Under the pressure of Bitis, Nike, Adidas, Thuong Dinh Shoes suffered losses for 5 consecutive years, the 3.6ha golden land on Nguyen Trai street has not brought any value yet.

In terms of the historical journey, there are few brands that can stick so deeply in the minds of Vietnamese consumers like Thuong Dinh Shoes. The image of simple white bata shoes with blue three-striped motifs and flexible rubber soles is very popular because of its durability, usefulness and suitable for many different audiences and ages.

However, since the equitization, the wine brand once based in Thanh Xuan District, Hanoi has had poor business results.

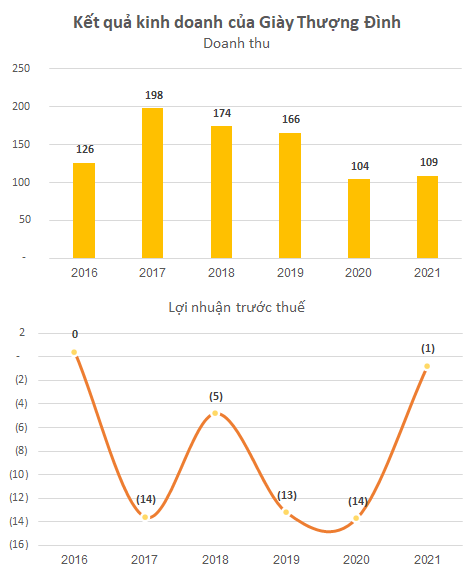

Recently, Thuong Dinh Shoes has just announced its financial report for 2021 with a loss of nearly 17.7 times compared to 2020 when the pre-tax profit was only 4 million dong. Meanwhile, revenue was slightly higher than in 2020, reaching 108.7 billion dong.

This is the 5th year in a row Thuong Dinh Shoes has recorded a loss in business results. The accumulated loss as of December 31, 2021 of Thuong Dinh Shoes amounted to 49.4 billion, accounting for more than half of the charter capital (93 billion).

Notably, the liabilities of Thuong Dinh Shoes almost remained unchanged with nearly 65 billion dong.

As of December 31, 2021, the balance of short-term liabilities exceeded current assets. This shows an imbalance in the company’s ability to pay short-term debt, thereby affecting the going concern of the company in the future.

Tragedy lies on the golden land of Nguyen Trai

Established in 1957, Thuong Dinh Shoes was formerly the X30 workshop under the Military Region Department – General Department of Logistics, specializing in the production of hard hats and rubber sandals for the military. In 1993, the name Thuong Dinh Shoes was officially applied and became an unforgettable brand of many generations of Vietnamese consumers.

In 2015, Thuong Dinh Shoes decided to IPO on HNX and converted to Joint Stock Company in 2016. Hanoi People’s Committee currently holds 68.67% of the company. From the time of equitization, the company has not increased its charter capital.

Over 60 years, Thuong Dinh Shoes now has export markets to EU countries, Australia and some Asian countries. However, in the past 5 years, a wave of brands such as Adidas, Puma, Nike, … landed in Vietnam, sparking a fierce competition between foreign and domestic footwear brands. like a complete failure.

Even, despite being in the market for a long time, Biti’s also had to “change clothes” of products, spend hundreds of billions of dong to implement brand identity strategies, and change its image in line with trends.

However, most products of Thuong Dinh Shoes do not have many changes in design. The image of Thuong Dinh Shoes in the eyes of consumers is still cheap sports shoes of about 100,000 VND and is labeled as “work safety shoes”. It is this weakness that has made the once-resounding shoe company lose its breath in the race for market share.

The sole support of Thuong Dinh Shoes today is probably only thanks to the company’s “golden land fund”, located in the most favorable locations of Hanoi such as owning a land area of 36,105 m2 at 277 Nguyen Trai. , Hanoi, land area 17,587m2 in Dong Van Industrial Park, Ha Nam, land area 18,403m2 in Dong Van industrial park, Duy Minh commune, Ha Nam, lease term up to 2054…Land plots in central street Ton Duc Thang, Dong Da District, Hanoi and Ha Dinh, Thanh Xuan.

The company said that the production and business at 277 Nguyen Trai, Hanoi is inefficient and less advantageous. The average cost increased due to fixed costs such as depreciation, land rental… almost unchanged while the output decreased, resulting in a loss in business results in 2020.

According to Decision No. 908 of the Prime Minister issued on June 29, 2020, the City People’s Committee. Hanoi will have to divest state capital in 28 enterprises, the deadline is until the end of 2020. Accordingly, the People’s Committee of Ho Chi Minh City. Hanoi was forced to divest all 68.67% of capital in Thuong Dinh Footwear Joint Stock Company (UPCoM: GTD) before December 31, 2020, but up to now, the divestment has not been completed.

at Blogtuan.info – Source: Soha.vn – Read the original article here