Stocks blossoming ‘drivers’, rumors and backyard companies

The rapid development of the domestic stock market has caused many consequences such as stock manipulation, leading rumors, lack of inspection…

The domestic stock market is going through a complicated period with many outstanding issues, from stock prices to the discipline of individuals involved, the operations of some securities companies to false rumors. really… is gradually distorting the general market.

The big cases in a row were named when the state agencies proved drastic. The last drop of water after the securities manipulation incident of FLC Chairman Trinh Van Quyet, along with the help of the individuals who operated the staff of BOS Securities and the satellite company used 20 accounts to collude to buy , sell securities with great frequency.

Backyard company blooms

BOS Securities, formerly known as Artex Securities, was established in 2008 and has long been known as a “backyard” company that effectively supports securities trading activities of the FLC Group ecosystem.

With a group of loyal customers and huge trading volume, it is not difficult to understand when BOS Securities quickly jumped from a small company to the top 10 brokerage market share on the largest listed exchange in 2017. This is thanks to FLC and ROS stocks are still regularly ranked first in terms of liquidity on the stock exchange.

Of course, in the opposite direction, businesses in the FLC Group ecosystem also have a reliable legal “background” to support capital mobilization activities, issuance of shares, bonds, mortgages, and pledges…

The proprietary trading portfolio of BOS Securities mainly holds shares of the FLC Group ecosystem. |

In fact, the concept of a “backyard” securities company has existed since the very beginning of the establishment of the stock market. At that time, many big banks in Vietnam gained market share when launching a series of brokerage companies such as VCBS, BSC, ACBS, MBS…

Over time, the private sector also became interested in this piece of market share as well as supporting trading activities, thus establishing or acquiring a series of securities companies.

For example, VIX Securities was quietly acquired by a group of shareholders related to giant Nguyen Van Tuan. Currently, this brokerage company benefits significantly from the related ecosystem including Gelex Group, Viglacera, Cadivi, Thibidi…

Another emerging group, Bamboo Capital, owned by Mr. Nguyen Ho Nam, also targeted the financial sector when it successfully acquired Capital Securities. From there, this company can effectively support the trading and fundraising activities of this multi-industry ecosystem.

Louis Holdings group also invested in APG Securities in the series of events to acquire a series of companies on the stock exchange. In fact, up to now, this securities company still has a close relationship, supporting significant transactions for the Louis ecosystem.

The development of the capital market has made many securities companies become acquisition targets of corporations since 2020, and the “stock trading license” has gradually become an expensive commodity.

With many recent cases, investors have the right to ask questions about certain distortions and favors to support the corporations behind. In the proposal to open a campaign to “clean up the stock market”, the Vietnam Association of Financial Investors (VAFI) said that it is necessary to inspect securities companies as a tool to set stock prices for their owners. .

VAFI recommends that there are thousands of trading accounts borrowed in the names of employees and relatives to create artificial supply and demand. It is necessary to identify fake investors and “ghost companies” to execute. conduct securities manipulation.

Profiting from self-employment?

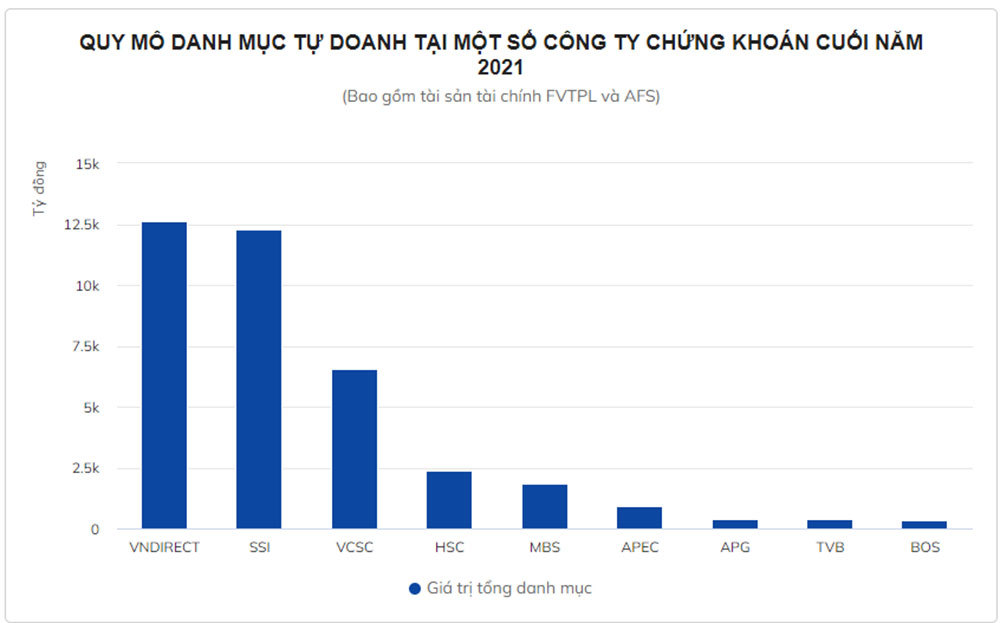

The boom of securities companies is accompanied by the strong development of many business operations. Among them, there is a significant expansion of proprietary trading (trading in securities: stocks, bonds, certificates…) at small securities companies, raising doubts about the distortion of securities companies. activities and conflicts of interest.

The top securities companies have always affirmed that proprietary trading activities are conducted fairly and ensure the safety of other activities. However, the actual proprietary trading portfolio of some large companies with a scale of up to trillions of dong still creates many concerns.

Retail investors often infer that proprietary trading blocks can be linked together to set stock prices and create market volatility. In addition, this block also has a great advantage in information, so it can compete to buy and sell before small individuals.

An HSC leader once said that proprietary trading activities are mainly trading in stocks with high liquidity, so they cause little market volatility, or switch to investing in other products such as bonds, indices, or just buy and sell stocks. sell to customers…

| ||||||||||||

Meanwhile, DSE Securities proprietary trading director Ms. Nguyen Ngoc Linh shared that in self-trading activities, a securities company only plays the role of a normal institutional investor.

The portfolio of the proprietary sector is established by professionals and managers. Accordingly, this activity is also dependent on subjective opinions of people and can sometimes lead to wrong decisions.

This person affirmed that the self-trading sector is noticed by reflecting the expectations of supply and demand, but not to the level of mystery and power as rumored. The participation rate of proprietary trading is not enough to go against the majority and lead the market, so it is also possible to lose.

In fact, there are also many proprietary trading divisions that have suffered heavy losses, for example VPS Securities last year had a net loss of nearly 600 billion VND (mainly due to increased loss from selling financial assets and large operating expenses). In contrast, APEC Securities won big when it was profitable 669 billion VND. Or BOS Securities had a sudden profit last year 34 billion VND.

Recently, HoSE surprised again when it announced that it would stop providing transaction-related data of the proprietary trading block since March. Ms. Nguyen Ngoc Linh said that this will not have much impact because the proprietary capital flow is no longer available. large, only the expectation of supply and demand of a part of investors.

“Driver”, rumors and punishment

When the stock market develops strongly, it also expands the space for bad actors with the intention of manipulating stock prices, for spreading unhealthy news and many other consequences.

The cash flow from new investors pouring into stocks has created a “wave of stocks” emerging throughout the market, just one side information is that investors quickly buy the whole ecosystem despite the intrinsics of the stocks. enterprise.

Never before have the “drivers” been named as many as they are today, there have never been as many rumors and stories of stocks rising as many times, which are hot topics on many leading stock forums.

For example, in the past, there was only a rumor that Louis group wanted to acquire any business, and investors fought to buy and push the price to the ceiling continuously. Or recently, there was a rumor that new FLC Chairman Dang Tat Thang registered to buy shares, which helped FLC code quickly escape from the floor and suddenly matched orders of more than 100 million units…

The market is used to unusual movements in a series of hot stocks with an increase of dozens of times, partly from the madness of new cash flow, but also from the calculations of the driving teams.

Many stocks have had a period of shock increases and deep declines recently. Graph: TradingView. |

However, the concept of “driver team” is not entirely negative. A securities expert with more than 20 years of experience shared that besides the partners with bad intentions, there are also healthier groups of activities, mainly regulating based on the prospects of businesses with good or bad backgrounds. following the good trend of oil prices, commodity prices…

This position said that harshly sanctioning, increasing the penalty frame or handling criminal acts can limit the operation of the driving teams, causing many people with the intention to manipulate the stock to “falter”.

In fact, the sanctioning of stock prices is still quite modest. In 2021, Mr. Le Manh Thuong and Ms. Pham Thi Phuong were sanctioned 1.2 billion VND in the case of manipulation of FTM stock price of Duc Quan Investment and Development Company. Mr. Nguyen Quang Vinh was fined VND 550 million for using 35 accounts to continuously cross-match TAR shares. Recently, Louis Holdings was fined more than 161 million dong for making an undercover transaction of more than 1 million TGG shares.

The latest investigation agency of the Ministry of Public Security has issued a decision to arrest and detain FLC Chairman Trinh Van Quyet for securities manipulation when conducting illegal transactions of selling 74.8 million FLC shares on January 10.

The consequences arising in the stock market were also pointed out by the Central Inspection Commission as the lack of responsibility, loose leadership, and lack of inspection and supervision by the Party Committee of the State Securities Commission.

This agency has many violations and shortcomings in advising on the development of institutions and policies and performing the state management of securities activities and the securities market. laws, market manipulation, illegal profits.

(According to Zing)

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here