Why did securities investors react to Sacombank shares when hearing rumors related to FLC Chairman Trinh Van Quyet?

In the trading session on March 28, after rumors appeared around the Chairman of the Board of Directors of FLC Group Trinh Van Quyet, a series of stocks belonging to the FLC ecosystem competed to “fall to the floor” with the status of white inside. buying, the oversold and oversold volumes piled up, while the liquidity trickled down.

Besides the massive sell-off in stocks of the FLC family, one bank stock was also “involved”, which is Sacombank’s STB. STB witnessed a deep decline when losing 3.5% in the morning session, closing the session down to 5.3% and became the biggest loser in banking, far outpacing the industry’s overall decline.

To explain why investors have such a reaction to STB stock, it is possible to point out the following reasons.

First, it is easy to see on FLC’s financial statements that Sacombank is currently the bank that lends the most, with a total outstanding loan balance as of December 31, 2021 of VND 1,840 billion. 100% of FLC’s outstanding loans at Sacombank are medium-term and long-term loans and newly incurred in March and May 2021.

If compared with Sacombank’s customer loan balance as of December 31, 2021, which was VND 387,929.5 billion, FLC’s outstanding loans accounted for 0.4% of the Bank’s total outstanding loans. However, this is only the outstanding loan for FLC Group, not including the outstanding loan balance with related companies or individuals, Mr. Trinh Van Quyet’s family.

Summary from FLC’s consolidated financial statements for the fourth quarter of 2021

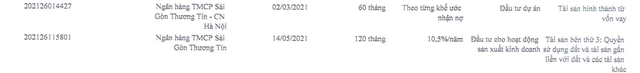

According to the information explained in the financial statements, the loan at Sacombank includes 2 loans with details as follows:

Extract from FLC’s consolidated financial statements for the fourth quarter of 2021

Loan (i) granted by Sacombank Hanoi, outstanding loan amount of VND 1,240 billion, term of 60 months, project investment purpose, collateral (collateral) formed from loan capital. Assuming this loan has a regular repayment schedule, the annual principal payment obligation will be VND 248 billion.

Loan (ii) granted by Sacombank, outstanding loan of 600 billion VND, term of 120 months, purpose of investment in production and business activities, 3rd party collateral is land use right and assets attached to land. If this loan has a regular repayment schedule, the annual principal payment obligation is VND 60 billion.

In the case of loan (i) applying the average interest rate of 10.5% like loan (ii), the interest payable by FLC is about 276 billion VND/year.

With the above calculation, in total, FLC has to pay about VND 584 billion/year for loans at Sacombank, of course this estimate ignores unidentifiable factors such as the principal repayment schedule which can be designed in a ladder and interest rate difference of each debt receipt agreement.

In addition to providing credit to FLC, Sacombank also cooperates with many other services in Mr. Trinh Van Quyet’s ecosystem.

According to Sacombank, on April 9, 2021, this bank and Bamboo Airways and Bamboo Airways ecosystem signed a comprehensive cooperation agreement.

Specifically, according to the signed agreement, Sacombank provides corporate financial services related to credit, bank guarantee, domestic and international payment services, cash flow management, foreign exchange services, etc. exchange… to meet the production and business needs of Bamboo Airways as well as the related ecosystem.

Source: Sacombank homepage

Along with providing solutions for businesses, Sacombank also provides personal financial services for employees of Bamboo Airways ecosystem with attractive incentives. Sacombank will give priority to using services of Bamboo Airways and related ecosystem in internal activities.

On the side of Bamboo Airways, with an increasingly diversified domestic flight network, a rapidly expanding international flight network, and 5-star service quality, this airline will promote providing Sacombank with transportation services. Passenger transport, cargo, tourism combined with conferences, golf events, … and other commercial services in the ecosystem under special priority policies, contributing to creating favorable conditions for business activities. smoothly in Vietnam and in the Bank’s region.

At the end of 2021, Sacombank launched a line of Sacombank – FLC linked credit cards for individuals and businesses with many incentives such as: Free play at the FLC Golf Course system, discount on golf rounds; refund when buying Bamboo Airways tickets or discount group tickets; incentives when renting yachts for events or resorts at FLC Biscom system; reduce the cost of organizing conferences, business seminars…

Sacombank FLC personal credit card – Source: Sacombank homepage

Sacombank FLC corporate credit card – Source: Sacombank homepage

By Business and Marketing

at Blogtuan.info – Source: cafebiz.vn – Read the original article here