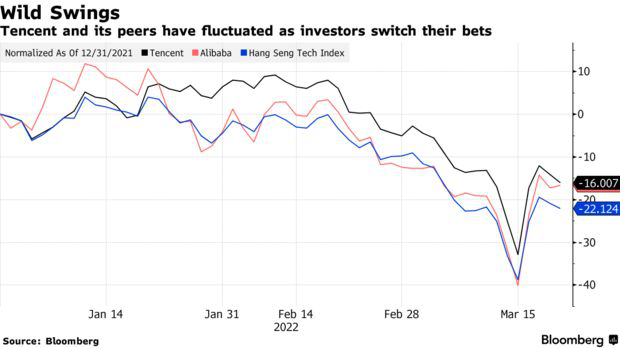

Market capitalization evaporated 490 billion USD after 1 year, all money-making businesses are on the radar

According to Bloomberg, if China’s sanctions against technology giants are showing signs of cooling off, Tencent seems to have not seen it yet. They still face bigger layoffs, a fintech overhaul, and a dearth of new games.

Tencent has lost $490 billion in market capitalization since its peak in 2021. While there are growing signs that China’s campaign is easing off, it’s hard to say the social media and gaming giant has exited. danger.

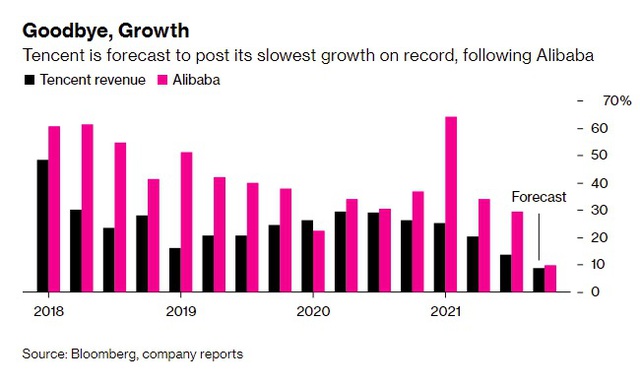

China’s second-largest company is expected to post its slowest growth rate during its earnings call on Wednesday. In addition to a string of results that could raise investor concerns, Tencent is facing other unprecedented challenges.

Authorities are considering asking Tencent to spin off WeChat Pay into a financial holding company – part of its overhaul giant Fintech giant. This, if true, would destroy the appeal of their social media business. And like its competitors, Tencent has begun to cut staff more than in previous years.

“Chinese internet companies are trading at all-time lows. They’ve reached sky-high valuations over the years thanks to rapid expansion, but the sell-off has blown bubbles. Profits. Tencent’s will face short-term pressure, but its core businesses will remain competitive.”

China’s tech conglomerates have stopped themselves and moved into an era of cautious expansion. Alibaba this month reported a 10% increase in revenue – the slowest increase and pledged to prioritize user retention over acquisitions. iQiyi and Bilibi are also now aiming to break even quickly after user growth slows.

Tencent has escaped direct punishment from Beijing, but its huge size with its possession of WeChat with more than 1 billion users has made it inevitable that it will go by storm. Damaged by the pandemic’s weakened economy, its online advertising business is expected to shrink for the first time in the third quarter. The freeze on new titles in China has now entered its eighth month. , forcing Tencent to ramp up bringing games like League of Legends outside of China. The cloud computing and fintech profit margins, which are expected to grow by double digits, will now have to meet requirements from financial planners and face competition from big companies. companies like Alibaba and Huawei.

Not to mention there are still a bunch of unresolved issues. Authorities are currently weighing whether Tencent should make WeChat a financial holding company. While the same requirements apply to Jack Ma’s Ant, Tencent’s case seems much more difficult.

Tencent’s fintech business – including cloud computing is the fastest growing segment, contributing nearly 30% of revenue – the largest revenue source after games. Tencent leaders have talked about a fintech overhaul that will have little impact on operations, and that WeChat Pay is primarily a trading platform, not a lending platform. The WSJ reported last week that Tencent is facing difficulties as authorities are finding WeChat Pay is violating anti-money laundering regulations.

But in the gaming segment, which accounts for the majority of Tencent’s revenue, is also facing uncertainties. Authorities have imposed strict rules on gaming time in this billion-populated country.

This is a time period where Tencent may be repeating the past. In 2018, the company saw its first decline in profits in a decade due to disruptions in approval of new titles. While older titles like Honor of King are still TEncent’s money-making machine, the company is still pushing deeper into the global market including through new branches in Amsterdam and Singapore. In the second quarter, Tencent’s domestic game revenue grew only 5%, a modest figure given the 20% increase in global activity.

“Tencent has many approved games in stock although we don’t have an exact time. We believe they have postponed new launches to avoid the attention of authorities in the near future. We hope We hope that cooperation with international game companies and overseas investments will help expand their influence globally.”

Tencent’s investment arm, which previously contributed capital to Meituan and Didi, is also entering a period of stagnation. The company recently reduced its stake in Sea and transferred most of its stake in JD. These are moves that indicate they are pulling out or reducing investments across industries.

Source: Bloomberg

By Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here