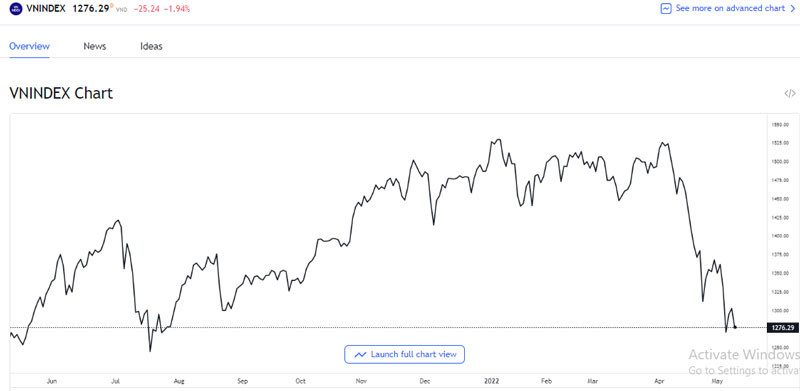

Cash flow into securities plummeted, VN-Index dropped 30 points to 1,270 points

The selling pressure was not too great, but the demand was low in the context of caution covering the stock market, causing the VN-Index near the end of the morning session on May 12 to drop nearly 30 points to 1,270 points.

The selling pressure was not too great but the demand was low in the context of cautiousness stock market caused the VN-Index near the end of the morning session of May 12 to drop nearly 30 points to 1,270 points.

After a slight recovery session with a deep drop in liquidity, reaching less than 13 trillion dong on all 3 exchanges in the 11/5 session, the stock market witnessed an increase in selling pressure, although not large, but also made most discount stocks.

Of the 30 key stocks in the VN-30 group, only Sabeco and GVR managed to maintain the green or reference price, the rest all fell.

In which, real estate, retail and consumption dropped sharply. Masan (MSN) dropped 4,600 dong to 107,300 dong/share. Mobile World dropped 2,700 dong to 138,300 dong/share. Vinhomes (VHM) decreased by 2,000 VND to 68,500 VND/share. Vingroup (VIC) decreased by 1,900 VND to 78,600 VND/share. Novaland (NVL) decreased by 1,700 dong to 77,000 dong/share. Phat Dat Real Estate (PDR) decreased by 1,500 VND to 59,200 VND/share.

Vietnamese stocks fell quite deeply even though the US futures indexes were recovering slightly.

In last night’s trading session (Vietnam time), US stocks dropped due to inflation exceeding forecasts and being at a 40-year high. The US S&P 500 broad-range index has hit a 52-week low and is down 18% from a 1-year high, or 17% since the start of 2022.

Investors continued to sell off stocks with high growth expectations, especially technology stocks. High interest rates are said to be the culprit that will kill businesses like in the tech industry.

The US has just announced April inflation at 8.3% after reaching a 40-year peak of 8.5% in March. With the current inflation rate, it is likely that the US has a long way to go. to the 2% target level. A series of monetary tightening measures will have to continue to be launched while the US economy faces the risk of recession.

Signals in the market show that investors are betting that the US Federal Reserve (Fed) will continue to raise interest rates by 50 percentage points in June. The dollar soared to a 20-year high. The DXY index, which measures the volatility of the greenback against a basket of six major currencies, rose above the 104-point threshold.

In the world, oil and coal prices increased sharply again. Coal prices have increased continuously since the beginning of May and are 10% from the peak in early March. Oil prices last night increased 5% above the threshold of 105 USD/barrel.

Closing the morning session of May 12, selling pressure eased a bit, thereby causing the VN-Index to drop by 25.24 points to 1,276.29 points. The HNX-Index fell 4.97 points to 328.06 points. Upcom-Index dropped 0.49 points to 98.29 points.

Liquidity in the morning session of May 12 on all 3 exchanges was only 6.6 trillion dong, of which nearly 5.9 trillion dong on HOSE.

M. Ha

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here