From Asia to Europe, America has witnessed a terrible crisis

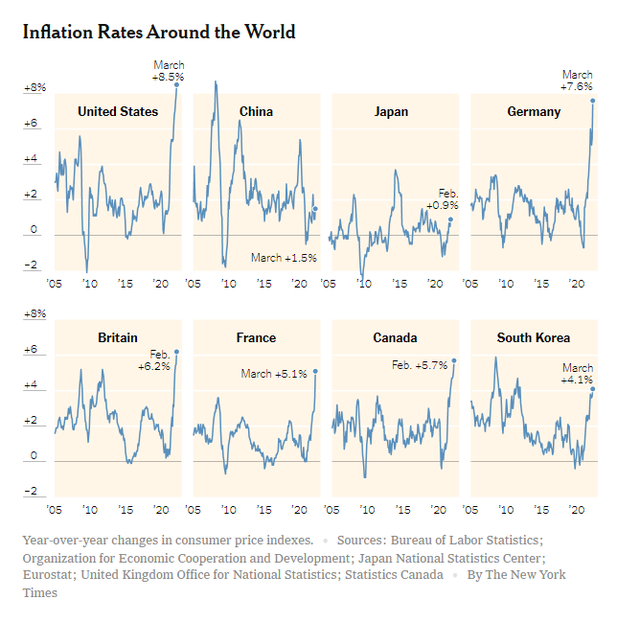

According to the New York Times, a series of countries around the world have had to act because of the strong price increase of goods. The disruption of the post-pandemic supply chain and the conflict in Ukraine has caused inflation to skyrocket in many countries from Europe to Asia.

Many experts had predicted that the inflation momentum would decline when the economies of many countries reopened after the Covid-19 epidemic, but the conflict in Ukraine has caused energy and food prices to soar, making the situation worse.

Data from the Bank for International Settlements (BIS) shows that up to 60% of developed economies exceed 5% in annual inflation. This 60% figure is the highest rate since the 1980s and is worrying a lot of central banks because the standard inflation rate is only about 2%.

Inflation spreads globally

Meanwhile, more than half of emerging economies have inflation rates above 7%. Currently, only China and Japan are exceptions.

“We are facing a new period of hyperinflation. The factors that cause commodity prices to rise are still there and will cause inflation to continue in the near future,” said BIS expert Augustin Carstens.

You get what you wish for?

The irony is that after more than a decade of trying to lower interest rates to push inflation to the 2% target in the US and Europe, they are now satisfied, but perhaps the price increase of commodities is outpacing. control. The fact that essential goods such as energy and food are more expensive causes workers to demand higher wages, thereby driving up costs as well as eroding demand for shopping, thereby causing the economy to fall into crisis. new post-pandemic crisis.

In the US, inflation reached 8.5% in March 2022, a 40-year high, prompting the government to open strategic petroleum reserves as well as raise interest rates to curb price increases.

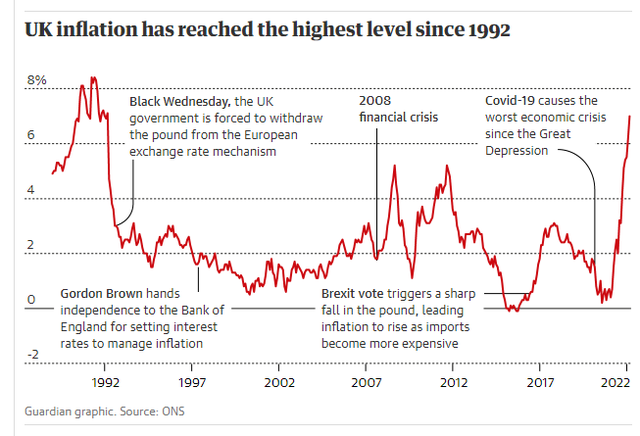

In the UK, inflation has risen to a 30-year record. Prices in the foggy country increased by 6.2% in February 2022 compared to the same period last year and continued to break a record of 7% in March 2022. Since December 2021, the Bank of England (BoE) has raised interest rates three times, reaching the same level as before the Covid-19 epidemic to curb inflation, but the situation is not better.

Worse, Goldman Sachs and Deutsche Bank predict that inflation will likely exceed 9% in April in the UK due to the strong increase in prices of energy and food. The BoE even warned that this rate could reach 10% by the end of this year.

Gasoline and diesel prices in the UK are now up to 160.2pence and 170.5pence/litre, equivalent to a 30% increase year-on-year and the highest since 1989.

In the euro area, inflation reached 7.5% in March 2022, higher than 5.9% in the previous month. The main reason is the conflict in Ukraine, which has caused energy prices to skyrocket, along with food inflation.

UK inflation highest in 30 years

The situation was so serious that the European Central Bank (ECB) had to plan to stop its bond buyback program, thereby clearing the way for a move to raise interest rates. The latest meeting report of the ECB also clearly states that this inflation will spread and last much longer than previous times.

Even in Japan, which has struggled with negative inflation and deflationary risks for decades, there are now signs of price appreciation. The Japanese government’s survey in March 2022 showed that inflation could reach 2.7% this year, the highest since 2014.

Mass price increase

According to CNN, a series of central banks around the world will be forced to raise interest rates to control inflation, followed by accompanying consequences such as rising borrowing rates and fluctuating currency prices. This will cause many markets from real estate to finance to be severely affected.

Specifically, the US Federal Reserve (FED) had to raise interest rates to 0.5% in March 2022. Meanwhile, the UK’s BoE is expected to raise interest rates to 1% in May and to 2.25% by the end of 2022 despite the fact that they have adjusted to raise interest rates 3 times from the end of 2021 to now.

In Canada, the country’s central bank (BoC) raised interest rates by 50 percentage points to 1%, the strongest increase since 2000. However, even with action, the BoC side was still quite pessimistic when It takes time for interest rates to affect the economy and cool down inflation.

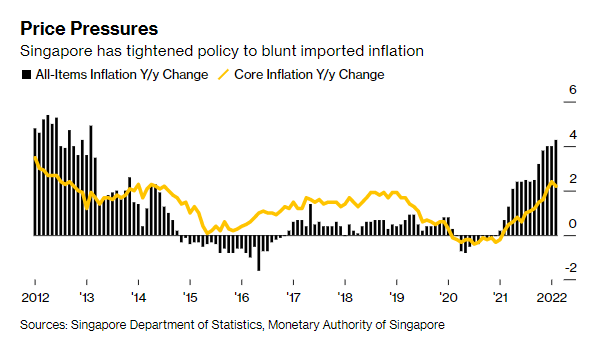

Inflation in Singapore

According to the BoC’s estimate, Canada’s inflation will surpass 6% in the first half of 2022 and will continue until the end of the year, thereby strongly affecting the real estate market as well as credit.

On the Asian side, the Singapore government has started tightening monetary policy since October 2021 and raised interest rates again in January 2022. Recently, Singapore continues to announce that it will adjust its policy and continue to raise interest rates at the same time, something that has not happened since 2010.

Singapore’s moves are considered obvious when a series of Asian countries such as South Korea have had to tighten monetary policy because of inflation.

Singapore’s statement is still gentle because in New Zealand, this country has raised interest rates to 1.5%, the highest increase in 22 years. Economists estimate inflation in New Zealand could reach 7% in the first half of 2022. The last time inflation was announced by the New Zealand government was in December 2021 with 5.9%, high. much higher than 1.4% in the same period in 2020.

*Source: NYT, CNN, Bloomberg

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here