The fund that once ‘swallowed’ venture capitalists now collapsed before the volatility, holding a loss of tens of billions of dollars

After an arduous 2021, Tiger Global has recorded losses that have piled up this year and shocked the industry. His primary hedge fund recorded a 15% fall in returns in April and drove its full-year 2022 loss to 44%. Meanwhile, his short position fund has fared worse, falling 25% last month and 52% year-to-date.

Tiger Global used to “go to the clouds” now “fall to the ground”

The reason why Tiger Global’s performance was so poor was due to a series of big bets falling into a “short squeeze” position, the market fluctuated due to the impact of the Russia-Ukraine conflict and the slump in the stock market. Terrible decline of technology stocks in both the US and China. On April 29, the fund acknowledged its poor performance, something the $100 billion fund rarely has to say when it comes to large profits over the past two decades.

Tiger Global was founded by Coleman and his partner Scott Shleifer. The fund has long been seen as a factor in the glory years of the hedge fund industry, which often recorded double-digit returns. Coleman pointed out that a “2 and 20” fee structure – 2% management fee and 20% investment fee is reasonable. In 2020 alone, Tiger Global had a profit margin of 48%.

The recent turnaround in Tiger Global’s investment performance has affected Coleman’s reputation. With $35 billion invested by this company in listed companies, investors including foundations, endowments and pension funds, along with a number of Tiger Global insiders, have lost more than $10 billion. . Furthermore, Coleman’s fortune also lost $1.3 billion, as calculated by the Blooomberg Billionaires Index.

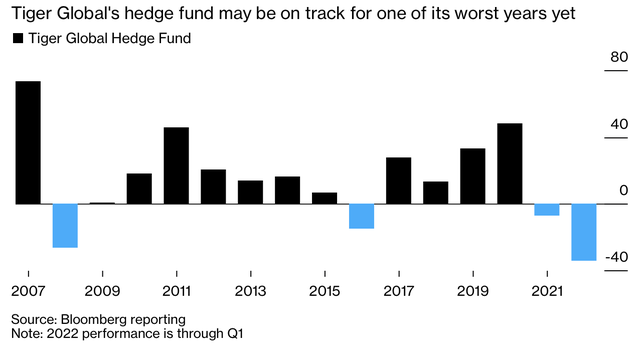

Profit rate of Tiger Global over the years.

Coleman was a technology analyst at Julian Robertson’s hedge fund Tiger for nearly four years, then officially became a “member of” Tiger Club in 2001. This is a term for “students” ‘ of Robertson founded his own company.

Initially, Coleman’s fund was Tiger Technology, then they expanded into payments, education and other areas, changing the name to Tiger Global. In the early 2000s, Coleman and Shleifer made some more private investments and found it possible to earn higher returns when expanding outside of the public market.

Tiger Global’s first “catastrophe” occurred during the 2008 financial crisis, when it lost 26% and gained 1% the following year. As a result, Coleman changed strategy, pledging to focus on their “core” area of technology, avoiding industries that are susceptible to political and macro events. This approach has catapulted Tiger Global to its zenith, with 2020 recording an annualized return of over 20% after only 2 years of losses.

With its bold investment style, Tiger Global has even made Silicon Valley funds wary. They are willing to “down the money”, paying higher prices for startups with high growth rates. In 2021 alone, they have invested in more than 170 startups, more than double the total number of deals done in 2020. On average, the fund “closes” 3 deals per week.

Bets that failed

And now, the biggest bets are dragging Tiger Global down. The market has been in turmoil this year due to high inflation and expectations of central banks raising interest rates, and the Russia-Ukraine conflict has poured another cold water on it. The Nasdaq 100 and Russell 2000 fell into a “bear market” in the first quarter of this year, falling as much as 20%, although they recovered somewhat in late March.

The fact that Tiger Global’s investments are closely tied to technology companies, especially from China, has brought “sweet fruit” for them. A good example is JD.com. Tiger Global invested up to 200 million USD in 2009 and ended up making a net profit of 5 billion USD. As of December 31, this is still the largest holding of the fund.

Affected by the overall market trend, the regulatory crackdown in China, and escalating tensions between Beijing and Washington, JD.com stock fell 20% last year and has continued to lose 16% since the start. year to present.

In a letter from investment group Tiger Global released on Friday, the fund said: “In retrospect, we should have sold more stocks in our portfolio in 2022.”

For the fund’s private investments, directors have “reduced valuations” to reduce pressure on public investments, Tiger Global said in a letter to clients. Tiger Global owns shares of private companies including ByteDance, Stripe, Checkout and Databricks.

It is not clear how the valuation will affect the venture capital of Tiger Global, which managed $65 billion in assets last year. Nearly a quarter of Tiger’s private bets as of August are in China, which has become a “minefield” for investors when the country’s authorities change policy.

Tiger’s Private Investment Partners funds, led by Shleifer, have purchased non-dominant shares in startups and have averaged 27% annual returns. Last year, these funds recorded a 54% increase and brought in $4 billion for investors, according to people familiar with the matter. Despite the upheavals this year, Tiger public funds have recorded monthly net inflows this year, and venture capital fund PIP 15 has just raised $12.7 billion.

Refer to Bloomberg

at Blogtuan.info – Source: cafebiz.vn – Read the original article here