In the midst of global chaos, Silicon Valley’s tech industry has a rare collapse

The fall has affected even the most believable city walls

Technology companies are inherently the darling of the pandemic economy. But now, with soaring inflation, rising interest rates, wars in Europe and instability in China, the biggest tech assets are dragging the stock market down, while startups in Silicon Valley are laying off employees – a significant downturn for an industry seen as a mainstay for the global economy.

The fall affected even the most believable city walls. Apple, despite its record revenue, dropped its market capitalization from $3 trillion in January to $2.5 trillion on May 9. Meanwhile, Microsoft, Amazon, Tesla and Alphabet have all lost more than 20% of their value in the first three months of this year.

Facebook, which shed 40% of its value earlier this year, has told its employees it will freeze hiring, which will mean the overall headcount will be fixed, or slightly reduced in the near future. According to Layoffs.fyi, which tracks layoffs in the tech industry, private Silicon Valley startups sheltered from the stock market are feeling the pain, too, with 29 companies lay off employees since the beginning of April 2022.

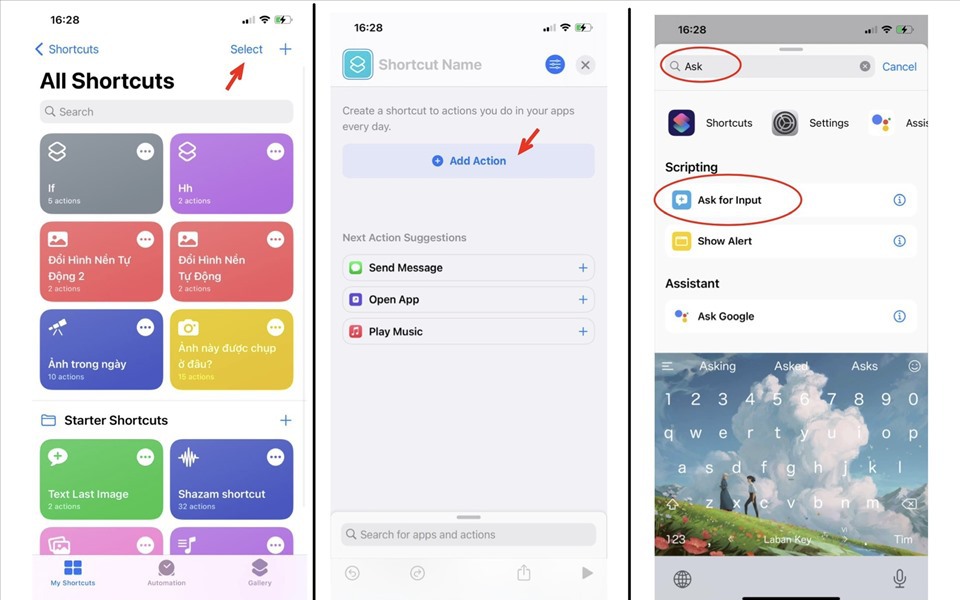

Amid the global turmoil, the tech industry has a rare collapse. Photo: @AFP.

That includes Robinhood, the financial services company; Cameo, the app that allows users to pay for personalized videos from their favorite celebrities; and On Deck, a Silicon Valley darling that helps tech talent start companies, secure funding or find jobs.

The technology industry that was once immune to the global crisis is now gradually “distorting” before the global crisis

This is a huge turning point for the tech industry, which for more than a decade has defied fierce competition, continues to expand beyond what even the industry’s biggest fans think is. maybe. Now, with a stagnant economy dragged on by a global pandemic and jostled by war, the tech industry that was once immune to the global crisis is now slowly faltering.

“There’s a lot of factors, a lot of headwinds,” said Greg Martin, chief executive officer of Rainmaker Securities, which facilitates the trading of shares in privately held tech companies. makes people nervous. “I’ve been doing this since the late ’90s. I’ve seen samples of crises like this. But the feeling of crisis this time is very different.”

Andrea Beasley, a spokeswoman for Facebook, which is owned by Meta, said the company is slowing down talent training according to its business needs. In a statement, Cameo chief executive Steven Galanis wrote that the company’s workforce had grown from 100 to 400 during the pandemic and described the layoff decision as a “painful but process adjustment.” necessary”. Other companies declined or did not respond to requests for comment.

During the dot-com boom of 2000, by 2004 the industry had grown again. Companies like Facebook set up shop and soon the industry exploded. Despite a global financial crisis and speculation of another bubble burst, the trajectory of companies like Facebook and Google remains on track. Then came Uber, Airbnb and Twitter, all of which faced skepticism about their sky-high valuations before going public.

For more than a decade, some investors have wondered if a crash reminiscent of 2000 is imminent. But it didn’t materialize, even as the Covid-19 pandemic shut down the world.

The technology industry that was once immune to the global crisis is now gradually “distorting” before the global crisis. Photo: @AFP.

The downturn of big tech companies could also benefit the next wave of startups

As you can see, the downturn affecting the tech industry today shows no sign of turning into a disaster. A partner at Sapphire Partners who invests in early-stage venture capital firms said: “I had a recent conversation with The Washington Post on condition of anonymity because of the sensitivity of the ventures. my investment, I believe the recession doesn’t affect my investment strategy”, but the person said tech startups need to pay attention to their “burn rate”. , Silicon Valley lingo for the amount of capital that startups raise, because it can become more difficult to raise additional rounds of funding.

Because most early-stage startups at this point are at high risk of loss, the amount of money they “burn” determines how long they can survive between funding rounds. The person also said that other investors are also looking at tech startups more seriously in this context, asking them to use their capital more efficiently.

Tod Francis, co-founder of venture capital firm Shasta Ventures, said it has been easier for startups to raise capital in recent years, and that the market values growth over profits. Startups responded by hiring aggressively. He hopes startups will adapt to the market turmoil by shedding non-essential areas, such as marketing. “Investors will put more value on business models and capital efficiency,” Francis said.

On the other hand, the downturn of big tech companies could also benefit the next wave of startups. When companies like Facebook and Netflix stop hiring or lay off employees, some of those employees often look to or join fledgling tech startups.

at Blogtuan.info – Source: danviet.vn – Read the original article here