How was Home Credit Vietnam doing business before the possible change of owner?

According to Bloomberg, Seize Holdings Ltd, the transportation and shipping giant in Southeast Asia, is competing with a group of Japanese banks in talks to acquire the assets of a consumer finance company in Southeast Asia. Home loans. Currently, the business segments in Indonesia, Vietnam and the Philippines are valued at around $2 billion – $2.5 billion by Home Credit.

Where, at the end of 2020, the size of Home Credit’s assets in Vietnam was 22,316 billion VND, equivalent to nearly 1 billion USD.

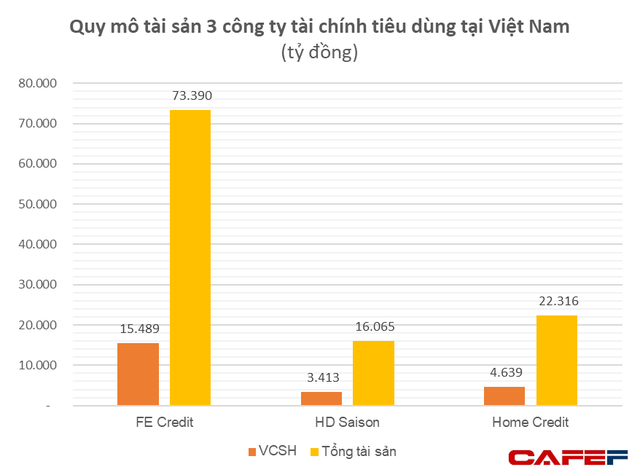

Home Credit Vietnam is a company consumer finance has the second largest scale of assets and loans after FE Credit. In 2020, Home Credit’s total assets were VND 22,316 billion, of which its equity was VND 4,639 billion, accounting for about 21% of the capital.

Unlike other competitors, Home Credit does not have parent company backing from major Vietnamese banks. For example, Vietnam’s largest consumer finance company, FE Credit is a subsidiary of the Vietnam Prosperity Joint Stock Commercial Bank (VPBank); HD Saison is a subsidiary of Ho Chi Minh City Development Commercial Joint Stock Bank (HDBank), while MCredit is a subsidiary of Military Commercial Joint Stock Bank (MBBank).

Meanwhile, Home Credit is a 100% foreign-owned company owned by the PPF Group – a group run by the family of the late Czech billionaire Petr Kellner.

Home Credit’s business operations in Vietnam face more difficulties than rival companies as Home Credit without bank support will have difficulty accessing customer files as well as preferential loans.

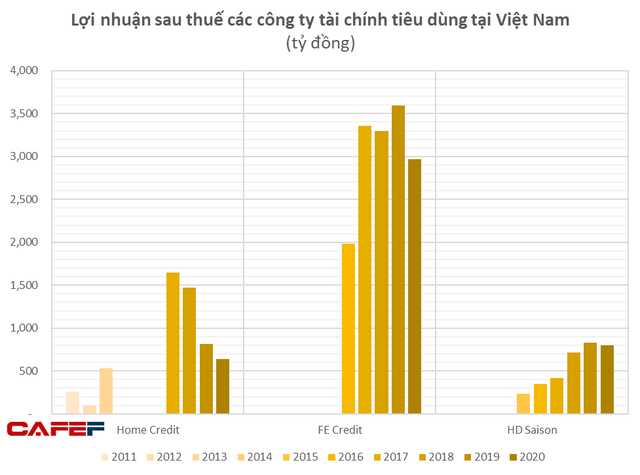

In fact, since 2017, Home Credit has entered a recession. In 3 years, Home Credit’s profit in 2020 was only VND 638 billion or equivalent to 39% from 2017. From 2019 until now, Home Credit’s profit is even lower than HD Saison while HD Saison’s asset size is only 72% of Home Credit .

While the period 2017 – 2019 is the golden period of FE Credit. The company’s net profit in 2017 increased suddenly by 69% compared to 2016, reaching VND 3,358 billion. FE Credit’s profit peaked in 2019 with over 3.590 billion dong.

From 2015 – 2019, HD Saison’s profit continued to increase. In 2019, HD Saison recorded a profit of VND 831 billion, VND 16 billion higher than Home Credit. HD Saison is also the consumer finance company least affected by the Covid epidemic.

In 2020, due to the impact of the Covid-19 outbreak, Vietnam took many drastic measures to prevent the pandemic, so that consumer finance companies were affected by the decline in profits. FE credits fell 17% year-on-year to collect 2,970 billion VND, HD Saison fell 4%, collecting 796 billion VND. And Home Credit achieved an after-tax profit of 638 billion dong, down 22% compared to 2019.

In 2021, FE Credit will face even more difficulties, its profit before tax in 2021 is only 610 billion VND, a sharp decline of 83.6% compared to 3.710 billion VND in 2020. In which, the profit is mainly thanks to the half first first semester. year and the company suffered losses in the last 2 quarters of this year, the third quarter lost 300 billion, the fourth quarter lost 290 billion.

And HD Saison posted pre-tax profit in 2021 of VND 1001 billion, flat compared to 2020, HD Saison for the first time surpassed FE Credit to lead the consumer finance segment in terms of profit. Despite the epidemic, the financial company’s revenue still reached VND 4,682 billion, a slight increase of 4.6% compared to 2020. However, outstanding loans fell to VND 13,376 billion, down 6%.

at Blogtuan.info – Source: Soha.vn – Read the original article here