Inflation is hot globally, the whole world urgently tightens currency

Here are 5 charts that will show what investors are interested in watching over the next week.

Consumption in the US

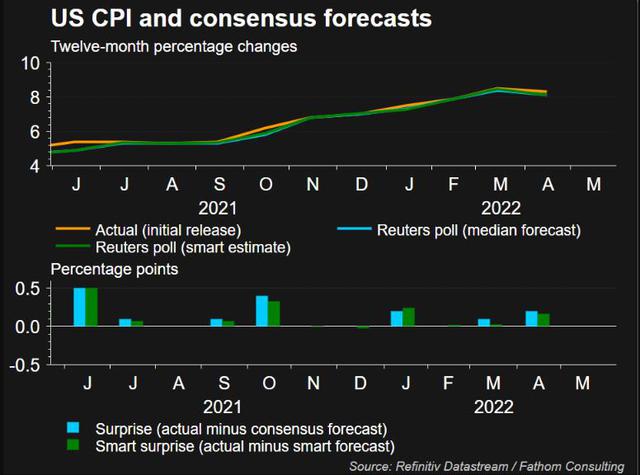

Currently, very little US economic data really matters more than consumer prices, so much so that Fed Chair Jerome Powell and Treasury Secretary Janet Yellen have both visited the White House in recent days to discuss inflation.

So the latest monthly figures through June 10 will show whether the Fed’s policy tightening has begun to rein in inflation – which is at its worst in decades.

A Reuters poll showed analysts expected consumer price data for May to show a 0.7 percent increase. In April, prices in the US rose 0.3% month-on-month, but that was lower than the previous month as gasoline prices cooled after a spike in March. However, for now. , gasoline prices are skyrocketing again.

Markets are stressed by worries about the Fed tightening policy aggressively, so investors expect the May data to be “healthy” so they can expect the Fed to pause. interest rate hike at the end of this year.

US CPI (data and projections).

The ECB is also under pressure to increase prices

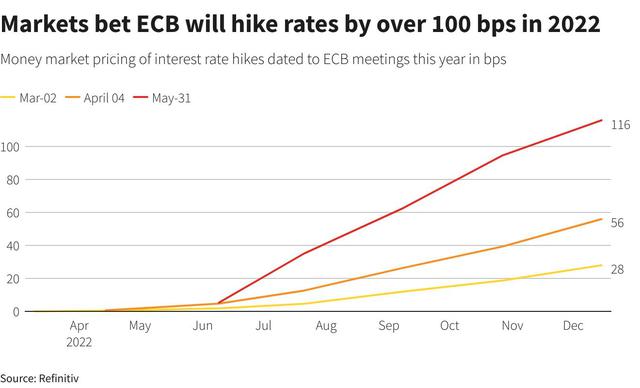

June 9 will likely mark the last meeting of the European Central Bank (ECB) before starting to raise interest rates – the first in 11 years.

ECB policymakers are under pressure to demonstrate that their plan of gradual rate hikes starting in July will be enough to rein in inflation, which has hit a record high of 8.1% last month.

In general, policymakers at the ECB as well as the market think a 25 basis point increase in interest rates in July and September is appropriate, but some policymakers think a 50 basis point increase should be made. basis in the July meeting.

Southern European countries, especially Italy, will oppose sharp rate hikes, but market participants will be listening for signs that ECB policy may be tightening more quickly than expected.

The market thinks that the ECB will raise interest rates by more than 100 basis points in 2022.

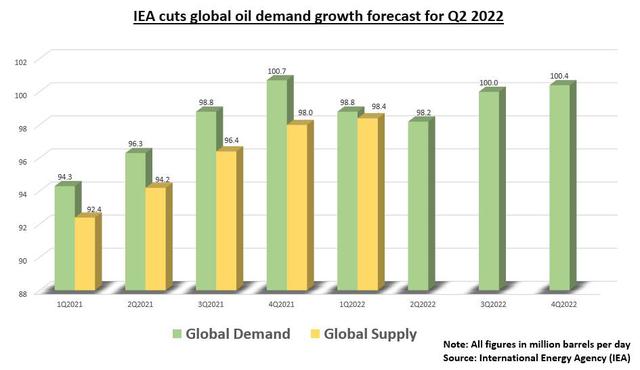

Oil scarcity

The end of China’s anti-Covid-19 blockade days, people returning to normal activities will give new impetus to oil prices, which have increased by 50% this year. For international investors, however, that matters little compared to data showing that China’s economic growth is starting to slow.

ANZ analysts estimate that Europe’s plan to cut imports of Russian oil will cause a supply shortfall of up to 2 million bpd in the second half of 2022. So, OPEC producers information. + The decision to increase production by 216,000 bpd in July and August left markets unimpressed.

OPEC+ has almost run out of spare capacity, and even the group is struggling to achieve that meager output increase.

Brent is currently around $115 a barrel, and analysts now expect the 2022 average price to hit $101, up nearly $2 from the April forecast.

A period of peak oil scarcity may be imminent.

The IEA lowered its forecast for oil demand growth in the second quarter of 2022.

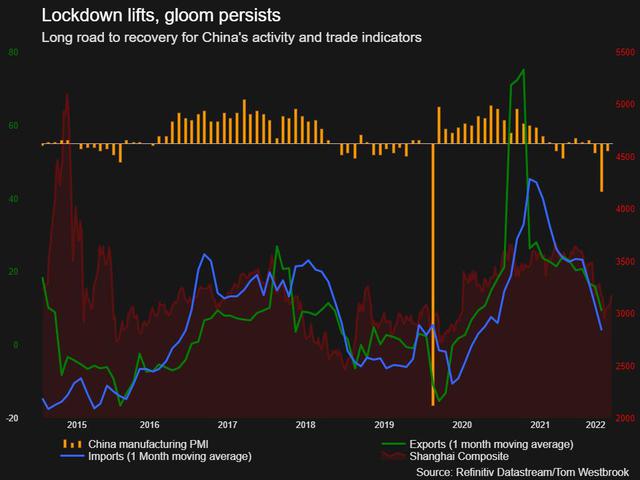

China’s economy is difficult because of the blockade against the epidemic

The city of Shanghai (China) has ended the blockade phase, but the feeling of fear is still there, because the city’s 25 million residents have been locked down for 2 months, and the possibility of in Other parts of China will repeat the situation like Shanghai if the Covid-19 epidemic breaks out again.

The economic damage in parts of China is deepening. Trade figures released on June 9 will determine the extent of the impact on demand in the country, and a “dark cloud” from there still hangs in the “sky” of China’s economic growth. as well as the world.

China’s inflation data due a day later could be the exception, with inflation expected to slow in China – something the rest of the world is looking forward to. However, China’s slow rise in inflation is not a sign that the government will focus more on stimulating consumption.

Updated data on loan growth in China will be released in the middle of the month. Like China’s stocks and currency, confidence in the Chinese economy is waning.

The city of Shanghai has lifted the blockade, but China’s economy is still weak.

The whole world urgently tightens currency

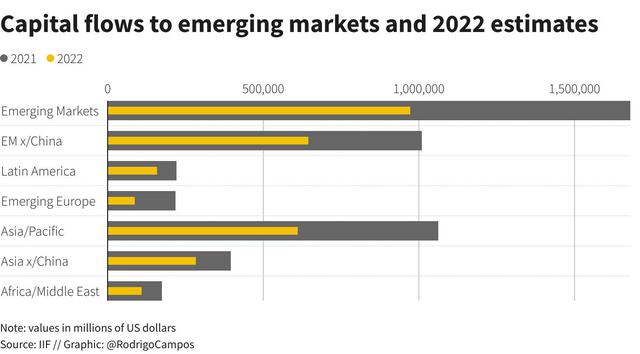

The Institute of International Finance believes that the problems of overheating inflation, a weakening Chinese economy, a stronger dollar, Russia’s debt burden and rising interest rates around the world will make emerging economies face challenges. investment risk and GDP growth decline sharply this year.

But despite that, the rate hike campaigns show no sign of slowing down, with Chile, Peru and Poland all expected to raise rates in the coming days, with increases ranging from 25 to 75 percentage points. .

India, after a surprise rate hike in May, will almost certainly continue to tighten its currency further on June 8, with some policymakers urging a sharp rate hike. .

Ukraine, ravaged by war, raised interest rates to 25% to tackle inflation, which is currently in double digits. But Russia, which is on the verge of recession and default, looks set to cut rates further after falling to 11% last month.

Capital into emerging markets 2021 and forecast 2022.

Reference: Refinitiv

at Blogtuan.info – Source: cafebiz.vn – Read the original article here