Credit tightening, cash flow of many real estate businesses may “die” after 6 months

Over the years, the State Bank of Vietnam (SBV) has gradually directed credit capital flows into the fields of manufacturing, services, agriculture, etc. and reduced the lending rate for the real estate sector.

Circular 22/2019/TT-NHNN, effective from 2020, requires commercial banks to reduce the maximum ratio of short-term capital used for medium and long-term loans to 34% from October 21 and 30. % from 10/22.

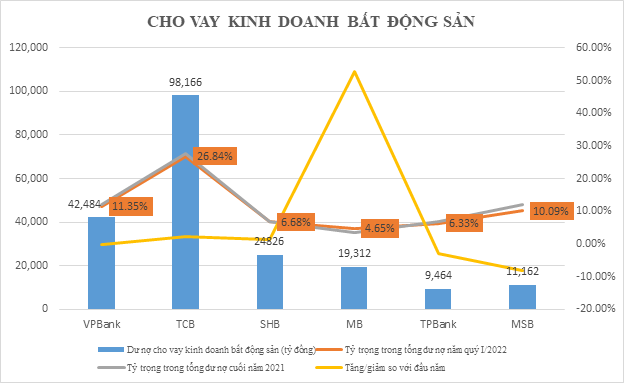

As a result, credit growth in the real estate sector has slowed down from 26% in 2018 to 12% in 2021 and may decline to 9-10% in 2022.

Source: Financial statements of banks in the first quarter of 2022. (Photo: LT)

Real estate credit tightening, cash flow of many businesses “dead” after 6 months

In April this year, in order to limit real estate speculation, the State Bank asked banks to closely monitor credit in the real estate sector and limit credit for investment in luxury real estate, tourism and resort real estate and real estate speculation.

In addition, the Government also requires supervision of the corporate bond market due to the risk of violating the issuance and auction of land use rights.

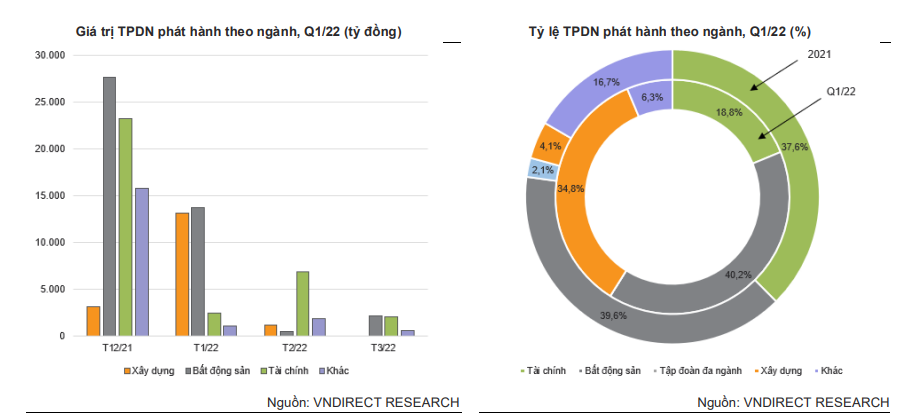

According to research by VnDirect Securities, real estate corporate bonds accounted for 40% of the total issued value in the first quarter of 2022, with growth of up to 73.1% and 25.2% over the same period in 2021 and first quarter of 2022.

Real estate corporate bonds accounted for 40% of the total issued value in the first quarter of 2022.

In order to reduce risks and enhance market transparency, the Ministry of Finance is urgently reviewing the legal framework with stricter conditions for issuers, especially private placement.

The SBV will supervise and inspect credit institutions that invest in corporate bonds, provide securities underwriting services, invest and distribute corporate bonds, especially bonds of real estate enterprises. , the enterprise has a large issuance volume, high interest rate, negative business results and no collateral.

Therefore, experts believe that the issuance of corporate bonds, especially in the real estate sector, will be strictly controlled. In the context of tightening credit to the real estate sector and closely monitoring corporate bond issuance, Vietnamese investors may face challenges in raising capital in the next few quarters.

Credit tightening is also expected by experts to see a supply recovery trend in 2022, when developers will focus on boosting sales to improve cash flow.

This is reflected in the prospect of strong growth in sales of listed real estate companies in 2022, with KDH (+14 times yoy), DXG (+300% yoy) NLG (+ 105% over the same period), with a low base in 2021 and the restoration of projects affected on schedule from 2021 due to the Covid-19 epidemic.

In addition, investors may be more cautious in expanding the land bank and may reduce the budget for this activity. At the same time, promote the trend of cooperation in real estate project development with partners with abundant money, or foreign developers in the context of tight capital as today.

At the economic forecast seminar 2022-2023, FiinGroup CEO Nguyen Quang Thuan admitted that the real estate industry did not recover other than cyclical reasons, and another reason was that the project could not be completed in 2 years due to the big representative. pandemic, lack of money source and now facing great challenges when being tightened credit, although the demand for real estate is still very large.

“There are businesses that can’t raise capital for another 10 years, but there are businesses that don’t raise capital, only 6 months later, they will no longer exist from a cash flow perspective,” he said. Thuan emphasized.

Real estate is currently facing great challenges when it comes to credit constraints, although the demand for real estate is still very large. (Photo: DV)

The current difficulties facing real estate may change the picture of the banking industry in the next 2-3 years

The difficulties of the real estate industry according to Mr. Thuan will have an impact on a number of related industries including: construction and building materials, especially the banking industry…

Citing data from the State Bank, this expert said that the outstanding loans for real estate business only account for about 8% of the total outstanding loans of the economy, but home loans are high, totaling more than 2 million billion VND (the proportion of 19 – 20% of the total outstanding balance of the system). Along with bonds, the risk (if any) would be cross default.

“The banking and finance industries are still developing well through the Covid-19 epidemic, but the difficulties the real estate industry is currently facing may change the picture of the banking industry in the next 2-3 years.

Therefore, policy changes need to take into account the impacts on the two pillars of the economy: real estate and banking, as well as the knock-on effects on the financial market in general and other sectors. related to Vietnam.

In our country, there is a great connection between the money market, the bond market, bank credit and the stock/stock market,” emphasized Mr.

at Blogtuan.info – Source: danviet.vn – Read the original article here