How are banks doing securities business in the first quarter of 2022?

In 2021, Vietnam’s stock market is in the top 7 of the world’s fastest growing stock indexes. VN-Index ends 2021 close to 1,500 points, up nearly 36% compared to the end of 2020. Favorable market conditions have helped banks’ securities trading activities gain a lot of profits.

If only calculating profit from securities trading activities, Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) is the most successful commercial bank with VND 583 billion in profit. Some banks have impressive profits from securities such as Asia Commercial Joint Stock Bank (ACB) 450 billion VND; Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank) 496 billion VND, An Binh Commercial Joint Stock Bank (ABBank) 249 billion VND; Vietnam Technological and Commercial Joint Stock Bank (Techcombank) 231 billion VND;…

Securities trading (CKKD) includes securities purchased by a commercial bank for short-term arbitrage purposes and derivative financial assets held other than for hedging purposes.

Depending on the bank, trading securities can be equity securities (stocks) or debt securities (bonds) or both.

Entering 2022, the stock market fluctuates up and down with a large margin. The most recent trading session on April 25th fell sharply, down to more than 80 points. At the end of the session on April 25, VN-Index decreased by more than 70 points and totaled down nearly 218 points since the historic peak at the beginning of the year.

VN Index dropped to 1285 points at the end of the session on April 25th

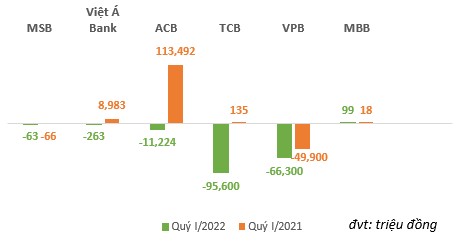

According to the financial statements of the first quarter of 2022, a number of banks have announced, although the overall business results have grown positively over the same period, in another dimension, the securities business proved to be ineffective when there were quite a few banks. Many banks have recorded losses from securities trading.

Among the banks that have announced their financial statements for the first quarter of 2022, besides Tien Phong Commercial Joint Stock Bank (TPBank) and Lien Viet Postbank Commercial Joint Stock Bank (LPB), which have no securities trading activities, the remaining banks have no securities trading activities. most of them recorded losses from business securities.

Synthesized from the data of the banks’ consolidated financial statements in the first quarter

Specifically, according to the consolidated financial statements for the first quarter of 2022, Techcombank loss of more than 95 billion dong, while in the same period last year, this bank made 135 billion dong and VPBank lost more than 66 billion dong from securities trading in the first quarter of this year. However, the business securities portfolio of both banks only has debt securities, not equity securities.

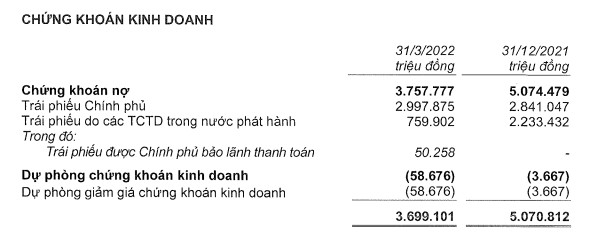

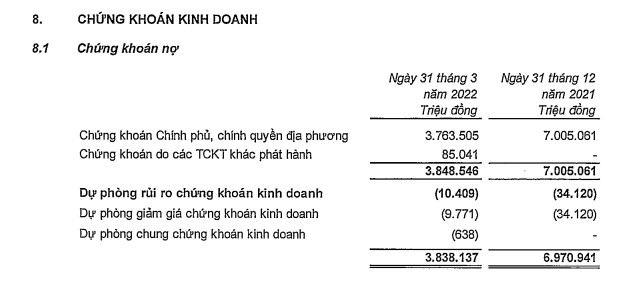

Excerpt from Techcombank’s financial statements for the first quarter of 2022

Techcombank’s trading securities portfolio as of March 31, 2022 consists mainly of Government bonds, which have decreased by more than VND 1,300 billion compared to the end of 2021, mainly in the group of bonds issued by domestic credit institutions. release. The balance of the provision for devaluation of business securities by the end of the first quarter of this year also increased by 55 billion dong.

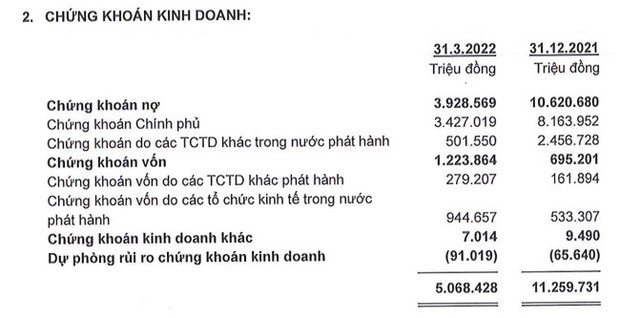

Excerpt from the financial statements of the first quarter of 2022 Vpbank

Similarly, looking at the trading securities portfolio of VPBank mainly debt securities of the Government and local authorities, accounting for more than 99%. The bank’s business balance at the end of the first quarter of 2022 has decreased by nearly 45% compared to the end of 2021.

Asia Commercial Joint Stock Bank ACB also lost more than 11 billion dong in the first 3 months of the year due to business transactions while the same period last year profit was more than 113 billion dong. ACB’s portfolio includes both debt securities and equity securities, of which this bank is holding more than VND 944 billion of equity securities issued by domestic economic organizations and VND 279 billion of equity securities issued by other credit institutions. onion.

Excerpt from financial statements for the first quarter of 2022 ACB

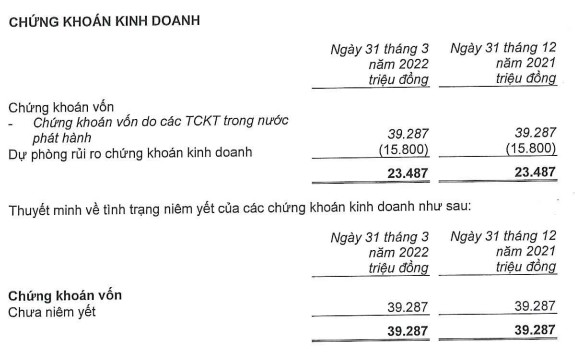

Bank MSB has business activities of equity securities but the value is quite small, specifically, by the end of the first quarter of this year, the bank’s equity securities held is worth more than 39 billion dong. This value stays the same from the end of 2021 with no changes.

Excerpt from financial statements for the first quarter of 2022 MSB

In addition, although there are no trading securities, but Lien Viet Post Bank is holding 431 billion dong of equity securities issued by other domestic credit institutions, while Tienphong bank is holding more than 180 billion dong of equity securities issued by other domestic economic organizations.

Following Economic Life

at Blogtuan.info – Source: cafebiz.vn – Read the original article here