Person America rich – poor at a speed… dizzying

The net worth of Americans’ socks has grown at a dizzying pace over the past two years, even as homes and businesses face the devastation of Covid-19. The Federal Reserve estimates that households accumulated an additional $38.5 trillion between the beginning of 2020 and the end of last year, bringing their total net worth to $142 trillion.

As the United States learns to live with the virus and pushes consumer spending back to pre-epidemic levels, the nation faces a terrifying new threat: A dramatic drop in wealth from In early 2022 that JPMorgan Chase & Co. estimated to total at least $5 trillion and possibly as much as $9 trillion by year-end.

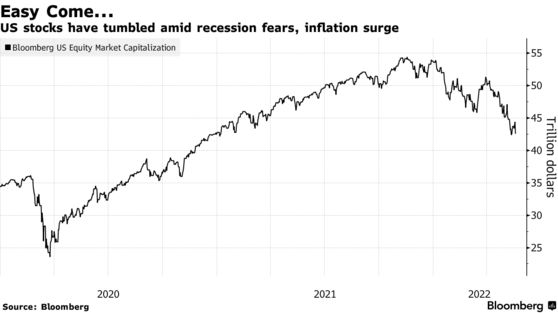

Outbursts are brutal. US stocks were sold off strongly before the fear of recession and inflation.

So far, the richest Americans have suffered. The fortunes of US billionaires have dropped nearly $800 billion from their peak amid a sharp drop in stocks, cryptocurrencies and a host of other financial assets. However, that’s not all. Interest rates rose and began to hit the housing market, where middle-class families and working-class people left most of their wealth there.

In an attempt to stamp out multi-decade high inflation, the Fed needs Americans to limit their spending, even if it could cripple the world’s largest economy. A series of bad signals is making the pressure stronger than ever.

John Norris, chief economist at Oakworth Capital Bank, said: “It’s painful to get back to normal after living in a fantasy world last year. We’re going to feel far worse things than we did. reality”.

Since the start of the year, the S&P 500 is down 18%. Nasdaq lost 27% while cryptocurrencies lost 48% of their value.

Asset shock is hard to avoid

“All of that leads to an asset shock, pulling back growth next year,” said JPMorgan economists led by Michael Feroli.

Billionaires are the biggest “winners” in 2020 and 2021. Now, they’re losing more than the rest. Since last November’s peak, the world’s 500 richest people have lost $1.6 trillion in wealth. US billionaires top this sad ranking as $797 billion has been wiped out of their fortunes from the top.

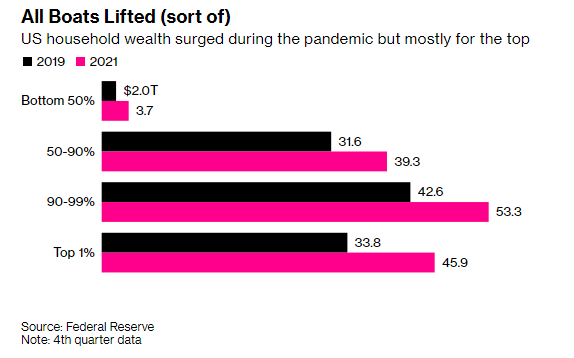

The wealth of American households has increased dramatically during the pandemic, but most of it belongs to the richest families.

Perhaps, Elon Musk leads this list when losing up to 139.1 billion USD, equivalent to 41% of his fortune compared to November. At the peak, Musk’s fortune sometimes reached 340 billion USD. Amazon founder Jeff Bezos is second with $82.7 billion, or 39% of his fortune, blown away.

While inequality may appear to be diminishing, the reality is that it’s not going to be comfortable for those worried about America’s wealth disparity. “In a relative sense, this seems to reduce inequality a bit, but in absolute terms, everyone,” said Reena Aggarwal, director of the Psaros Center for Financial Markets and Policy at Georgetown University. Everyone will suffer the loss.”

Like many, Aggarwal fears a falling mayor will create more problems for the economy as a whole. The market “needs a little correction” but what is happening is a pretty big correction and it won’t stop.

The housing downturn, likely triggered by a spike in mortgage rates to their highest levels since 2009, threatens to produce even bigger effects. Over the past decade, the thriving real estate market has added $18 trillion in market value to homeowners’ valuations.

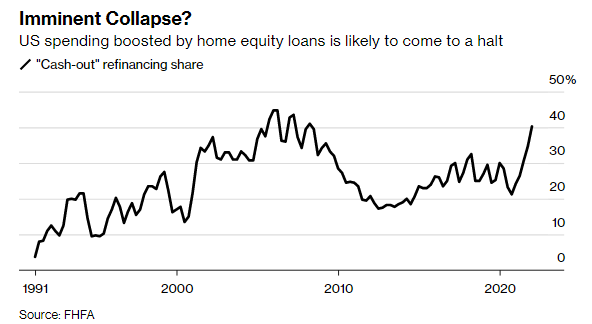

American spending has also increased in recent years as owners harness the enhanced values of their homes for cash. Home equity mining may have stopped this year. More than 40% of refinances in the final quarter of last year saw homeowners withdraw cash from their properties.

Real estate is much more evenly distributed than financial wealth. According to estimates by the Federal Reserve, the richest 1% own more than half of US stocks and mutual funds, and the remaining 90% own less than 12%. In real estate by contrast, the bottom 90% own more than half while the top 1% hold less than 14%.

American spending, boosted by home loans, may be about to stall.

“House prices and higher mortgage rates have dampened buyer activity. It looks like more declines are coming in the next month,” said Lawrence Yun, chief economist for the National Association of Realtors. America, said.

It may be a while before Americans realize that their pandemic home price gains have evaporated. Even the stock market sell-off takes a while to affect spending in a way that could push the US into a recession.

Chris Gaffney, head of global markets at TIAA Bank, said: “The general sell-off in equity markets can have an impact on value. There will come a time when investors look at the report. quarterly and suddenly say, ‘Oh my, my stock portfolio is down 20%. Maybe I shouldn’t have gone on that outing. Maybe I shouldn’t have bought a new TV or a car. new'”.

Reference: Bloomberg

at Blogtuan.info – Source: Soha.vn – Read the original article here