point to create value for HSG, shareholders and employees.

In general, HSG does not invest in production anymore. In the coming time, properties not related to the distribution system will be sold out, including hotel projects, industrial parks… As for the steel segment, if we want to develop further, we have to invest in upstream, like how A few years ago, HSG invested in Ca Na, but it didn’t work because we were blocked by obstacles: Preventing protection, preventing relationships.”, Mr. Vu said.

This year’s HSG congress also agreed on the plan to convert HSG one-member limited liability company into Hoa Sen Plastic Joint Stock Company, to take over all production and business activities of the plastic segment and establish a new Construction Materials Distribution Joint Stock Company. and Hoa Sen Furniture (hereinafter referred to as Hoa Sen Home) to take over all business activities of the distribution, retail and Hoa Sen Home segments.

It is expected that, when the two companies above meet the legal requirements, the Board of Directors will continue to submit to the General Meeting of Shareholders in the following periods to approve the IPO and listing of these two companies on the stock market.

at Blogtuan.info – Source: cafebiz.vn – Read the original article here