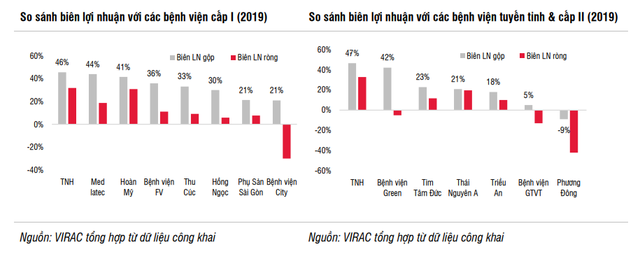

Profit margin is up to 46%, higher than Medlatec, Hoan My, Thu Cuc, Hong Ngoc, a mysterious private hospital in Thai Nguyen is evaluated with potential thanks to stable benefits from Samsung’s industrial park.

Mysterious private hospital in Thai Nguyen

Not long ago, SSI securities company gave positive reviews to a local medical enterprise listed on HOSE. According to SSI’s assessment, this hospital is one of the few listed hospitals with good profitability and relatively cheap valuation, with a forward P/E 29% lower than its peers in the industry. area. The hospital mentioned by SSI is Thai Nguyen International Hospital (TNH).

SSI estimates TNH’s net revenue to reach VND 407 billion (up 21%) in 2021 and VND 471 billion (up 16%) in 2022. EAT is estimated at VND 112 billion (+3% y/y) ) in 2021 and VND 121 billion (+9%) in 2022. In the next 5 years, this securities company estimates the CAGR of net revenue and NPAT of TNH at 22% and 26% respectively.

Thai Nguyen International Hospital is a private hospital in Thai Nguyen province, established in 2013. Initially, TNH only had one hospital in Thai Nguyen province, with 150 beds and 950 medical services. After that, TNH has expanded to 2 hospital facilities, with a total of 600 beds and 1300 medical services in 2021. TNH is currently targeting specialized medical services in obstetrics and gynecology (pregnancy care). , ophthalmology (eye diagnosis/treatment) and surgery/procedure, while expanding operations to neighboring provinces.

After many issuances of shares, the shareholder structure of this company is relatively fragmented, in which the management owns 36% of the shares, the rest is held by retail investors and hospital staff. Hold. The largest shareholder of the company is Mr. Hoang Tuyen – Chairman of the Board of Directors (12%), Mr. Nguyen Van Thuy – Deputy Director (6%), Mr. Le Xuan Tan – Director (7%), Mr. Vu Hong Minh – member of the Board of Directors (4%) and Mr. Nguyen Xuan Don – a member of the Board of Directors (10%).

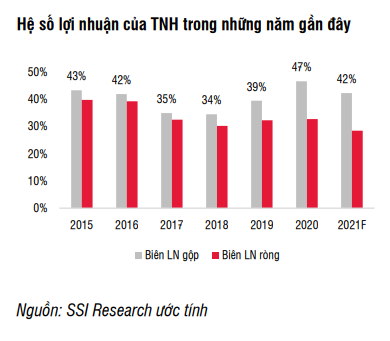

According to SSI, TNH has maintained a stable profit margin since its establishment in 2014, with a gross profit margin of about 35-40% while net profit margin is at 30-35%., thanks to optimized operation capacity and tight costs. Although the current abnormally high profit margin will gradually adjust when the hospital operates stably, but SSI estimates that the profit margin will remain in the upper range, when the medical market continues to be favorable and the level of competition is high. Competition in the industry is low, with a limited number of public hospitals and only a handful of new private hospitals opening in the region.

TNH is also among the hospitals with a much higher profit margin than level II and equivalent provincial hospitals, even private grade I hospitals such as Thu Cuc, Hoan My, FV, and Hong Ngoc. .

Rare advantages

SSI assesses that TNH has a favorable position with stable medical examination and treatment demand and is under low competitive pressure. Currently, the Northeast region has only 10-15 large private hospitals in operation, the rest are public hospitals and small private clinics. This is a market with fewer competitors. Thus, TNH can avoid direct competition with famous private hospitals such as Vinmec, Medlatec, Thu Cuc or large public hospitals. such as Bach Mai, 108, Huu Nghi Hospitals in highly competitive areas such as the Red River Delta. In addition, as there are few competing private hospitals in the Northeast region, the number of health workers becomes more abundant, with average salaries being 15-20% lower than in the past. big cities.

In addition, Thai Nguyen is ranked as the 8th most populous province in the North. The number of annual medical visits in Thai Nguyen also ranks fifth in the region, with an average occupancy rate in the region of 81% according to the Vietnam Health Statistical Yearbook 2019.

This locality is located not too far away and is more convenient for people in other Northeast and Northwest provinces such as Tuyen Quang, Bac Kan, Lang Son, Cao Bang and Ha Giang. Currently, 35% of patients at TNH’s hospitals come from provinces outside Thai Nguyen. With Thai Nguyen’s medical infrastructure growing, people can choose to redirect to Thai Nguyen as a regular medical treatment site, instead of having to travel for a long time to Hanoi.

One point to note is that Thai Nguyen International Hospital currently possesses a strategic location for the facility. The main hospital is located in the center of Thai Nguyen province, near the large public hospital of the central level, which is Thai Nguyen Central General Hospital (TWTN). Meanwhile, Yen Binh campus in Pho Yen town is located near 3 large industrial zones, namely Yen Binh, Pho Yen and Diem Thuy. This brings various advantages to TNH’s hospitals.

Even though it is located near the central hospital and both hospitals compete for the same services, TNH still benefits from the presence of TWTN in the area. Firstly, TWTN is a central hospital with more experience and prestige in specialized treatment (surgery, acute patient care, chronic diseases & other complex surgeries). As a result, patients requiring intensive care will typically choose to go directly to TWTN for treatment, while patients with milder conditions will choose TNH to receive faster service visits. Second, national hospitals like TWTN also attract more patients from other provinces because there are only 38 national hospitals in the country, thus increasing the attractiveness of Thai Nguyen health services, indirectly continue to bring benefits to TNH. However, in the long run, there may be a risk that TWTN may expand its bed capacity, causing competitive pressure on neighboring hospitals.

For the remaining facility, Yen Binh Hospital, benefit from the stable medical examination and treatment needs of 3 large industrial zones of Thai Nguyen, where businesses with a large number of employees are concentrated such as Samsung Electronics. According to SSI data, these industrial parks meet nearly 89% of the current capacity of Yen Binh Hospital.

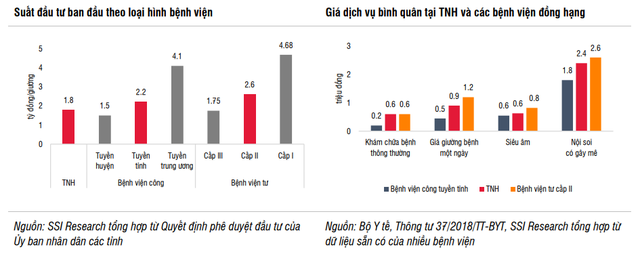

With the current criteria of the Ministry of Health, TNH will be ranked as a Level II private hospital, equivalent to a provincial public hospital. After comparing with similar hospitals, The first competitive advantage of TNH is the investment cost per hospital bed which is 18% lower than that of provincial public hospitals and 31% lower than that of Level II private hospitals. According to SSI, the results from TNH’s leadership experience in managing many different hospitals and relationships with medical equipment suppliers, make an important contribution to factors such as equipment selection. specialized equipment/machinery or hospital layout design, without overinvesting in expensive medical equipment while maintaining a minimum standard of performance.

At the same time, thanks to the advantages of good control of operating costs, TNH is maintaining a relatively competitive hospital fee, only 25 – 30% higher than provincial public hospitals, while lower than private hospitals. Level II is about 15-20%. In addition, because TNH is currently registered as a district hospital, 100% of the hospital fees will be covered by the public health insurance fund (calculated according to the public hospital price), which means that the patient only needs to pay a small fee. Hospital fees are about 25-30% of medical examination and treatment prices, much lower than other similar-class private hospitals.

With such competitive hospital fees, TNH maintains a high occupancy rate, averaging 80% in the period 2015-2020, up to 110% in 2016. Since the hospital business is similar to the hotel business model, any factors in the establishment process such as initial capital investment, construction location and customer segmentation will contribute to building a competitive advantage. sustainable compared to new competitors in the future.

According to the Law and readers

at Blogtuan.info – Source: cafebiz.vn – Read the original article here