One of 5 enterprises producing cancer drugs in Vietnam, gross profit margin is up to 50-70%

Nearly 150 stocks fell to the floor in the whole market, VN-Index in the trading session on April 18, 2022 “died” 26 points. In a forest of red stocks, it is rare for investors to find a few stocks that go against the current. One of them is DBD stock from a little known Binh Dinh enterprise.

Binh Dinh Pharmaceutical & Medical Equipment Company (DBD), established in 1976, is a state-owned pharmaceutical manufacturing enterprise in Binh Dinh province. What is more surprising is that DBD is one of the companies with many achievements in the field of pharmaceutical research and development in Vietnam, as well as the The first company in Vietnam to successfully research and produce injectable antibiotics (1992), freeze-drying methods (2003), and injectable cancer drugs (2008). Currently, DBD is one of the enterprises with a large market share in the hospital channel and is rapidly expanding into the retail channel in drug stores.

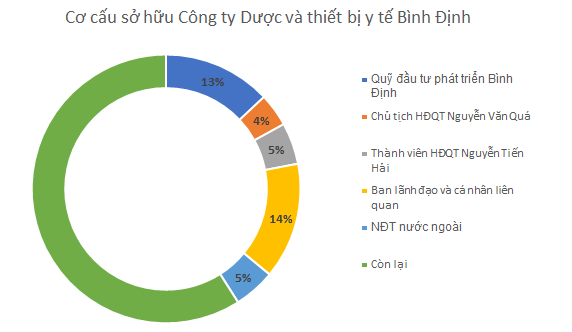

Currently, the largest shareholder of DBD is Binh Dinh Investment and Development Fund, with an ownership rate of 13%. DBD leadership and related individuals own 23% of DBD, of which the two largest shareholders are Mr. Nguyen Van Qua – Chairman of the Board of Directors (4%) and Mr. Nguyen Tien Hai – Member of the Board of Directors (5%) . Foreign investors own only 5% of DBD shares, although the company has removed the foreign ownership limit cap since March 2020.

Huge profit margin from special products

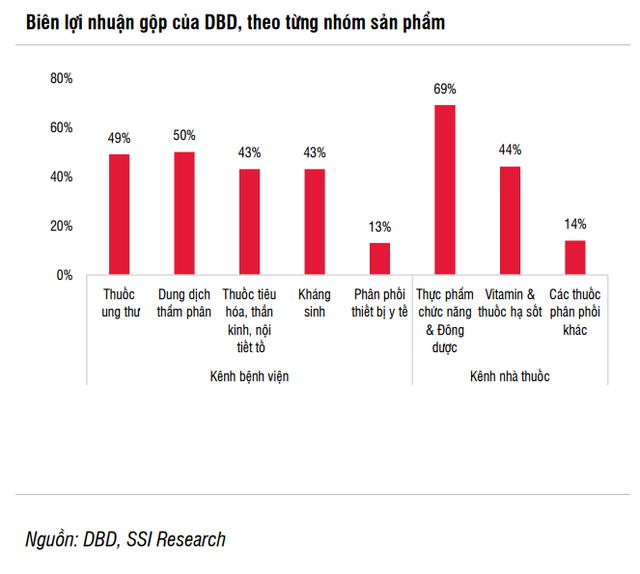

According to research by SSI securities company, DBD Company currently owns a portfolio of more than 200 products, which can be classified into 6 main groups as follows: (1) antibiotics, (2) cancer drugs, (3) dialysis solution, (4) digestive + nerve + hormone medicine, (5) vitamins + antipyretic, (5) functional food + traditional medicine and (6) other drugs. In which, antibiotics, cancer treatment and dialysis solutions are the main products of DBD, accounting for about 40% of total revenue with an average growth rate of 4.9%/year.

In addition to manufacturing drugs, DBD also imports and distributes medical equipment along with a number of other drugs. Most of this company’s products are sold in the hospital channel, accounting for 59% of the total revenue, the remaining 41% of the total revenue comes from the pharmacy channel.

Cancer drugs and dialysis solutions are highly profitable products due to the complexity of manufacturing. Currently, in the country, there are only 5 companies manufacturing cancer drugs and 6 companies producing dialysis fluid. These products require high complexity in production as well as higher R&D costs than other common products such as antibiotics, vitamins, antipyretics. According to SSI, DBD’s gross margin for cancer drugs is 49%, and dialysis solutions are 50%. Functional foods are also a product group with a very high gross profit margin, up to 70%, but it costs a lot of selling, advertising and discounting for customers, so the net profit margin may not be much higher than that of other products. other drug classes.

DBD owns a significant market share in the hospital channel, but still lacks a presence in the pharmacy channel. DBD currently holds 0.8% market share in the hospital channel and has contracts with most central hospitals. However, the company has faced constant changes in the government’s drug procurement mechanism and law in recent years, leading to limited growth in this channel.

Therefore, from 2020, DBD begins to make efforts to expand the pharmacy channel to achieve higher growth and promote product consumption. DBD also exports some products to countries in the ASEAN region, although the company has no plans to increase exports due to relatively low margins and expensive logistics costs.

During the period 2016 – 2021, DBD’s revenue at the hospital channel grew at a CAGR of 3.8%/year while revenue at the drug store channel grew at a CAGR of 6.0%/year. .

Hard to have an opponent

DBD possesses special competitive advantages as well as high barriers to entry, making it difficult for new competitors to appear. The first distinctive competitive advantage of DBD is the group of cancer drugs. According to SSI, manufacturing cancer drugs poses a high barrier for pharmaceutical companies for three reasons.

First, companies need to put a lot of effort into researching generic drug formulations (copy drugs) compared to generic formulations already available in other prescription and over-the-counter drug classes.

Second, the production scale needs to be larger than other drug lines to ensure profitability due to higher investment in specialized equipment.

The third is a significantly stricter drug registration and inspection route because these drugs possess high toxicity and affect the health of users.

Currently, DBD has a relatively large competitive advantage in the group of cancer drug manufacturers, especially compared to domestic competitors. Up to now, there are only 5 companies producing cancer drugs in the country, namely DBD, Davipharm, Nanogen, BRV Healthcare, Hera Biopharm, and a group of domestic enterprises account for less than 6% of the total market share of cancer drugs. The remaining 94% market share belongs to drugs imported from large foreign pharmaceutical enterprises such as Roche Diagnostic (Switzerland), F Hoffman (Switzerland), Novartis (Switzerland)…

The company also has the largest number of winning cancer treatment active ingredients in the hospital, with a total of 14 related active ingredients, compared to an average of only 3-4 cancer active ingredients/manufacturer. SSI assesses that the total market size of these 14 active ingredients is currently 3.6 times higher than the bid value of DBD, offering significant growth potential in the coming years.

The reason this company has not been able to gain more market share for this product group is because the current production line does not have much excess in terms of capacity, and there is no GMP-EU standard for bidding for group 1 hospital drugs. and 2 according to Circular 15/2019/TT-BYT.

The second special advantage of this pharmaceutical company from Binh Dinh is the product group of dialysis solutions. DBD is one of 6 domestic manufacturing companies (along with Fresenius Kabi, B.Braun, Otsuka, Mekophar and Allomed) capable of producing dialysis solutions in Vietnam. Hemodialysis products have little competition due to complex manufacturing requirements (high purity medium and near-zero solute concentration), and the current market size is relatively small compared to other dialysis products. other pharmaceutical products.

DBD also has a competitive advantage in price compared to other brands in the market, especially compared to imported dialysis solutions, which currently cost about 20-30% more than the domestically produced ones. and accounted for 28% of the total market share of dialysis solutions. Because of these special points, it is not difficult to understand when SSI considers DBD to be a rare investment opportunity in the pharmaceutical industry.

Following the Economic Lifestyle

at Blogtuan.info – Source: cafebiz.vn – Read the original article here