Capital of 700 million dong and 8 million dong of idle money per month, should a family of 2 children buy a house on installments?

Question:

I live in Ha Dong, Hanoi. The family has a husband and wife, an 11-year-old son and a 7-year-old daughter.

– The couple have a house for rent for 12.5 million VND/month. The family lives in a dormitory, rents for 4.5 million VND/month with 2 bedrooms. The income from housing (rent – rent) is 8 million VND/month.

– There is an old car, which is valued at VND 200 million when sold.

– Income: Husband earns 10 million dong/month to take care of fuel, car, electricity and water, cannot accumulate. His wife has a fixed salary of 12 million VND/month, with a few other extras. The total average income of the couple fluctuates from 18 to 20 million VND/month. The amount of the wife’s income is used to spend on children’s education, milk, functional foods, insurance premiums, gifts to parents…

My family only accumulates 8 million dong/month (actually it can be more, but in the period when my son enters secondary school, he needs to study more, so this is only calculated). There is an accumulation of 200 million VND. Being given one-third of the collective house by grandparents (if my sister buys it, she will have 500 million dong). Temporarily, the total cash available is 700 million VND.

– Grandparents on both sides: Grandparents and grandparents do not have pensions. Particularly, grandfathers have pensions to take care of themselves, children do not have to support (because grandparents do not live together). Grandparents on each side have 3 children, who can share the care and support later.

My current wish:

– Cash is not much, currently only investing in securities, but because there is no time to learn, after 1 year there is no profit. Not expected to continue following this channel.

– The children have grown up, need their own room, so they want to renovate the house they are renting. This house can now be renovated with 1 more bedroom or option 2 is to buy a unit with 3 bedrooms.

I am looking to buy a house and can save more costs. On the contrary, my husband does not like financial pressure because if buying a house, he needs to borrow more money. My question is, if I only have income from renting a house, should my wife and I buy a house?

In addition, old cars should often break down and need repair costs. I have an idea to sell the car to save money, but my husband disagrees. The option of choosing to sell the car to make up for the money to buy a house will shorten the repayment period. Should I do it this way?

Get expert advice to help my family.

Advise:

Hello. We have forwarded your question to financial expert Kim Lien who is the Founder of Amy Advise – Personal Financial Advisor. Expert Kim Lien will answer specific questions for you.

Hello!

With the current situation of your family, you should not take out a home loan for the following reasons:

The first:

Husband and wife disagree, differ on financial “risk appetite”. So if you take out a loan to buy a house in this context, it will easily lead to you being under great financial pressure because you do not have the support and support of your husband, easily affecting family happiness.

Monday:

The debt ratio is too high, the cash flow to repay the debt exceeds the ability to pay.

I assume that you and your wife buy a 3-bedroom apartment in the Ha Dong district (near where you live). The total value of a 3-bedroom apartment, comfortable for a family of 4 for a long-term stay will be about 3.5 billion VND.

After deducting the available cash of 700 million, it is necessary to borrow 2.8 billion – ie 80% of the house value.

In the current context of rising inflation, bank interest rates tend to increase, so lending rates also increase.

Assuming a debt of 2.8 billion within 20 years, with a fixed interest rate of 9%/year, the principal payable alone is 11.7 million/month.

If including principal + interest in the first 5 years, it is about 27 – 30 million / month => While the couple only has a balance of 8 million / month from the rent. Not to mention home loan interest rates are usually floating interest rates each year.

– If the car is sold, it is only about 200 million, not enough to cover the loan amount.

I suggest reasonable financial solutions that families can consider:

– Re-evaluate the value of the house being rented. Since you did not share the specific area and condition of this house (ground house or apartment, urban or suburban district …), I temporarily estimate: Given the current rental housing market situation, there are The price can be about 3-4 billion VND.

Calculated, the rental rate of return is only about 3-4%/year, excluding other depreciation expenses. This is even lower than the deposit rate in the bank. Your family should re-evaluate the upside potential of this apartment to consider selling the house, addressing immediate financial needs as well as obtaining capital to invest in higher cash flow properties.

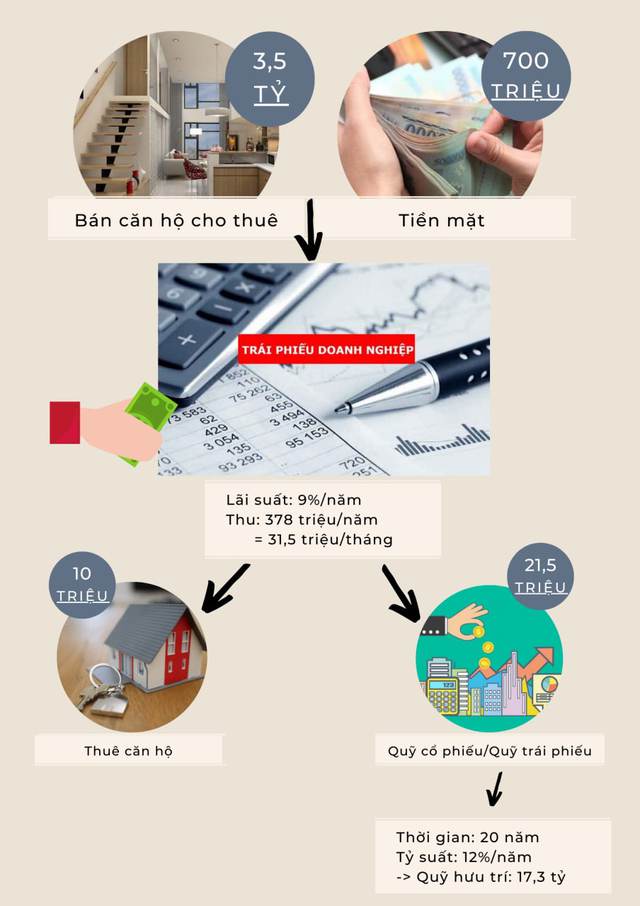

I estimate that if I sell this house, I will get 3.5 billion + cash 700 million = 4.2 billion.

Bring the money to buy long-term bonds, the interest rate is about 9%/year (this is the profit level of safe bonds on the market today).

=> 1 year the family can earn 378 million equivalent to 31.5 million/month. With this money, the family can fully rent a beautiful apartment with 3 bedrooms in Ha Dong for about 10 million/month and still have 20 million left over. This extra money the family needs to continue to invest to increase profits.

Instead of investing in securities (the family has found it unsuitable) or investing in real estate (liquidity risk, large investment costs, no knowledge), this amount is suitable for this type of investment. Investment Stock Fund – Bond Fund.

If they can persist in investing for a long time, say 20 years, the expected rate of return is only 12%/year, then when they retire, both husband and wife are completely secure with a retirement fund of more than 17.3 billion. copper. This type of investment is suitable for small capital but can be maintained regularly and long term. It does not take too much effort or incur high risks like other forms of investment.

As for cars, you can consider changing if your current car is too old, unsafe, and incurs a lot of costs. This decision will be based on the needs of your family using the car more or less to make.

Above is my advice, hope your family can consult and soon find the most suitable solution.

at Blogtuan.info – Source: Kenh14.Vn – Read the original article here