Crypto investors ‘just laugh’ at the crisis named Luna

Just 5 weeks ago, the Bitcoin “festival” 2022 – an event organized to celebrate digital currencies, took place in Miami to connect investors to share the joy and hunt for profits. Among the thousands of participants was billionaire Michael Novogratz. At that time, everyone was excited about copper Luna – the token behind TerraUST, a supposedly safe stablecoin pegged at $1.

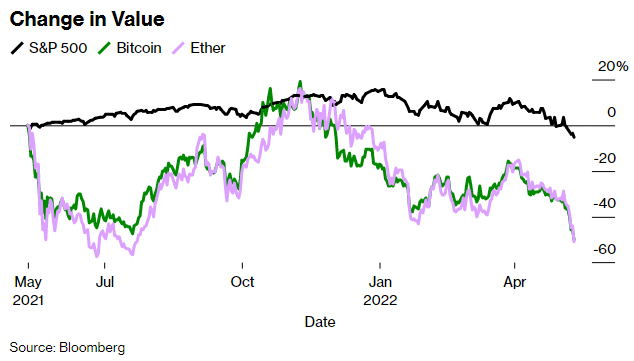

30 days after the above event, Luna and Terra simultaneously plunged and the future of these digital currencies is a big question mark for investors. Bitcoin and the cryptocurrency market also suffered a sharp and unresolved sell-off, causing a loss of more than $200 billion in capitalization.

To those with a pessimistic view of cryptocurrencies, this seems like an inevitable shake-up and reflects broader problems in the financial markets. As the stock market also keeps falling and interest rates rise, the uncertain alignment of cryptocurrencies is also showing consequences.

Before this unstoppable plunge, the components of the global cryptocurrency ecosystem are in danger, namely: cryptocurrency miners, supporters of cryptocurrency development, traders and trading platforms. Late on May 11, Do Kwon – CEO of Terraform Labs, developer of the Terra blockchain, struggled to rescue this coin.

As for the followers of cryptocurrencies, times like these are only part of the “game”. Many amateur investors have poured money into cryptocurrencies, stocks, and memes in the early days of the pandemic, which saw huge fluctuations. Many have even learned to smile at a heavy loss, wait for the next bull run, or move their investment to another part of the crypto market.

Bitcoin and Ether Drops Against the S&P 500.

Gigi De Vries, a marketing consultant in Dubai, shared on May 11, when Luna and Terra were “in free fall”: “Look at this hilarious chart.” The chart she’s talking about shows that a $10,000 investment has dropped to $200.

De Vries (30 years old) added: “This is a huge amount for me. But I don’t know what to do. Do you have another way?”

De Vries said she wished she had placed her stop loss order earlier. In the future, she aims to “bluechip” digital currencies that are said to be safer like Bitcoin or Ether. For now, however, she has stopped looking at portfolios or calculating losses. She also considers continuing to invest if the price rises again.

And in Perth (Australia), Emmanuel Deligeorges is also accounting for his losses. He is a blockchain consultant, 40 years old. Deligeorges says he’s been investing in cryptocurrencies since 2012, around the time the market started to flourish. However, he did not expect that a coin with advanced technology behind Luna would drop in price so quickly. He believes that the cause of this phenomenon is “rug-pull” – the sudden abandonment of the project by the developer and a run away with the investor’s money.

Deligeorges said that the first time he heard of these tokens was an influencer in the crypto world mentioned. Now, the components of his portfolio related to these digital currencies have all “evaporated”. He declined to share his losses.

In British Columbia, Graham Anderson told his wife he had a very bad day on Wednesday, just as they were going to bed. Luna makes up about 40% of his portfolio. Since September, Anderson, a salesman, has invested about $40,000 in Luna. When the token dropped in price, he immediately cut his loss and was left with only $6,000. Currently, Anderson still keeps some cryptocurrencies in his portfolio, along with 40 NFTs on the Terra market, but finds them worthless.

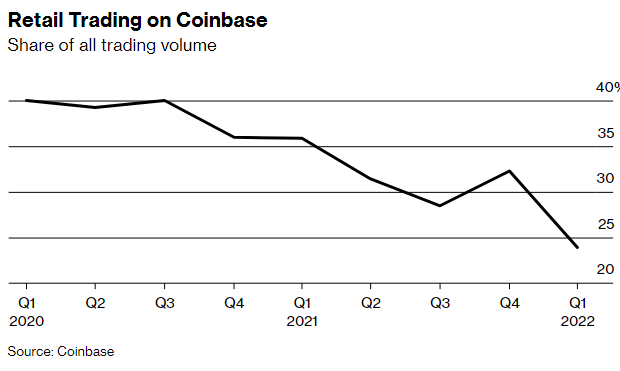

Trading volume on Coinbase exchange plummeted.

Anderson said: “This is crypto anyway. This is the space we’re investing in. Everyone thinks these tokens are pretty safe bets, but I’m not like that about anything. in this space. If you’re putting money into crypto, that’s not where you depend to make big profits.”

The recent sharp declines have affected another “face-to-face” figure in the cryptocurrency world. It was Coinbase – the largest cryptocurrency exchange in the world, which also wobbled. CEO Brian Armstrong saw his fortune plummet from $13.7 billion in November to $2.3 billion, as Coinbase shares plummeted.

This is a notable turnaround since the Bitcoin 2022 event took place just a few weeks ago.

Novogratz told conference attendees: “I’m probably the only person in the world with both Bitcoin and Luna tattoos.” In another speech, he talked about Kwon’s plan to use Bitcoin as a reserve currency for Terra. “Clearly there’s a risk, isn’t it? He’s making the transition right now,” Novogratz said.

This billionaire added that Kwon planned to buy 10 billion USD and said: “Everything is going well if investors do not withdraw massively.”

Refer to Bloomberg

at Blogtuan.info – Source: cafebiz.vn – Read the original article here