Gold price increased to 74 million dong/tael, face distorted gold

Last month, the price of gold rose to a historical high of more than 74 million dong/tael, causing many gold borrowers to distort their faces. At this time, whether to buy gold to pay off debt.

Can’t wait for the gold price to jump

In 2021, Nguyen Hong Van and her husband (Long Bien, Hanoi) borrowed 10 taels of gold from their family to buy a house. At that time, with the number of gold trees, Ms. Van sold 530 million VND. Less than a year, gold has continuously increased rapidly, making Ms. Van worried. “From the beginning of the year until now, gold has increased to 60 and then 70 million dong/tael, and my husband and I are sitting on a fire,” said Ms. Van.

According to the price at 74 million VND/tael, Ms. Van lost more than 190 million VND. Ms. Van is watching the gold price drop to buy and pay off debt. “I will pay the debt gradually, if I can buy any amount of gold, I will buy it,” Van said.

Some borrowers 2-3 years ago were more worried than Ms. Van, like in the case of Mr. Do Tuan Long (Thanh Oai, Hanoi). Mr. Long borrowed gold to sell 10 trees for 45 million VND/tael. Compared to the current price, he has to make up more than 230 million VND to buy gold to pay the debt. “Borrowing gold from the family does not have to pay interest, but the sharp increase in price is higher than the bank interest rate,” Mr. Long said.

|

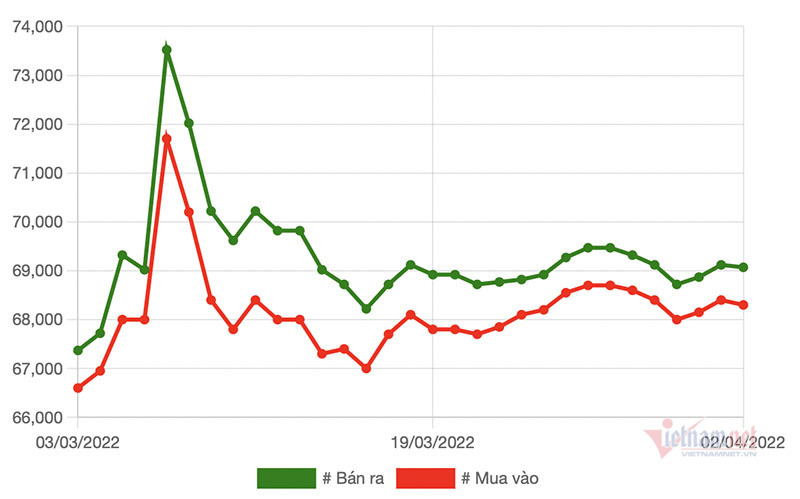

| Gold price chart |

The domestic gold market ended the first quarter of 2022 with a strong price increase. Beginning in 2022, domestic price of 9999 gold bars were Doji Jewelry Group at 60.9 million dong/tael (buy in) and 61.65 million dong/tael (sold out) in Hanoi.

Gold price at SJC listed at 60.95 million dong/tael (buy in) and 61.67 million dong/tael (sold out) in Hanoi. In Ho Chi Minh City, the price of SJC gold listed at 60.95 million dong/tael (buying in) and 61.65 million dong/tael (sold out).

Gold started to increase strongly after the time close to the Lunar New Year. On January 24, the gold price surpassed 62 million dong/tael, the historic milestone of 2020. Gold prices rose the most starting in March. In the morning of March 8, the gold price of 9999 was still regulated by gold and silver trading companies. continuously increased and set a new peak of 74 million VND/tael. The price difference sometimes reaches over 15 million VND/tael.

In the following sessions, the gold price left the historical mark and adjusted down around 69 million dong/tael. This “turn” has caused many people to “fall off their horses” because they bought gold at the peak with the expectation that the price would go up.

Since the beginning of this year, the price of SJC gold has increased by 6.6 million VND/tael. If selling at the peak of the gold price to 74 million dong/tael, customers would have taken a profit of over 12 million dong/tael.

|

| Loss of hundreds of millions when swinging the peak of gold price 74 million VND/tael |

Should I buy this time?

At the end of yesterday’s trading session, the price of 9999 gold bars at SJC Hanoi was 68.3 million dong/tael (buying in) – 69.07 million dong/tael (sold out). SJC Ho Chi Minh City listed at 68.3 million dong/tael (buy in) and 69.05 million dong/tael (sold out).

At Doji Hanoi, the price of SJC gold is 68.25 million dong/tael (buying in) and 68.95 million dong/tael (selling out). The price of gold at Doji Ho Chi Minh City is 68.3 million VND/tael (buy in) and 69 million VND/tael (sold out).

Meanwhile, the world spot gold price fell 0.8%, down to 1,921.86 USD/ounce. And the price of gold for future delivery lost 1.6%, down to 1,923.7 USD/ounce. The price of this precious metal fell 1.8% in the past week.

At the end of the first quarter of 2022, gold increased by 6%, this is the best increase since the third quarter of 2020. According to experts’ forecasts, gold is likely to move towards the $2,000 mark per ounce in the second quarter of 2022.

Senior Market Strategist Bob Haberkorn The geopolitical situation has dragged on for a month now and inflation data continues to pick up. So the general sentiment in the market right now is that everyone is looking for a safe haven.” We could see gold weaken if there is some positive news from the Russia-Ukraine war, but I think investors will see it as a buying opportunity because of inflation concerns.

Frank Cholly, senior strategist at RJO Futures, said that gold has had a sustainable uptrend and gained momentum from February to March. Currently, gold is having a correction, around the level of 1,900-1,925 USD// ounce. He believes that gold is more likely to rise to 2,000 in the second quarter of 2022.

Meanwhile, according to domestic experts, people should not speculate, especially should not borrow money to invest in gold during this period. People are also cautious when focusing on investing in gold bars because with limited supply, if the market only targets this type of gold, the price will be pushed up.

Financial experts said that the lack of connection with the world market makes gold a risky investment channel, not favored by many investors. According to Dr. Nguyen Tri Hieu, a finance-banking expert, at this time, investing in gold must be very cautious.

Macroeconomic changes are likely to encourage more gold purchases throughout 2022. Gold prices are forecast to peak between $2,000-2,100 an ounce by the end of the year, top strategists said. Wells Fargo’s Austin Pickle makes the point.

Told him

at Blogtuan.info – Source: vietnamnet.vn – Read the original article here