Investors move cash flow into real estate to prevent inflation

Fear of possible inflation makes many investors tend to hoard real estate in search of a safe investment channel.

Real estate still attracts investors

A storm of price increases from energy to fertilizers, grains to metals is taking place globally and with a large economic openness, Vietnam is difficult to stay out of.

On March 11, the domestic gasoline price jumped to nearly 30,000 VND/liter, the strongest increase in history. The increase in gasoline prices has led to an increase in many imported dependent products. Logistics units also report that domestic transport prices have increased sharply.

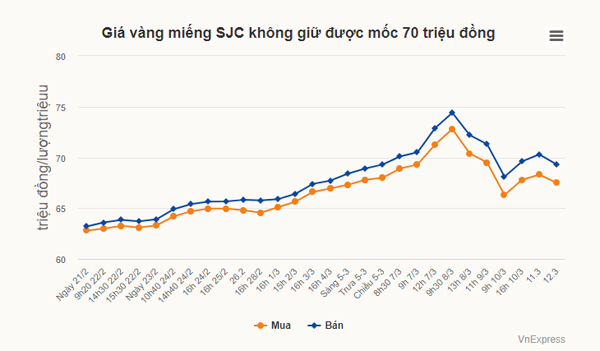

Statistics on March 10, the gold price was only 65 million/tael, down to 7 million compared to the previous 3 days, causing many investors to struggle. Similarly, the stock market in the past 3 months has always been in a vortex of peaking – retreating. While virtual currencies like bitcoin continue to plunge, down 40% from their peak, bank savings interest rates are only 5-6%, not attractive enough.

|

| Gold price chart fluctuates continuously |

In this context, many investors withdraw money from risky channels to switch to more effective investment channels such as real estate. Senior Director of Savills Vietnam Dr. Su Ngoc Khuong said that the bigger the real estate investment, the better. If you buy a house for 1 billion dong, when inflation occurs, the price will increase to 1.2-1.5 billion dong.

This is a lesson that has been proven through many periods of inflation both in Vietnam and the world. For example, in the period 2006-2008, Vietnam was caught up in a cycle of strong inflation along with the world economy. During this period, housing prices increased by 100-150% in just one year, the strongest increase in history.

Tourism recovers, beach real estate is the destination

After two years of hiatus due to the epidemic, since the Lunar New Year, Vietnamese tourism has recovered strongly. According to the Vietnam National Administration of Tourism, 9 days of Tet holiday welcomed and served 6.1 million domestic tourists. The sublime tourism pulls the resort real estate market back to the track. In which, Binh Thuan continues to be the market leader.

According to statistics, from the 29th to the 6th of the Lunar New Year, the province has welcomed about 75,000 visitors, the room capacity is over 80%. These data further increase investor confidence.

|

| Ke Ga Real Estate has a lot of potential |

Currently, Binh Thuan is receiving many national key projects, creating a direct boost for tourism growth. The Dau Giay – Phan Thiet highway route shortens Ho Chi Minh City to Ke Ga by nearly 2 hours, Phan Thiet airport helps this place to optimize domestic tourists with the same destination at the end of this year, which will be the turning point for the strong acceleration cycle. strong in both tourism and real estate. In 2023, the roads DT.719 and DT.719B will also complete upgrading the appearance of Binh Thuan tourism.

By 2025, Long Thanh airport, an hour away from Ke Ga, is forecast to create a second growth rate as this is an important lever to help Binh Thuan welcome the influx of international tourists. With these key projects, Binh Thuan promises to be the leading destination in Vietnam, competing with traditional markets such as Da Nang and Nha Trang. Along with that, not only the price of real estate but also the problem of exploiting accommodation or doing business in tourism services are very positive.

In terms of price level, if traditional markets have peaked, saturated or grown slowly, Binh Thuan is assessed to have strong fluctuations because the price is only or even 1/5 of other markets. this.

Under normal conditions, Binh Thuan real estate has been appreciated for its good growth potential. When placed in the context of inflation, this rate is forecasted to increase even more because the resort real estate here satisfies both the factor of rental exploitation to have stable cash flow and increase sustainable real estate value. Not to mention meeting the needs of convalescence and health rehabilitation – a popular trend after the epidemic. In particular, the cash flow is currently shifting to large resort complexes with transparent legal and macro development strategies.

|

| Urban area of entertainment – resort – sea sport Thanh Long Bay |

For example, Thanh Long Bay – the largest super complex in Ke Ga has a scale of 90ha with 8 subdivisions and more than 1,000 utilities. Notably, Thanh Long Bay owns the largest marine sports center in Vietnam, in line with the development trend and specific strengths of Binh Thuan province. Therefore, this complex is expected to be the driving force of the province’s tourism, helping it to become a global destination. Since then, the problem of increasing the value of real estate – exploitation of accommodation, commerce or resort needs are guaranteed between inflation and epidemics.

Urban resort – entertainment – sea sports Thanh Long Bay. Developer: Nam Group Corporation. Location: Ke Ga – Binh Thuan |

Tan Tai

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here