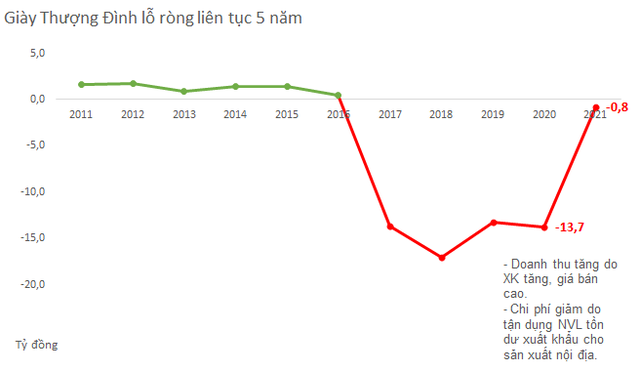

Why did Thuong Dinh Shoes reduce its loss spectacularly from 13.7 billion to only 774 million in 2021?

In terms of historical journey, there are few brands that can stick deeply into Vietnamese consumers’ minds like Thuong Dinh Shoes.

In the 80s, almost every house owned a pair of Thuong Dinh canvas shoes. These shoes are most often used for work and sports purposes. During the years 2000-2006, Thuong Dinh’s shoe products have always been at the top of the votes of Vietnamese customers.

Once stormed in the domestic market, this 60-year-old shoe brand is gradually losing its strength ahead of its time. In the last 5 years, the wave of brands like Adidas, Puma, Nike,… landed in Vietnam along with the drastic change of domestic brands like Biti’s, Thuong Dinh shoes were almost completely outdone.

The financial report of the domestic shoe company also partly shows the fierce competition scene.

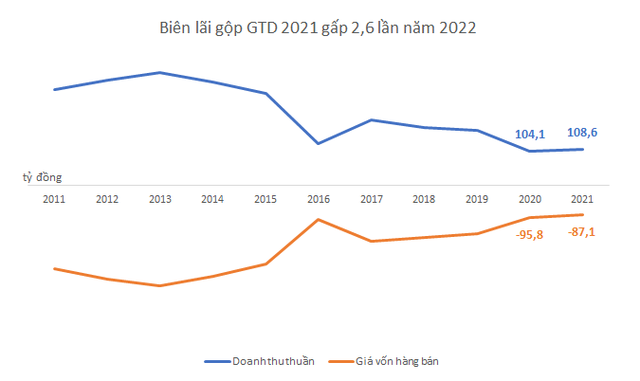

The audited financial statements for 2021 show that the net revenue of Thuong Dinh Shoes reached VND 108.5 billion, a slight increase of 4.2%. Profit before tax of Thuong Dinh shoes suddenly improved sharply when only a loss of 774 million VND compared to 13.7 billion VND in 2020. This is the 5th year in a row Thuong Dinh Shoes has recorded a loss in business results. The accumulated loss as of December 31, 2021 of Thuong Dinh Shoes amounted to 49.4 billion, accounting for more than half of the charter capital (93 billion).

Although revenue increased slightly by 4% and other expenses or income did not change significantly, why did the loss of Thuong Dinh shoes drop so sharply?

According to documents from the 2022 shareholder meeting, the company explained that in 2021, due to the impact of the Covid-19 epidemic, the first months of the year did not receive orders, the price of raw materials fluctuated and increased due to unstable that was difficult. The company has found all ways to be proactive and find export orders, meeting the production plan for the months from the second quarter of 2021, the company’s revenue in 2021 will reach 109.4 billion dong (only the company’s business will be the same. export revenue doubled).

In terms of costs, the total cost of Thuong Dinh shoes’ production and business activities in 2021 is VND 110 billion, of which COGS accounts for 79%, administrative expenses account for 18.8%, and other expenses. 2% of the total cost. This company said that in 2021, the output of exported shoes will increase, the selling price will be high, the cost of goods sold will decrease because during the production process, the workshop has ensured the quality requirements of customers, the shoes are not damaged much. but the company can also take advantage of some leftover raw materials from export codes to switch to domestic shoe production, increase revenue, and reduce input material costs. This is also the most important factor that decided to reduce the company’s loss to VND 774 million.

Despite the improvement, the business of Thuong Dinh shoes is still at a loss. This company explained the causes of losses such as the complicated situation of the Covid-19 epidemic in 2021, so it directly and seriously affected the production and business situation of Thuong Dinh shoes. In particular, in 2021, domestic footwear products will be greatly affected by the increase in input material prices. While input materials increased continuously, the selling price did not increase much because the selling price was always competitive with domestic manufacturers.

In addition, costs increase due to the process of equitization such as: depreciation of machinery, equipment, and factories because when equitizing enterprises, the State revalues the value of assets, so depreciation costs increase. up. The cost of land rent increased, right from the beginning of 2021, Thuong Dinh shoes owed land rent of VND 5.9 billion due to difficulties in cash flow in 2020, so this company had to pay a high fine for late payment.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here