The “headwind” of the stock market

In the long-term, policy effects will gradually bring the capital market into shape, the economic recovery and growth of corporate profits are the basic foundation for “favorable” securities.

After the exhilaration when “close to shore” at the end of last week, many investors were disappointed when the market turned to decline (illustration image).

Stocks continue to find bottoms

After a rally that brought the stock indexes to the green at the end of last week, the market’s first trading session after the ceremony was not very positive.

Strong selling pressure on the whole market made the index not only lose 15 plus points but also gained more from the last session of the week before the holiday, but also lost more deeply.

Closing the first session of the week on May 4, VN-Index dropped 18.12 points (-1.33%) to 1,348.68 points. HNX-Index fell 1.33% to 360.97 points. UPCoM-Index fell 0.28% to 104.02 points. Market liquidity was low with a value of about VND 17,000 billion.

Notably, after the first 3 weeks of April, foreign investors were net buyers, had sold signals from the last week of the month, maintained a net buying position of about 4,000 billion dong throughout April, and turned to be active net sellers right away. at the beginning of the week with about 8 million units, worth more than 300 billion dong.

Investors continued to be under selling pressure in the index’s downward slide to find the bottom. Foreign investors are also said to be influenced by the just-opened meeting of the US Federal Reserve (FED) with the plan to raise interest rates that experts predict, at as high as 50 basis points – the highest level. that the Fed last used was in…2000.

Four factors create a “headwind”

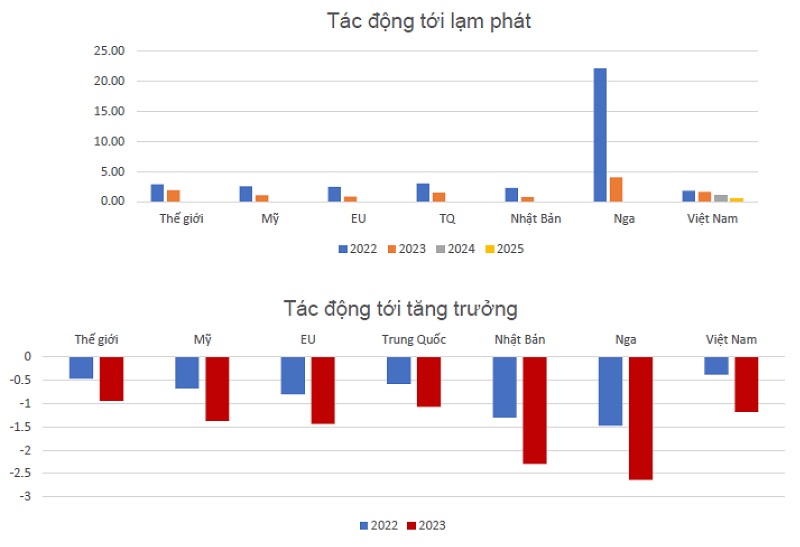

But the factors that caused the stock market to experience headwinds and deep headwinds are still concentrated around the pillars that previously, Mr. David Spika, Chairman and Chief Investment Officer of investment management company GuideStone Capital Management had Analysis: It is first of all the geopolitical tension between Russia and Ukraine. A wave of tensions that, by now, could be seen as having the potential to extend the negative impact to many countries, especially when the EU is meeting to discuss the sixth package of sanctions against Russia.

COVID-19 and the Russia-Ukraine war affect both the world and Vietnam (source: VEPR)

The second is the issue of high inflation and this, as you know, is a problem for many economies in which, the US Federal Reserve (FED) will raise interest rates many times this year to deal with the situation. This situation is no longer a story of possibility or prediction, but is gradually becoming a reality.

The third is that the COVID-19 epidemic has not shown any signs of ending, with the recent spike in cases in China. The country of nearly 1.6 billion people has had hard blockades of giant economic centers like Shanghai, causing great concern about the disruption of global supply chains and affecting trade activities. core.

Meanwhile, in the Vietnamese market, it must be added that the headwind caused the capitalization of the entire stock market to evaporate tens of billions of dollars in just a short time, also coming from legal violations. laws are exposed in turn. But the drastic move of the regulator, in the long term, promises an open and transparent market, the foundation for the opportunity to upgrade and real growth of Vietnamese securities. The young school, even though it’s… 22 years old, it’s still hard to avoid the impact.

When will there be a favorable wind?

With the monetary policy no longer loosening and possibly being squeezed into risk areas including real estate, investment in bonds, securities (which this policy used to be the driving force behind the strong price increase of the market). stock market – is the wind in the direction of the past), this is also seen as a factor pushing the market against the wind.

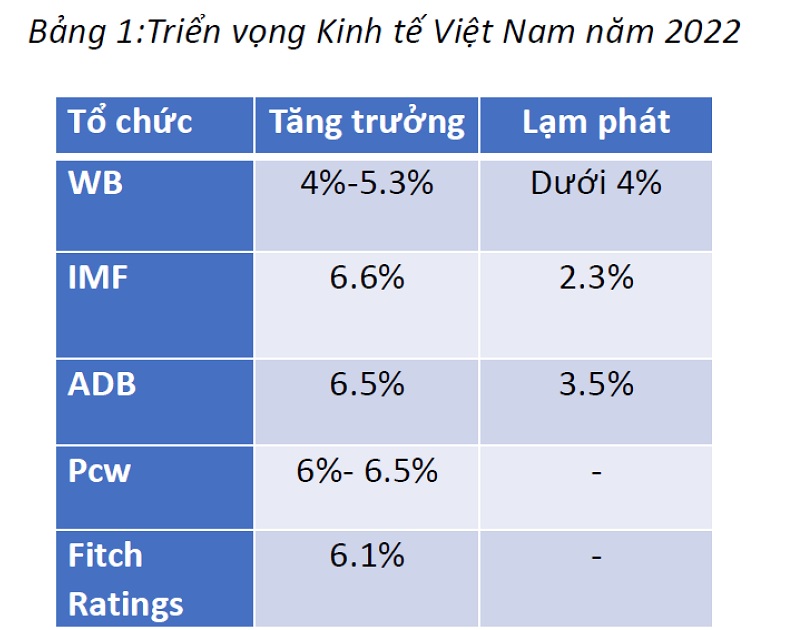

The prospect of Vietnam’s economic growth in 2022 is still “bright door” (source: VEPR)

In a new report of the Institute for Economic and Policy Research (VEPR), experts point out many risks to Vietnam’s economic growth in 2022, notably the risk of high inflation and an increase in inflation. increase in the price of assets shows that cash flow has not really gone into production.

Previously, Prof. Dr. Pham The Anh, Chief Economist of VEPR, affirmed that Vietnam’s money supply growth in recent years has always been high compared to the real growth rate of the economy.” GDP growth was only about 7% before the COVID-19 pandemic. -19 and during the pandemic it was 3% but money supply growth was at 14% to 15%. That’s a very high number in the long run that will cause inflation,” he said. To deal with this, he said that monetary policy should be very cautious and Vietnam must look to the solution of lowering lending rates, not deposit rates. Because lowering deposit rates will direct cash flow to other investment channels, asset speculation channels.

According to analysis by VEPR experts, the driving force for Vietnam’s economy in 2022 comes from the policy of opening the economy, the recovery of the labor market is an important condition for production recovery. In which, the driving force for growth also comes from exports and FDI.

Except for objective factors such as the Russia-Ukraine war, the COVID-19 epidemic and international responses; The recommended practice of “limiting inflation imports”, along with that, the policy impacts that investors expect will gradually bring the capital market into the framework, the basis for institutional investors and individuals to The main expectation is the economic recovery, the growth of corporate profits. Thereby, it will gradually contribute a new wind to create a trend of stock price recovery.

According to DDDN

at Blogtuan.info – Source: infonet.vietnamnet.vn – Read the original article here